Emerging Trends in Real Estate® Europe 2006 - Urban Land Institute

Emerging Trends in Real Estate® Europe 2006 - Urban Land Institute

Emerging Trends in Real Estate® Europe 2006 - Urban Land Institute

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The past two years have seen <strong>in</strong>vestors forced relentlessly up the risk curve <strong>in</strong> order<br />

greater effort is required by fund managers to achieve the<br />

desired returns. However, it rema<strong>in</strong>s to be seen whether managers<br />

can deliver returns <strong>in</strong> more difficult markets. These<br />

funds did not exist at the time of the last market cycle.<br />

Along with ris<strong>in</strong>g fees, <strong>in</strong>vestors are observ<strong>in</strong>g a weaken<strong>in</strong>g<br />

<strong>in</strong> covenants <strong>in</strong> favour of the fund managers. Technical<br />

po<strong>in</strong>ts such as default clauses, exclusivity, and term<strong>in</strong>ation<br />

rights are critical to some <strong>in</strong>stitutions, and several long-term<br />

participants <strong>in</strong> the <strong>in</strong>direct market are now turn<strong>in</strong>g back<br />

toward do<strong>in</strong>g more direct <strong>in</strong>vestment with local jo<strong>in</strong>t venture<br />

partners due to the deterioration <strong>in</strong> covenants. In addition,<br />

many large <strong>in</strong>stitutions are question<strong>in</strong>g the utility of <strong>in</strong>vest<strong>in</strong>g<br />

<strong>in</strong> closed-end funds when the biggest problem they face is<br />

re<strong>in</strong>vestment risk. “What good is a fund that matures and<br />

returns my money after seven years when I can’t even get to<br />

my target weight<strong>in</strong>g?” In response to the latter problem, the<br />

new “flavour du jour” is the <strong>in</strong>stitutional open-ended fund<br />

that has no expiration date. Several of these have already been<br />

launched and more are expected <strong>in</strong> <strong>2006</strong>.<br />

Despite the current problems, <strong>in</strong>direct <strong>in</strong>vestment is still<br />

the most efficient route to cross-border <strong>in</strong>vestment for the<br />

majority of <strong>in</strong>vestors. There are more systematic data on<br />

funds, and this will cont<strong>in</strong>ue to improve dur<strong>in</strong>g <strong>2006</strong> with<br />

<strong>in</strong>itiatives from organisations such as INREV and IPD. There<br />

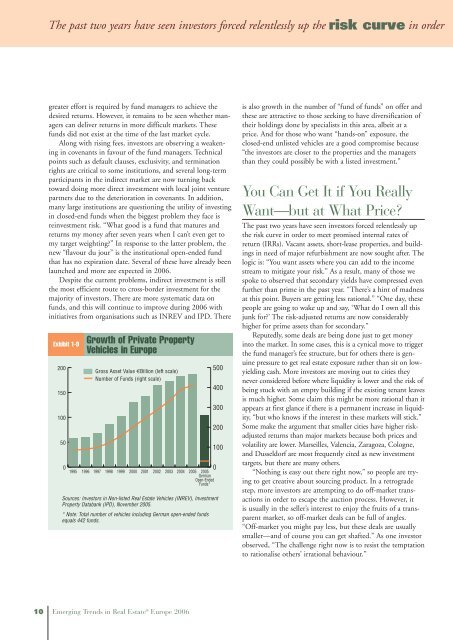

Exhibit 1-9<br />

200<br />

150<br />

100<br />

50<br />

0<br />

Growth of Private Property<br />

Vehicles <strong>in</strong> <strong>Europe</strong><br />

Gross Asset Value €Billion (left scale)<br />

Number of Funds (right scale)<br />

1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2005<br />

German<br />

Open-Ended<br />

Funds*<br />

Sources: Investors <strong>in</strong> Non-listed <strong>Real</strong> Estate Vehicles (INREV), Investment<br />

Property Databank (IPD), November 2005.<br />

* Note: Total number of vehicles <strong>in</strong>clud<strong>in</strong>g German open-ended funds<br />

equals 442 funds.<br />

10 <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> Estate ® <strong>Europe</strong> <strong>2006</strong><br />

500<br />

400<br />

300<br />

200<br />

100<br />

0<br />

is also growth <strong>in</strong> the number of “fund of funds” on offer and<br />

these are attractive to those seek<strong>in</strong>g to have diversification of<br />

their hold<strong>in</strong>gs done by specialists <strong>in</strong> this area, albeit at a<br />

price. And for those who want “hands-on” exposure, the<br />

closed-end unlisted vehicles are a good compromise because<br />

“the <strong>in</strong>vestors are closer to the properties and the managers<br />

than they could possibly be with a listed <strong>in</strong>vestment.”<br />

You Can Get It if You <strong>Real</strong>ly<br />

Want—but at What Price?<br />

The past two years have seen <strong>in</strong>vestors forced relentlessly up<br />

the risk curve <strong>in</strong> order to meet promised <strong>in</strong>ternal rates of<br />

return (IRRs). Vacant assets, short-lease properties, and build<strong>in</strong>gs<br />

<strong>in</strong> need of major refurbishment are now sought after. The<br />

logic is: “You want assets where you can add to the <strong>in</strong>come<br />

stream to mitigate your risk.” As a result, many of those we<br />

spoke to observed that secondary yields have compressed even<br />

further than prime <strong>in</strong> the past year. “There’s a h<strong>in</strong>t of madness<br />

at this po<strong>in</strong>t. Buyers are gett<strong>in</strong>g less rational.” “One day, these<br />

people are go<strong>in</strong>g to wake up and say, ‘What do I own all this<br />

junk for?’ The risk-adjusted returns are now considerably<br />

higher for prime assets than for secondary.”<br />

Reputedly, some deals are be<strong>in</strong>g done just to get money<br />

<strong>in</strong>to the market. In some cases, this is a cynical move to trigger<br />

the fund manager’s fee structure, but for others there is genu<strong>in</strong>e<br />

pressure to get real estate exposure rather than sit on lowyield<strong>in</strong>g<br />

cash. More <strong>in</strong>vestors are mov<strong>in</strong>g out to cities they<br />

never considered before where liquidity is lower and the risk of<br />

be<strong>in</strong>g stuck with an empty build<strong>in</strong>g if the exist<strong>in</strong>g tenant leaves<br />

is much higher. Some claim this might be more rational than it<br />

appears at first glance if there is a permanent <strong>in</strong>crease <strong>in</strong> liquidity,<br />

“but who knows if the <strong>in</strong>terest <strong>in</strong> these markets will stick.”<br />

Some make the argument that smaller cities have higher riskadjusted<br />

returns than major markets because both prices and<br />

volatility are lower. Marseilles, Valencia, Zaragoza, Cologne,<br />

and Dusseldorf are most frequently cited as new <strong>in</strong>vestment<br />

targets, but there are many others.<br />

“Noth<strong>in</strong>g is easy out there right now,” so people are try<strong>in</strong>g<br />

to get creative about sourc<strong>in</strong>g product. In a retrograde<br />

step, more <strong>in</strong>vestors are attempt<strong>in</strong>g to do off-market transactions<br />

<strong>in</strong> order to escape the auction process. However, it<br />

is usually <strong>in</strong> the seller’s <strong>in</strong>terest to enjoy the fruits of a transparent<br />

market, so off-market deals can be full of angles.<br />

“Off-market you might pay less, but these deals are usually<br />

smaller—and of course you can get shafted.” As one <strong>in</strong>vestor<br />

observed, “The challenge right now is to resist the temptation<br />

to rationalise others’ irrational behaviour.”