Emerging Trends in Real Estate® Europe 2006 - Urban Land Institute

Emerging Trends in Real Estate® Europe 2006 - Urban Land Institute

Emerging Trends in Real Estate® Europe 2006 - Urban Land Institute

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Exhibit 2-6<br />

Gross Asset Value (GAV) <strong>in</strong> Billions €<br />

25<br />

20<br />

15<br />

10<br />

5<br />

Private Property Vehicles <strong>in</strong> <strong>Europe</strong><br />

by Term<strong>in</strong>ation Year and Fund Type<br />

■ Core ■ Value-Added ■ Opportunity<br />

0<br />

2005 <strong>2006</strong> 2007 2008 2009 2010 2011 2012 2013<br />

Sources: Investors <strong>in</strong> Non-listed <strong>Real</strong> Estate Vehicles (INREV), Investment<br />

Property Databank (IPD), November 2005.<br />

Note: From 2007 to 2012, 167 funds with GAV €76 billion are planned to end.<br />

Pension funds and their advisory consultants are try<strong>in</strong>g<br />

to negotiate this m<strong>in</strong>efield, but there is obviously a limit to<br />

what they can acquire, even <strong>in</strong> the medium term. There is<br />

also a fear that the objective of provid<strong>in</strong>g pensions for an age<strong>in</strong>g<br />

population will be negated by everyone try<strong>in</strong>g to pile <strong>in</strong>to<br />

real estate at the same time, with a resultant distortion <strong>in</strong><br />

pric<strong>in</strong>g. To some extent, this cannot be avoided because there<br />

are <strong>in</strong>vestment deadl<strong>in</strong>es to be met and the returns on cash<br />

are miserable. Clearly, more assets are needed because there<br />

is a structural shortage of <strong>in</strong>stitutional-quality real estate.<br />

Some of those we <strong>in</strong>terviewed from outside the pension<br />

<strong>in</strong>dustry optimistically stated that “more product will come<br />

on the market soon, because the scheduled liquidation of<br />

closed-end private vehicles between 2007 and 2011 will<br />

release huge amounts of assets.” But the majority of <strong>in</strong>vestors<br />

<strong>in</strong> these closed-end vehicles are none other than the <strong>in</strong>stitutions<br />

themselves. This means that these <strong>in</strong>stitutions will have<br />

the additional headache of gett<strong>in</strong>g the money released by the<br />

funds back <strong>in</strong>to the market. For this reason, open-ended<br />

funds with no end date are becom<strong>in</strong>g more popular as noted<br />

earlier <strong>in</strong> this report.<br />

Publicly Listed <strong>Real</strong> Estate:<br />

High Hopes for the Future<br />

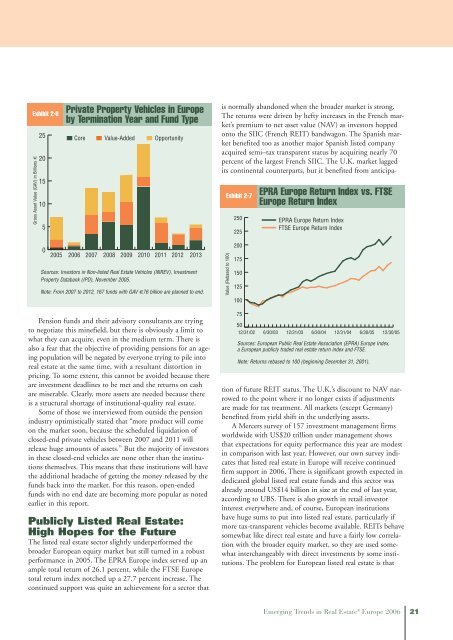

The listed real estate sector slightly underperformed the<br />

broader <strong>Europe</strong>an equity market but still turned <strong>in</strong> a robust<br />

performance <strong>in</strong> 2005. The EPRA <strong>Europe</strong> <strong>in</strong>dex served up an<br />

ample total return of 26.1 percent, while the FTSE <strong>Europe</strong><br />

total return <strong>in</strong>dex notched up a 27.7 percent <strong>in</strong>crease. The<br />

cont<strong>in</strong>ued support was quite an achievement for a sector that<br />

is normally abandoned when the broader market is strong.<br />

The returns were driven by hefty <strong>in</strong>creases <strong>in</strong> the French market’s<br />

premium to net asset value (NAV) as <strong>in</strong>vestors hopped<br />

onto the SIIC (French REIT) bandwagon. The Spanish market<br />

benefited too as another major Spanish listed company<br />

acquired semi–tax transparent status by acquir<strong>in</strong>g nearly 70<br />

percent of the largest French SIIC. The U.K. market lagged<br />

its cont<strong>in</strong>ental counterparts, but it benefited from anticipa-<br />

Exhibit 2-7<br />

Value (Rebased to 100)<br />

250<br />

225<br />

200<br />

175<br />

150<br />

125<br />

100<br />

75<br />

50<br />

12/31/02<br />

EPRA <strong>Europe</strong> Return Index vs. FTSE<br />

<strong>Europe</strong> Return Index<br />

6/30/03<br />

EPRA <strong>Europe</strong> Return Index<br />

FTSE <strong>Europe</strong> Return Index<br />

12/31/03<br />

6/30/04<br />

12/31/04<br />

6/30/05<br />

Sources: <strong>Europe</strong>an Public <strong>Real</strong> Estate Association (EPRA) <strong>Europe</strong> Index,<br />

a <strong>Europe</strong>an publicly traded real estate return <strong>in</strong>dex and FTSE.<br />

Note: Returns rebased to 100 (beg<strong>in</strong>n<strong>in</strong>g December 31, 2001).<br />

12/30/05<br />

tion of future REIT status. The U.K.’s discount to NAV narrowed<br />

to the po<strong>in</strong>t where it no longer exists if adjustments<br />

are made for tax treatment. All markets (except Germany)<br />

benefited from yield shift <strong>in</strong> the underly<strong>in</strong>g assets.<br />

A Mercers survey of 157 <strong>in</strong>vestment management firms<br />

worldwide with US$20 trillion under management shows<br />

that expectations for equity performance this year are modest<br />

<strong>in</strong> comparison with last year. However, our own survey <strong>in</strong>dicates<br />

that listed real estate <strong>in</strong> <strong>Europe</strong> will receive cont<strong>in</strong>ued<br />

firm support <strong>in</strong> <strong>2006</strong>. There is significant growth expected <strong>in</strong><br />

dedicated global listed real estate funds and this sector was<br />

already around US$14 billion <strong>in</strong> size at the end of last year,<br />

accord<strong>in</strong>g to UBS. There is also growth <strong>in</strong> retail <strong>in</strong>vestor<br />

<strong>in</strong>terest everywhere and, of course, <strong>Europe</strong>an <strong>in</strong>stitutions<br />

have huge sums to put <strong>in</strong>to listed real estate, particularly if<br />

more tax-transparent vehicles become available. REITs behave<br />

somewhat like direct real estate and have a fairly low correlation<br />

with the broader equity market, so they are used somewhat<br />

<strong>in</strong>terchangeably with direct <strong>in</strong>vestments by some <strong>in</strong>stitutions.<br />

The problem for <strong>Europe</strong>an listed real estate is that<br />

<strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> Estate ® <strong>Europe</strong> <strong>2006</strong> 21