Emerging Trends in Real Estate® Europe 2006 - Urban Land Institute

Emerging Trends in Real Estate® Europe 2006 - Urban Land Institute

Emerging Trends in Real Estate® Europe 2006 - Urban Land Institute

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

The Dubl<strong>in</strong> market is its own <strong>in</strong>ternal eng<strong>in</strong>e. Growth cont<strong>in</strong>ues to be impressive; it<br />

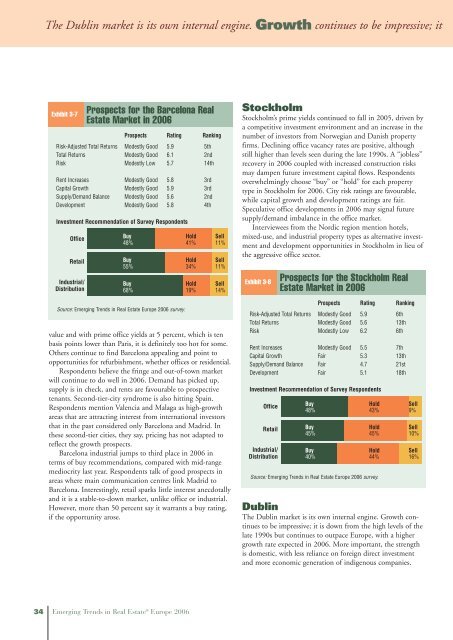

Exhibit 3-7<br />

Prospects for the Barcelona <strong>Real</strong><br />

Estate Market <strong>in</strong> <strong>2006</strong><br />

Prospects Rat<strong>in</strong>g Rank<strong>in</strong>g<br />

Risk-Adjusted Total Returns Modestly Good 5.9 5th<br />

Total Returns Modestly Good 6.1 2nd<br />

Risk Modestly Low 5.7 14th<br />

Rent Increases Modestly Good 5.8 3rd<br />

Capital Growth Modestly Good 5.9 3rd<br />

Supply/Demand Balance Modestly Good 5.6 2nd<br />

Development Modestly Good 5.8 4th<br />

Investment Recommendation of Survey Respondents<br />

Office<br />

Retail<br />

Industrial/<br />

Distribution<br />

Buy Hold Sell<br />

48% 41% 11%<br />

Buy Hold Sell<br />

55% 34% 11%<br />

Buy Hold Sell<br />

68% 19% 14%<br />

Source: <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> Estate <strong>Europe</strong> <strong>2006</strong> survey.<br />

value and with prime office yields at 5 percent, which is ten<br />

basis po<strong>in</strong>ts lower than Paris, it is def<strong>in</strong>itely too hot for some.<br />

Others cont<strong>in</strong>ue to f<strong>in</strong>d Barcelona appeal<strong>in</strong>g and po<strong>in</strong>t to<br />

opportunities for refurbishment, whether offices or residential.<br />

Respondents believe the fr<strong>in</strong>ge and out-of-town market<br />

will cont<strong>in</strong>ue to do well <strong>in</strong> <strong>2006</strong>. Demand has picked up,<br />

supply is <strong>in</strong> check, and rents are favourable to prospective<br />

tenants. Second-tier-city syndrome is also hitt<strong>in</strong>g Spa<strong>in</strong>.<br />

Respondents mention Valencia and Malaga as high-growth<br />

areas that are attract<strong>in</strong>g <strong>in</strong>terest from <strong>in</strong>ternational <strong>in</strong>vestors<br />

that <strong>in</strong> the past considered only Barcelona and Madrid. In<br />

these second-tier cities, they say, pric<strong>in</strong>g has not adapted to<br />

reflect the growth prospects.<br />

Barcelona <strong>in</strong>dustrial jumps to third place <strong>in</strong> <strong>2006</strong> <strong>in</strong><br />

terms of buy recommendations, compared with mid-range<br />

mediocrity last year. Respondents talk of good prospects <strong>in</strong><br />

areas where ma<strong>in</strong> communication centres l<strong>in</strong>k Madrid to<br />

Barcelona. Interest<strong>in</strong>gly, retail sparks little <strong>in</strong>terest anecdotally<br />

and it is a stable-to-down market, unlike office or <strong>in</strong>dustrial.<br />

However, more than 50 percent say it warrants a buy rat<strong>in</strong>g,<br />

if the opportunity arose.<br />

34 <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> Estate ® <strong>Europe</strong> <strong>2006</strong><br />

Stockholm<br />

Stockholm’s prime yields cont<strong>in</strong>ued to fall <strong>in</strong> 2005, driven by<br />

a competitive <strong>in</strong>vestment environment and an <strong>in</strong>crease <strong>in</strong> the<br />

number of <strong>in</strong>vestors from Norwegian and Danish property<br />

firms. Decl<strong>in</strong><strong>in</strong>g office vacancy rates are positive, although<br />

still higher than levels seen dur<strong>in</strong>g the late 1990s. A “jobless”<br />

recovery <strong>in</strong> <strong>2006</strong> coupled with <strong>in</strong>creased construction risks<br />

may dampen future <strong>in</strong>vestment capital flows. Respondents<br />

overwhelm<strong>in</strong>gly choose “buy” or “hold” for each property<br />

type <strong>in</strong> Stockholm for <strong>2006</strong>. City risk rat<strong>in</strong>gs are favourable,<br />

while capital growth and development rat<strong>in</strong>gs are fair.<br />

Speculative office developments <strong>in</strong> <strong>2006</strong> may signal future<br />

supply/demand imbalance <strong>in</strong> the office market.<br />

Interviewees from the Nordic region mention hotels,<br />

mixed-use, and <strong>in</strong>dustrial property types as alternative <strong>in</strong>vestment<br />

and development opportunities <strong>in</strong> Stockholm <strong>in</strong> lieu of<br />

the aggressive office sector.<br />

Exhibit 3-8<br />

Prospects for the Stockholm <strong>Real</strong><br />

Estate Market <strong>in</strong> <strong>2006</strong><br />

Prospects Rat<strong>in</strong>g Rank<strong>in</strong>g<br />

Risk-Adjusted Total Returns Modestly Good 5.9 6th<br />

Total Returns Modestly Good 5.6 13th<br />

Risk Modestly Low 6.2 6th<br />

Rent Increases Modestly Good 5.5 7th<br />

Capital Growth Fair 5.3 13th<br />

Supply/Demand Balance Fair 4.7 21st<br />

Development Fair 5.1 18th<br />

Investment Recommendation of Survey Respondents<br />

Office<br />

Retail<br />

Industrial/<br />

Distribution<br />

Buy Hold Sell<br />

48% 43% 9%<br />

Buy Hold Sell<br />

45% 45% 10%<br />

Buy Hold Sell<br />

40% 44% 16%<br />

Source: <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> Estate <strong>Europe</strong> <strong>2006</strong> survey.<br />

Dubl<strong>in</strong><br />

The Dubl<strong>in</strong> market is its own <strong>in</strong>ternal eng<strong>in</strong>e. Growth cont<strong>in</strong>ues<br />

to be impressive; it is down from the high levels of the<br />

late 1990s but cont<strong>in</strong>ues to outpace <strong>Europe</strong>, with a higher<br />

growth rate expected <strong>in</strong> <strong>2006</strong>. More important, the strength<br />

is domestic, with less reliance on foreign direct <strong>in</strong>vestment<br />

and more economic generation of <strong>in</strong>digenous companies.