EUR 3000000000 debt issuance programme, 10 ... - Volksbank AG

EUR 3000000000 debt issuance programme, 10 ... - Volksbank AG

EUR 3000000000 debt issuance programme, 10 ... - Volksbank AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

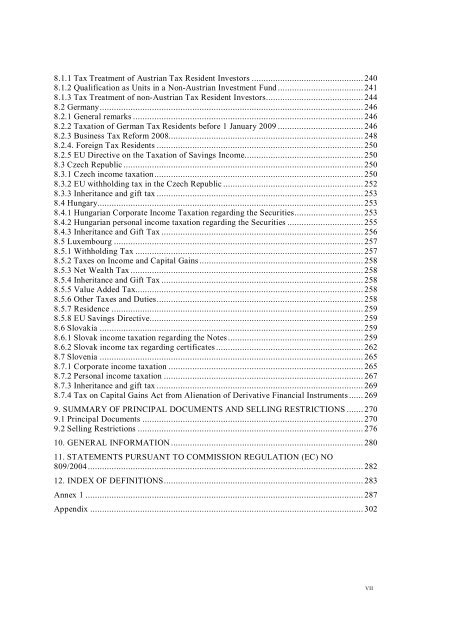

8.1.1 Tax Treatment of Austrian Tax Resident Investors ............................................... 240<br />

8.1.2 Qualification as Units in a Non-Austrian Investment Fund.................................... 241<br />

8.1.3 Tax Treatment of non-Austrian Tax Resident Investors......................................... 244<br />

8.2 Germany............................................................................................................... 246<br />

8.2.1 General remarks ................................................................................................. 246<br />

8.2.2 Taxation of German Tax Residents before 1 January 2009 .................................... 246<br />

8.2.3 Business Tax Reform 2008.................................................................................. 248<br />

8.2.4. Foreign Tax Residents ....................................................................................... 250<br />

8.2.5 EU Directive on the Taxation of Savings Income.................................................. 250<br />

8.3 Czech Republic ..................................................................................................... 250<br />

8.3.1 Czech income taxation........................................................................................ 250<br />

8.3.2 EU withholding tax in the Czech Republic ........................................................... 252<br />

8.3.3 Inheritance and gift tax ....................................................................................... 253<br />

8.4 Hungary................................................................................................................ 253<br />

8.4.1 Hungarian Corporate Income Taxation regarding the Securities............................. 253<br />

8.4.2 Hungarian personal income taxation regarding the Securities ................................ 255<br />

8.4.3 Inheritance and Gift Tax ..................................................................................... 256<br />

8.5 Luxembourg ......................................................................................................... 257<br />

8.5.1 Withholding Tax ................................................................................................ 257<br />

8.5.2 Taxes on Income and Capital Gains..................................................................... 258<br />

8.5.3 Net Wealth Tax .................................................................................................. 258<br />

8.5.4 Inheritance and Gift Tax ..................................................................................... 258<br />

8.5.5 Value Added Tax................................................................................................ 258<br />

8.5.6 Other Taxes and Duties....................................................................................... 258<br />

8.5.7 Residence .......................................................................................................... 259<br />

8.5.8 EU Savings Directive.......................................................................................... 259<br />

8.6 Slovakia ............................................................................................................... 259<br />

8.6.1 Slovak income taxation regarding the Notes......................................................... 259<br />

8.6.2 Slovak income tax regarding certificates.............................................................. 262<br />

8.7 Slovenia ............................................................................................................... 265<br />

8.7.1 Corporate income taxation .................................................................................. 265<br />

8.7.2 Personal income taxation .................................................................................... 267<br />

8.7.3 Inheritance and gift tax ....................................................................................... 269<br />

8.7.4 Tax on Capital Gains Act from Alienation of Derivative Financial Instruments...... 269<br />

9. SUMMARY OF PRINCIPAL DOCUMENTS AND SELLING RESTRICTIONS ....... 270<br />

9.1 Principal Documents ............................................................................................. 270<br />

9.2 Selling Restrictions ............................................................................................... 276<br />

<strong>10</strong>. GENERAL INFORMATION................................................................................. 280<br />

11. STATEMENTS PURSUANT TO COMMISSION REGULATION (EC) NO<br />

809/2004.................................................................................................................... 282<br />

12. INDEX OF DEFINITIONS.................................................................................... 283<br />

Annex 1 ..................................................................................................................... 287<br />

Appendix ................................................................................................................... 302<br />

VII