Emerging Trends in Real Estate® Europe 2006 - Urban Land Institute

Emerging Trends in Real Estate® Europe 2006 - Urban Land Institute

Emerging Trends in Real Estate® Europe 2006 - Urban Land Institute

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>in</strong> <strong>2006</strong>, largely due to its improved risk rat<strong>in</strong>g.<br />

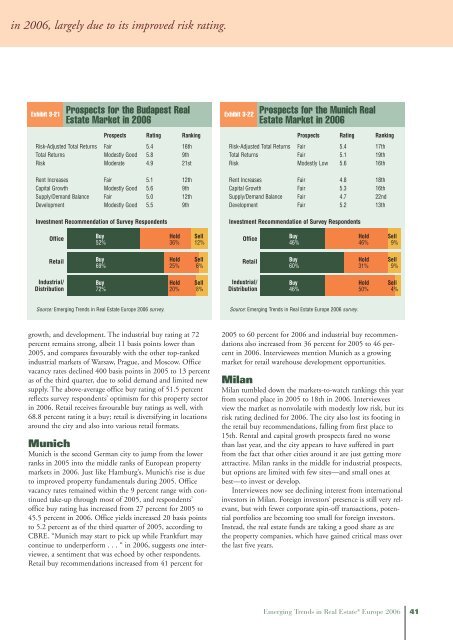

Exhibit 3-21<br />

Prospects for the Budapest <strong>Real</strong><br />

Estate Market <strong>in</strong> <strong>2006</strong><br />

Prospects Rat<strong>in</strong>g Rank<strong>in</strong>g<br />

Risk-Adjusted Total Returns Fair 5.4 16th<br />

Total Returns Modestly Good 5.8 9th<br />

Risk Moderate 4.9 21st<br />

Rent Increases Fair 5.1 12th<br />

Capital Growth Modestly Good 5.6 9th<br />

Supply/Demand Balance Fair 5.0 12th<br />

Development Modestly Good 5.5 9th<br />

Investment Recommendation of Survey Respondents<br />

Office<br />

Retail<br />

Industrial/<br />

Distribution<br />

Buy Hold Sell<br />

52% 36% 12%<br />

Buy Hold Sell<br />

69% 25% 6%<br />

Buy Hold Sell<br />

72% 20% 8%<br />

Source: <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> Estate <strong>Europe</strong> <strong>2006</strong> survey.<br />

growth, and development. The <strong>in</strong>dustrial buy rat<strong>in</strong>g at 72<br />

percent rema<strong>in</strong>s strong, albeit 11 basis po<strong>in</strong>ts lower than<br />

2005, and compares favourably with the other top-ranked<br />

<strong>in</strong>dustrial markets of Warsaw, Prague, and Moscow. Office<br />

vacancy rates decl<strong>in</strong>ed 400 basis po<strong>in</strong>ts <strong>in</strong> 2005 to 13 percent<br />

as of the third quarter, due to solid demand and limited new<br />

supply. The above-average office buy rat<strong>in</strong>g of 51.5 percent<br />

reflects survey respondents’ optimism for this property sector<br />

<strong>in</strong> <strong>2006</strong>. Retail receives favourable buy rat<strong>in</strong>gs as well, with<br />

68.8 percent rat<strong>in</strong>g it a buy; retail is diversify<strong>in</strong>g <strong>in</strong> locations<br />

around the city and also <strong>in</strong>to various retail formats.<br />

Munich<br />

Munich is the second German city to jump from the lower<br />

ranks <strong>in</strong> 2005 <strong>in</strong>to the middle ranks of <strong>Europe</strong>an property<br />

markets <strong>in</strong> <strong>2006</strong>. Just like Hamburg’s, Munich’s rise is due<br />

to improved property fundamentals dur<strong>in</strong>g 2005. Office<br />

vacancy rates rema<strong>in</strong>ed with<strong>in</strong> the 9 percent range with cont<strong>in</strong>ued<br />

take-up through most of 2005, and respondents’<br />

office buy rat<strong>in</strong>g has <strong>in</strong>creased from 27 percent for 2005 to<br />

