Emerging Trends in Real Estate® Europe 2006 - Urban Land Institute

Emerging Trends in Real Estate® Europe 2006 - Urban Land Institute

Emerging Trends in Real Estate® Europe 2006 - Urban Land Institute

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Investors rate Copenhagen as the city with the lowest risk of any <strong>in</strong> the survey.<br />

cities, which are benefit<strong>in</strong>g from the overspill of competition<br />

<strong>in</strong> Paris. Office property yields <strong>in</strong> Lyon at 7.5 percent are still<br />

160 basis po<strong>in</strong>ts above Paris at 5.1 percent. It is a smaller, less<br />

liquid market, but respondents have the confidence to believe<br />

that development with some prelett<strong>in</strong>g will be possible <strong>in</strong><br />

<strong>2006</strong>. While Lyon is perceived as be<strong>in</strong>g somewhat risky, over<br />

60 percent of survey respondents recommend buy<strong>in</strong>g office,<br />

retail, and/or <strong>in</strong>dustrial properties <strong>in</strong> Lyon <strong>in</strong> <strong>2006</strong>, mak<strong>in</strong>g it<br />

one of the favourite “buy” markets <strong>in</strong> <strong>Europe</strong>.<br />

Copenhagen<br />

Copenhagen has moved <strong>in</strong>to the elite top ten market rank<strong>in</strong>gs<br />

<strong>in</strong> <strong>2006</strong> from the middle of the pack last year. Fall<strong>in</strong>g<br />

yields, fundamental improvements, and optimism regard<strong>in</strong>g<br />

employment growth <strong>in</strong> <strong>2006</strong> fuel positive expectations that<br />

flat prime rents <strong>in</strong> 2005 will improve <strong>in</strong> <strong>2006</strong>. Investors also<br />

rate Copenhagen as the city with the lowest risk of any <strong>in</strong> the<br />

survey, which significantly bolstered its rat<strong>in</strong>g. Positive economic<br />

growth is susta<strong>in</strong><strong>in</strong>g property market demand and foreign<br />

<strong>in</strong>vestment is visible <strong>in</strong> the market. Retail properties<br />

attracted foreign <strong>in</strong>vestors <strong>in</strong> 2005 with cont<strong>in</strong>ued <strong>in</strong>terest <strong>in</strong><br />

<strong>2006</strong>. The hold recommendation for <strong>in</strong>dustrial at 71.4 percent<br />

