You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ings to be used for various museum activities. An ideas<br />

competition was planned towards the end of the year<br />

for a future residential dwelling development outside<br />

the present prison wall. However, the municipality of<br />

Horsens has deferred a decision on the conditions that,<br />

in <strong>Freja</strong>’s opinion, should be set out before such a<br />

competition.<br />

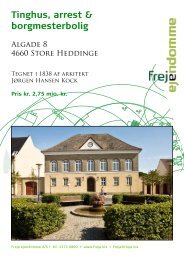

We are still working intently on finding parties interested<br />

in renting and investing in the former<br />

Randers Barracks. The future use of the property is<br />

therefore yet to be determined.<br />

NEW ACCOUNTING POLICIES<br />

This is the first Annual Report that <strong>Freja</strong> presents<br />

under the International Financial Reporting<br />

Standards, IFRS.<br />

The most significant change in connection with the<br />

transition to the new standards relates to the valuation<br />

of the properties not yet sold, as the properties<br />

currently for sale are treated as inventories. This<br />

means that the properties are not revalued, even<br />

where there is a clear indication that the value of<br />

the property is higher than cost.<br />

As a result of this change, two revaluations made in<br />

previous years have been reversed, resulting in a<br />

DKK 42.2 million reduction of equity.<br />

RISKS<br />

During the year, the Company’s operations have not<br />

been subject to particular risk, and the Company is<br />

therefore not considered to be exposed to either<br />

technical or financial risk. The Company is not exposed<br />

to any financing risk. All the Company’s property<br />

transactions are denominated in DKK, and the<br />

Company’s need to draw on credit lines is modest.<br />

Some of the Company’s properties are polluted and<br />

therefore pose a potential environmental hazard.<br />

When the Company takes over a property, the<br />

expected future clean-up costs are included in its<br />

valuation. Costs that may change over the course<br />

of the project. All known and anticipated environ-<br />

60<br />

mental costs have been deducted from the value of<br />

individual properties in the balance sheet.<br />

CORPORATE GOVERNANCE<br />

The Company continues to follow the debate about<br />

corporate governance and about management and<br />

direction of state-owned public limited companies.<br />

In January <strong>2004</strong>, a report, "The State as Shareholder"<br />

was released under government auspices by a number<br />

of ministries. The report examines the corporate<br />

governance requirements specifically for stateowned<br />

public limited companies. Based on this, and<br />

with reference to the report’s recommendations,<br />

<strong>Freja</strong>’s Board of Directors has found it natural to<br />

re-examine its corporate governance.<br />

The Board of Directors considers that with the implemented<br />

adjustments, <strong>Freja</strong> complies with both the<br />

recommendations of the Nørby Committee and the<br />

recommendations of the "The State as Shareholder"<br />

report. The Company plans to perform a new, independent<br />

assessment of corporate governance issues<br />

when a revised edition of the Nørby Committee’s<br />

Report is available. It will in all likelihood be incorporated<br />

in the Annual Report for 2005.<br />

OUTLOOK FOR 2005<br />

It can be difficult to predict the development of the<br />

Company’s sales over the next year, although the<br />

demand for residential construction rights, particularly<br />

in the Copenhagen area, is expected to remain<br />

high. The demand for business construction rights in<br />

this area is expected to be stagnant or slightly down,<br />

which is indicative of the situation in the rest of the<br />

country as well.<br />

One of the implications of the transition to new<br />

accounting policies is that the recognition of the<br />

proceeds from a sale may be deferred beause the<br />

formal recognition requirements are not met.<br />

Based on the above general expectations and a<br />

concrete assessment of the sales expected to be<br />

effected as well as recognised before year end, <strong>Freja</strong><br />

expects a profit for 2005 of around DKK 100 million.