45.5 percent <strong>in</strong> <strong>2006</strong>. Office yields <strong>in</strong>creased 20 basis po<strong>in</strong>ts<br />

to 5.2 percent as of the third quarter of 2005, accord<strong>in</strong>g to<br />

CBRE. “Munich may start to pick up while Frankfurt may<br />

cont<strong>in</strong>ue to underperform . . . “ <strong>in</strong> <strong>2006</strong>, suggests one <strong>in</strong>terviewee,<br />

a sentiment that was echoed by other respondents.<br />

Retail buy recommendations <strong>in</strong>creased from 41 percent for<br />

Exhibit 3-22<br />

Prospects for the Munich <strong>Real</strong><br />

Estate Market <strong>in</strong> <strong>2006</strong><br />

Prospects Rat<strong>in</strong>g Rank<strong>in</strong>g<br />

Risk-Adjusted Total Returns Fair 5.4 17th<br />

Total Returns Fair 5.1 19th<br />

Risk Modestly Low 5.6 16th<br />

Rent Increases Fair 4.8 18th<br />

Capital Growth Fair 5.3 16th<br />

Supply/Demand Balance Fair 4.7 22nd<br />

Development Fair 5.2 13th<br />

Investment Recommendation of Survey Respondents<br />

Office<br />

Retail<br />

Industrial/<br />

Distribution<br />

Buy Hold Sell<br />

46% 46% 9%<br />

Buy Hold Sell<br />

60% 31% 9%<br />

Buy Hold Sell<br />

46% 50% 4%<br />

Source: <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> Estate <strong>Europe</strong> <strong>2006</strong> survey.<br />

2005 to 60 percent for <strong>2006</strong> and <strong>in</strong>dustrial buy recommendations<br />

also <strong>in</strong>creased from 36 percent for 2005 to 46 percent<br />

<strong>in</strong> <strong>2006</strong>. Interviewees mention Munich as a grow<strong>in</strong>g<br />

market for retail warehouse development opportunities.<br />

Milan<br />

Milan tumbled down the markets-to-watch rank<strong>in</strong>gs this year<br />

from second place <strong>in</strong> 2005 to 18th <strong>in</strong> <strong>2006</strong>. Interviewees<br />

view the market as nonvolatile with modestly low risk, but its<br />

risk rat<strong>in</strong>g decl<strong>in</strong>ed for <strong>2006</strong>. The city also lost its foot<strong>in</strong>g <strong>in</strong><br />

the retail buy recommendations, fall<strong>in</strong>g from first place to<br />

15th. Rental and capital growth prospects fared no worse<br />

than last year, and the city appears to have suffered <strong>in</strong> part<br />

from the fact that other cities around it are just gett<strong>in</strong>g more<br />

attractive. Milan ranks <strong>in</strong> the middle for <strong>in</strong>dustrial prospects,<br />

but options are limited with few sites—and small ones at<br />

best—to <strong>in</strong>vest or develop.<br />

Interviewees now see decl<strong>in</strong><strong>in</strong>g <strong>in</strong>terest from <strong>in</strong>ternational<br />

<strong>in</strong>vestors <strong>in</strong> Milan. Foreign <strong>in</strong>vestors’ presence is still very relevant,<br />

but with fewer corporate sp<strong>in</strong>-off transactions, potential<br />

portfolios are becom<strong>in</strong>g too small for foreign <strong>in</strong>vestors.<br />

Instead, the real estate funds are tak<strong>in</strong>g a good share as are<br />

the property companies, which have ga<strong>in</strong>ed critical mass over<br />

the last five years.<br />

<strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> Estate ® <strong>Europe</strong> <strong>2006</strong> 41