- Page 2 and 3:

STYLE GUIDE

- Page 4 and 5:

STYLE GUIDE

- Page 6 and 7:

Contents Preface vi Introduction 1

- Page 8 and 9:

Introduction On only two scores can

- Page 10 and 11:

introduction negative, then it cann

- Page 12 and 13:

part 1 the essence of style

- Page 14 and 15:

ampersands should be used: 1 when t

- Page 16 and 17:

And Trips (trade-related aspects of

- Page 18 and 19:

If you use one accent (except the t

- Page 20 and 21:

company not corporation court not c

- Page 22 and 23:

Americanisms rhetoric (of which the

- Page 24 and 25:

among and between > anon the Christ

- Page 26 and 27:

as to There is usually a more appro

- Page 28 and 29:

lack In the black means in profi t

- Page 30 and 31:

Guatemala City New York City Ho Chi

- Page 32 and 33:

historical terms Black Death Recons

- Page 34 and 35:

from its National Assembly). If you

- Page 36 and 37:

And if in doubt use lower case (the

- Page 38 and 39:

Francophone (but prefer French-spea

- Page 40 and 41:

clerical titles see titles. clerica

- Page 42 and 43:

word for the job or if you would ha

- Page 44 and 45:

axa, French insurance company Barne

- Page 46 and 47:

countries and their inhabitants and

- Page 48 and 49:

of the Turkish race mostly living i

- Page 50 and 51:

current, contemporary > cyber-expre

- Page 52 and 53:

different from not to or than. dile

- Page 54 and 55:

effectively, in effect Effectively

- Page 56 and 57:

euphemisms Avoid, where possible, e

- Page 58 and 59:

thousand curses, a hundred years of

- Page 60 and 61:

It was hoped that after improvement

- Page 62 and 63:

Forza Italia Médecins Sans Fronti

- Page 64 and 65:

French names see names. fresh is no

- Page 66 and 67:

global > grammar and syntax And wha

- Page 68 and 69:

or for its constituents: The counci

- Page 70 and 71:

passive or active? Be direct. Use t

- Page 72 and 73:

stockbrokers Furman Selz Mager, ban

- Page 74 and 75:

past continuance: He grew up in pos

- Page 76 and 77:

Russia With Love”, “The Man Who

- Page 78 and 79:

eopen reorder repurchase subcommitt

- Page 80 and 81:

9 Avoiding ambiguities a little-use

- Page 82 and 83:

prefi x is of one or two syllables,

- Page 84 and 85:

22 Two words ad hoc (always) air ba

- Page 86 and 87:

i iconoclasm Many good writers brea

- Page 88 and 89:

elite en masse, en route grand prix

- Page 90 and 91:

j Japanese names see names. jargon

- Page 92 and 93:

meaningful perceptions prestigious

- Page 94 and 95:

k key A key may be major or minor,

- Page 96 and 97:

the individual; in the United State

- Page 98 and 99:

m masterful, masterly Masterful mea

- Page 100 and 101:

foundering chains, both fl oods and

- Page 102 and 103:

n names For guidance on spelling pe

- Page 104 and 105:

Arabic names and words Al, al- Try

- Page 106 and 107:

Fahd Qawasmeh Ahmed Qurei Qurnah Ma

- Page 108 and 109:

appropriate title: Mr Budiono. For

- Page 110 and 111:

Georgy Yury Gennady Zhirinovsky Niz

- Page 112 and 113:

the language of a useful or well-li

- Page 114 and 115:

p Pakistani names see names. palate

- Page 116 and 117:

the Caucasus the Netherlands the Ga

- Page 118 and 119:

political correctness But do not la

- Page 120 and 121:

adopt because they cannot bring the

- Page 122 and 123:

