Emerging Trends in Real Estate® Europe 2006 - Urban Land Institute

Emerging Trends in Real Estate® Europe 2006 - Urban Land Institute

Emerging Trends in Real Estate® Europe 2006 - Urban Land Institute

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

The decl<strong>in</strong>e <strong>in</strong> yields has to stop at some po<strong>in</strong>t, but few of those we <strong>in</strong>terviewed believe<br />

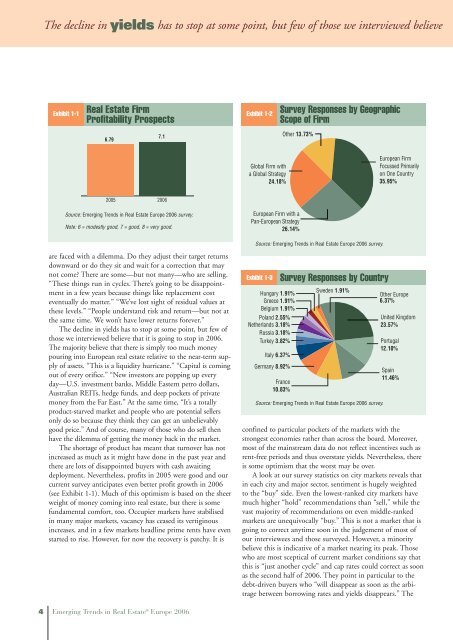

Exhibit 1-1<br />

<strong>Real</strong> Estate Firm<br />

Profitability Prospects<br />

6.79<br />

2005 <strong>2006</strong><br />

Source: <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> Estate <strong>Europe</strong> <strong>2006</strong> survey.<br />

are faced with a dilemma. Do they adjust their target returns<br />

downward or do they sit and wait for a correction that may<br />

not come? There are some—but not many—who are sell<strong>in</strong>g.<br />

“These th<strong>in</strong>gs run <strong>in</strong> cycles. There’s go<strong>in</strong>g to be disappo<strong>in</strong>tment<br />

<strong>in</strong> a few years because th<strong>in</strong>gs like replacement cost<br />

eventually do matter.” “We’ve lost sight of residual values at<br />

these levels.” “People understand risk and return—but not at<br />

the same time. We won’t have lower returns forever.”<br />

The decl<strong>in</strong>e <strong>in</strong> yields has to stop at some po<strong>in</strong>t, but few of<br />

those we <strong>in</strong>terviewed believe that it is go<strong>in</strong>g to stop <strong>in</strong> <strong>2006</strong>.<br />

The majority believe that there is simply too much money<br />

pour<strong>in</strong>g <strong>in</strong>to <strong>Europe</strong>an real estate relative to the near-term supply<br />

of assets. “This is a liquidity hurricane.” “Capital is com<strong>in</strong>g<br />

out of every orifice.” “New <strong>in</strong>vestors are popp<strong>in</strong>g up every<br />

day—U.S. <strong>in</strong>vestment banks, Middle Eastern petro dollars,<br />

Australian REITs, hedge funds, and deep pockets of private<br />

money from the Far East.” At the same time, “It’s a totally<br />

product-starved market and people who are potential sellers<br />

only do so because they th<strong>in</strong>k they can get an unbelievably<br />

good price.” And of course, many of those who do sell then<br />

have the dilemma of gett<strong>in</strong>g the money back <strong>in</strong> the market.<br />

The shortage of product has meant that turnover has not<br />

<strong>in</strong>creased as much as it might have done <strong>in</strong> the past year and<br />

there are lots of disappo<strong>in</strong>ted buyers with cash await<strong>in</strong>g<br />

deployment. Nevertheless, profits <strong>in</strong> 2005 were good and our<br />

current survey anticipates even better profit growth <strong>in</strong> <strong>2006</strong><br />

(see Exhibit 1-1). Much of this optimism is based on the sheer<br />

weight of money com<strong>in</strong>g <strong>in</strong>to real estate, but there is some<br />

fundamental comfort, too. Occupier markets have stabilised<br />

<strong>in</strong> many major markets, vacancy has ceased its vertig<strong>in</strong>ous<br />

<strong>in</strong>creases, and <strong>in</strong> a few markets headl<strong>in</strong>e prime rents have even<br />

started to rise. However, for now the recovery is patchy. It is<br />

4 <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> Estate ® <strong>Europe</strong> <strong>2006</strong><br />

7.1<br />

Note: 6 = modestly good, 7 = good, 8 = very good.<br />

Exhibit 1-2<br />

Global Firm with<br />

a Global Strategy<br />

24.18%<br />

<strong>Europe</strong>an Firm with a<br />

Pan-<strong>Europe</strong>an Strategy<br />

26.14%<br />

Survey Responses by Geographic<br />

Scope of Firm<br />

Other 13.73%<br />

Source: <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> Estate <strong>Europe</strong> <strong>2006</strong> survey.<br />

Exhibit 1-3 Survey Responses by Country<br />

Source: <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> Estate <strong>Europe</strong> <strong>2006</strong> survey.<br />

<strong>Europe</strong>an Firm<br />

Focussed Primarily<br />

on One Country<br />

35.95%<br />

Hungary 1.91%<br />

Greece 1.91%<br />

Belgium 1.91%<br />

Sweden 1.91%<br />

Other <strong>Europe</strong><br />

6.37%<br />

Poland 2.55%<br />

Netherlands 3.18%<br />

Russia 3.18%<br />

Turkey 3.82%<br />

Italy 6.37%<br />

Germany 8.92%<br />

France<br />

10.83%<br />

United K<strong>in</strong>gdom<br />

23.57%<br />

Portugal<br />

12.10%<br />

Spa<strong>in</strong><br />

11.46%<br />

conf<strong>in</strong>ed to particular pockets of the markets with the<br />

strongest economies rather than across the board. Moreover,<br />

most of the ma<strong>in</strong>stream data do not reflect <strong>in</strong>centives such as<br />

rent-free periods and thus overstate yields. Nevertheless, there<br />

is some optimism that the worst may be over.<br />

A look at our survey statistics on city markets reveals that<br />

<strong>in</strong> each city and major sector, sentiment is hugely weighted<br />

to the “buy” side. Even the lowest-ranked city markets have<br />

much higher “hold” recommendations than “sell,” while the<br />

vast majority of recommendations on even middle-ranked<br />

markets are unequivocally “buy.” This is not a market that is<br />

go<strong>in</strong>g to correct anytime soon <strong>in</strong> the judgement of most of<br />

our <strong>in</strong>terviewees and those surveyed. However, a m<strong>in</strong>ority<br />

believe this is <strong>in</strong>dicative of a market near<strong>in</strong>g its peak. Those<br />

who are most sceptical of current market conditions say that<br />

this is “just another cycle” and cap rates could correct as soon<br />

as the second half of <strong>2006</strong>. They po<strong>in</strong>t <strong>in</strong> particular to the<br />

debt-driven buyers who “will disappear as soon as the arbitrage<br />

between borrow<strong>in</strong>g rates and yields disappears.” The