2011 Annual Report - SBM Offshore

2011 Annual Report - SBM Offshore

2011 Annual Report - SBM Offshore

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

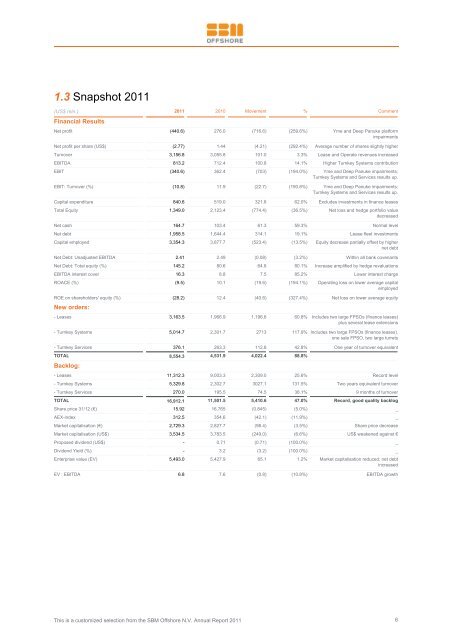

1.3 Snapshot <strong>2011</strong><br />

(US$ mln.) <strong>2011</strong> 2010 Movement % Comment<br />

Financial Results<br />

Net profit (440.6) 276.0 (716.6) (259.6%) Yme and Deep Panuke platform<br />

impairments<br />

Net profit per share (US$) (2.77) 1.44 (4.21) (292.4%) Average number of shares slightly higher<br />

Turnover 3,156.8 3,055.8 101.0 3.3% Lease and Operate revenues increased<br />

EBITDA 813.2 712.4 100.8 14.1% Higher Turnkey Systems contribution<br />

EBIT (340.6) 362.4 (703) (194.0%) Yme and Deep Panuke impairments;;<br />

Turnkey Systems and Services results up.<br />

EBIT: Turnover (%) (10.8) 11.9 (22.7) (190.8%) Yme and Deep Panuke impairments;;<br />

Turnkey Systems and Services results up.<br />

Capital expenditure 840.6 519.0 321.6 62.0% Excludes investments in finance leases<br />

Total Equity 1,349.0 2,123.4 (774.4) (36.5%) Net loss and hedge portfolio value<br />

decreased<br />

Net cash 164.7 103.4 61.3 59.3% Normal level<br />

Net debt 1,958.5 1,644.4 314.1 19.1% Lease fleet investments<br />

Capital employed 3,354.3 3,877.7 (523.4) (13.5%) Equity decrease partially offset by higher<br />

net debt<br />

Net Debt: Unadjusted EBITDA 2.41 2.49 (0.08) (3.2%) Within all bank covenants<br />

Net Debt: Total equity (%) 145.2 80.6 64.6 80.1% Increase amplified by hedge revaluations<br />

EBITDA interest cover 16.3 8.8 7.5 85.2% Lower interest charge<br />

ROACE (%) (9.5) 10.1 (19.6) (194.1%) Operating loss on lower average capital<br />

employed<br />

ROE on shareholders' equity (%) (28.2) 12.4 (40.6) (327.4%) Net loss on lower average equity<br />

New orders:<br />

- Leases 3,163.5 1,966.9 1,196.6 60.8% Includes two large FPSOs (finance leases)<br />

plus several lease extensions<br />

- Turnkey Systems 5,014.7 2,301.7 2713 117.9% Includes two large FPSOs (finance leases),<br />

one sale FPSO, two large turrets<br />

- Turnkey Services 376.1 263.3 112.8 42.8% One year of turnover equivalent<br />

TOTAL 8,554.3 4,531.9 4,022.4 88.8%<br />

Backlog:<br />

- Leases 11,312.3 9,003.3 2,309.0 25.6% Record level<br />

- Turnkey Systems 5,329.8 2,302.7 3027.1 131.5% Two years equivalent turnover<br />

- Turnkey Services 270.0 195.5 74.5 38.1% 9 months of turnover<br />

TOTAL 16,912.1 11,501.5 5,410.6 47.0% Record, good quality backlog<br />

Share price 31/12 (€) 15.92 16.765 (0.845) (5.0%) _<br />

AEX-index 312.5 354.6 (42.1) (11.9%) _<br />

Market capitalisation (€) 2,729.3 2,827.7 (98.4) (3.5%) Share price decrease<br />

Market capitalisation (US$) 3,534.5 3,783.5 (249.0) (6.6%) US$ weakened against €<br />

Proposed dividend (US$) - 0.71 (0.71) (100.0%) _<br />

Dividend Yield (%) - 3.2 (3.2) (100.0%) _<br />

Enterprise value (EV) 5,493.0 5,427.9 65.1 1.2% Market capitalisation reduced;; net debt<br />

increased<br />

EV : EBITDA 6.8 7.6 (0.8) (10.8%) EBITDA growth<br />

This is a customized selection from the <strong>SBM</strong> <strong>Offshore</strong> N.V. <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong><br />

6