is the highest among all property markets, and the hold<br />

recommendation for office is high as well, with office vacancy<br />

at a fairly low 7.2 percent.<br />

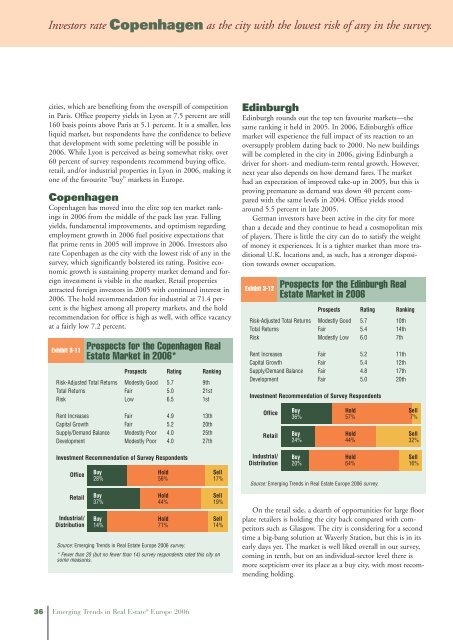

Exhibit 3-11<br />

Prospects for the Copenhagen <strong>Real</strong><br />

Estate Market <strong>in</strong> <strong>2006</strong>*<br />

Prospects Rat<strong>in</strong>g Rank<strong>in</strong>g<br />

Risk-Adjusted Total Returns Modestly Good 5.7 9th<br />

Total Returns Fair 5.0 21st<br />

Risk Low 6.5 1st<br />

Rent Increases Fair 4.9 13th<br />

Capital Growth Fair 5.2 20th<br />

Supply/Demand Balance Modestly Poor 4.0 25th<br />

Development Modestly Poor 4.0 27th<br />

Investment Recommendation of Survey Respondents<br />

Office<br />

Retail<br />

Industrial/<br />

Distribution<br />

Buy Hold Sell<br />

28% 56% 17%<br />

Buy Hold Sell<br />

37% 44% 19%<br />

Buy Hold Sell<br />

14% 71% 14%<br />

Source: <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> Estate <strong>Europe</strong> <strong>2006</strong> survey.<br />

* Fewer than 20 (but no fewer than 14) survey respondents rated this city on<br />

some measures.<br />

36 <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> Estate ® <strong>Europe</strong> <strong>2006</strong><br />

Ed<strong>in</strong>burgh<br />

Ed<strong>in</strong>burgh rounds out the top ten favourite markets—the<br />

same rank<strong>in</strong>g it held <strong>in</strong> 2005. In <strong>2006</strong>, Ed<strong>in</strong>burgh’s office<br />

market will experience the full impact of its reaction to an<br />

oversupply problem dat<strong>in</strong>g back to 2000. No new build<strong>in</strong>gs<br />

will be completed <strong>in</strong> the city <strong>in</strong> <strong>2006</strong>, giv<strong>in</strong>g Ed<strong>in</strong>burgh a<br />

driver for short- and medium-term rental growth. However,<br />

next year also depends on how demand fares. The market<br />

had an expectation of improved take-up <strong>in</strong> 2005, but this is<br />

prov<strong>in</strong>g premature as demand was down 40 percent compared<br />

with the same levels <strong>in</strong> 2004. Office yields stood<br />

around 5.5 percent <strong>in</strong> late 2005.<br />

German <strong>in</strong>vestors have been active <strong>in</strong> the city for more<br />

than a decade and they cont<strong>in</strong>ue to head a cosmopolitan mix<br />

of players. There is little the city can do to satisfy the weight<br />

of money it experiences. It is a tighter market than more traditional<br />

U.K. locations and, as such, has a stronger disposition<br />

towards owner occupation.<br />

Exhibit 3-12<br />

Prospects for the Ed<strong>in</strong>burgh <strong>Real</strong><br />

Estate Market <strong>in</strong> <strong>2006</strong><br />

Prospects Rat<strong>in</strong>g Rank<strong>in</strong>g<br />

Risk-Adjusted Total Returns Modestly Good 5.7 10th<br />

Total Returns Fair 5.4 14th<br />

Risk Modestly Low 6.0 7th<br />

Rent Increases Fair 5.2 11th<br />

Capital Growth Fair 5.4 12th<br />

Supply/Demand Balance Fair 4.8 17th<br />

Development Fair 5.0 20th<br />

Investment Recommendation of Survey Respondents<br />

Office<br />

Retail<br />

Industrial/<br />

Distribution<br />

Buy Hold Sell<br />

36% 57% 7%<br />

Buy Hold Sell<br />

24% 44% 32%<br />

Buy Hold Sell<br />

20% 64% 16%<br />

Source: <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> Estate <strong>Europe</strong> <strong>2006</strong> survey.<br />

On the retail side, a dearth of opportunities for large floor<br />

plate retailers is hold<strong>in</strong>g the city back compared with competitors<br />

such as Glasgow. The city is consider<strong>in</strong>g for a second<br />

time a big-bang solution at Waverly Station, but this is <strong>in</strong> its<br />

early days yet. The market is well liked overall <strong>in</strong> our survey,<br />

com<strong>in</strong>g <strong>in</strong> tenth, but on an <strong>in</strong>dividual-sector level there is<br />

more scepticism over its place as a buy city, with most recommend<strong>in</strong>g<br />

hold<strong>in</strong>g.