2 After plurals that do not end in

- Page 124 and 125: The doctor suggested an aspirin, ha

- Page 126 and 127: q question-marks see punctuation. q

- Page 128 and 129: for Business (2005): “Sector Skil

- Page 130 and 131: short words Use them. They are ofte

- Page 132 and 133: and the need for a strong defence,

- Page 134 and 135: forswear, forsworn fuelled -ful, no

- Page 136 and 137: -able debatable indescribable salab

- Page 138 and 139: quangos sopranos virtuosos radios s

- Page 140 and 141: t table Avoid table as a transitive

- Page 142 and 143: 3 Knights, dames, princes, kings, e

- Page 144 and 145: total is all right as a noun, but a

- Page 146 and 147: Companies can be bought and sold ra

- Page 148 and 149: w warn is transitive, so you must e

- Page 150 and 151: part 2 American and British English

- Page 152 and 153: punctuation commas in lists The use

- Page 154 and 155: spelling the unfamiliar form may st

- Page 156 and 157: -re/-er Most British English words

- Page 158 and 159: of past tense and past participle,

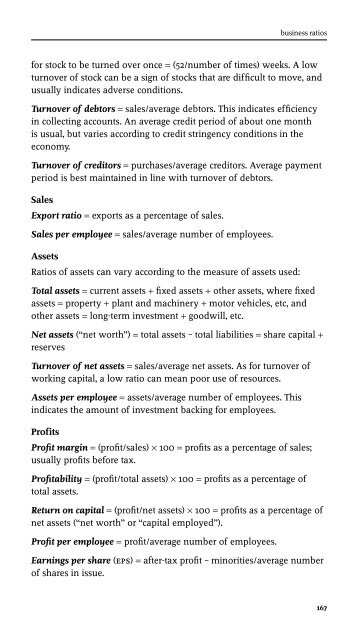

- Page 160 and 161: Accounting, banking and finance voc

- Page 162 and 163: British American crayfish crawfish

- Page 164 and 165: British American high street main s

- Page 166 and 167: part 3 useful reference

- Page 168 and 169: abbreviations chaps Clearing House

- Page 170 and 171: abbreviations nav net asset value n

- Page 172 and 173: Beaufort Scale For devotees of the

- Page 176 and 177: a Figures in brackets denote the nu

- Page 178 and 179: Italy (Italian Republic) Regions Ab

- Page 180 and 181: Krais Altai Krasnoyarsk Khabarovsk

- Page 182 and 183: Peterborough Plymouth Poole Portsmo

- Page 184 and 185: Newtownabbey North Down Omagh Strab

- Page 186 and 187: currencies Country Currency Symbol

- Page 188 and 189: currencies Country Currency Symbol

- Page 190 and 191: e Earthquakes An earthquake is meas

- Page 192 and 193: Name Symbol Radium Ra Radon Rn Rhen

- Page 194 and 195: at the end of the publication in a

- Page 196 and 197: g Geological eras Astronomers and g

- Page 198 and 199: internet iab internet architecture

- Page 200 and 201: l Latin Here are some common Latin

- Page 202 and 203: in loco in the place of; eg, in loc

- Page 204 and 205: Gresham’s law When money of a hig

- Page 206 and 207: m Measures UK imperial units A chan

- Page 208 and 209: Area 1,000km = 1 megametre nautical

- Page 210 and 211: Spanish: short (corta) = 2,000 libr

- Page 212 and 213: Crude oil 1 barrel = 42 US gallons

- Page 214 and 215: Multiply number of Length by to obt

- Page 216 and 217: Multiply number of Weight (mass) by

- Page 218 and 219: 1990 Chemistry Elias James Corey Ec

- Page 220 and 221: Physics Zhores I. Alferov, Jack S.

- Page 222 and 223: Equatorial Guinea Eritrea Ethiopia

- Page 224 and 225:

Observer status Aruba Netherlands A

- Page 226 and 227:

EFTA European Free Trade Associatio

- Page 228 and 229:

G7, G8, G10, G22, G26 In 1975, six

- Page 230 and 231:

organisations OPEC Organization of

- Page 232 and 233:

organisations Specialised agencies

- Page 234 and 235:

populations of the world Country Po

- Page 236 and 237:

presidents of the US and prime mini

- Page 238 and 239:

proofreading illustrations, the pro

- Page 240 and 241:

INSTRUCTION TEXTUAL MARK MARGINAL M

- Page 242 and 243:

INSTRUCTION TEXTUAL MARK MARGINAL M

- Page 244 and 245:

s Stockmarket indices The following

- Page 246 and 247:

Russia rts Slovakia Sax Spain ibex

- Page 248 and 249:

Eastern +9 Central +8 Western +7 Ir

- Page 250 and 251:

apostrophes 114-15 with small capit

- Page 252 and 253:

England, administrative divisions 1

- Page 254 and 255:

lower case for measurements 8 for t

- Page 256 and 257:

sources for references 186-8 spacec