Emerging Trends in Real Estate® Europe 2006 - Urban Land Institute

Emerging Trends in Real Estate® Europe 2006 - Urban Land Institute

Emerging Trends in Real Estate® Europe 2006 - Urban Land Institute

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>in</strong> <strong>2006</strong>.<br />

Exhibit 4-3<br />

100%<br />

80%<br />

60%<br />

40%<br />

20%<br />

0%<br />

also show some promise, but office, street retail, and manufactur<strong>in</strong>g<br />

offer only fair prospects. It is no surprise that, while<br />

the prospects for the office market may improve, the sector<br />

certa<strong>in</strong>ly does not need any new development, especially <strong>in</strong><br />

the bus<strong>in</strong>ess park/out-of-town segment.<br />

Retail<br />

<strong>Europe</strong>an Direct <strong>Real</strong> Estate<br />

Investment, by Property Type<br />

Office<br />

Retail<br />

Industrial<br />

Hotel<br />

Mixed-Use/<br />

Other<br />

2000 2001 2002 2003 2004 1H 2005<br />

Source: Jones Lang LaSalle <strong>Europe</strong>an Research.<br />

Note: Figures exclude Portugal and Denmark.<br />

There is much less consistency of views about the retail sector<br />

this year from our survey. Retail parks and shopp<strong>in</strong>g centres<br />

have rema<strong>in</strong>ed the top-rated sectors for total returns, with<br />

slightly higher rat<strong>in</strong>gs than last year, but beneath this headl<strong>in</strong>e<br />

the survey rat<strong>in</strong>gs show creep<strong>in</strong>g concerns over rental<br />

growth and development prospects.<br />

Cont<strong>in</strong>u<strong>in</strong>g weak consumer spend<strong>in</strong>g across <strong>Europe</strong> is<br />

now caus<strong>in</strong>g concern among <strong>in</strong>vestors as well as economists.<br />

Spa<strong>in</strong> and the U.K. face a somewhat weaker <strong>2006</strong>. Germany<br />

cont<strong>in</strong>ues to be somewhat weaker but is set to get a temporary<br />

boost with the stag<strong>in</strong>g of the World Cup <strong>in</strong> summer<br />

<strong>2006</strong>. Meanwhile, buck<strong>in</strong>g the trend, at least temporarily, is<br />

France, which is outpac<strong>in</strong>g economic forecasts for its consumer<br />

spend<strong>in</strong>g.<br />

Despite this, retail rema<strong>in</strong>s the sector of choice for many.<br />

“Retail has been very attractive, and because of the more stable<br />

performance, many <strong>in</strong>vestors are look<strong>in</strong>g at it. The outlook<br />

for Germany, France, southern <strong>Europe</strong>, and the Nordic<br />

region is very attractive, while the prices <strong>in</strong> the U.K. and central<br />

<strong>Europe</strong> are not.” Yields are quite low, but survey results<br />

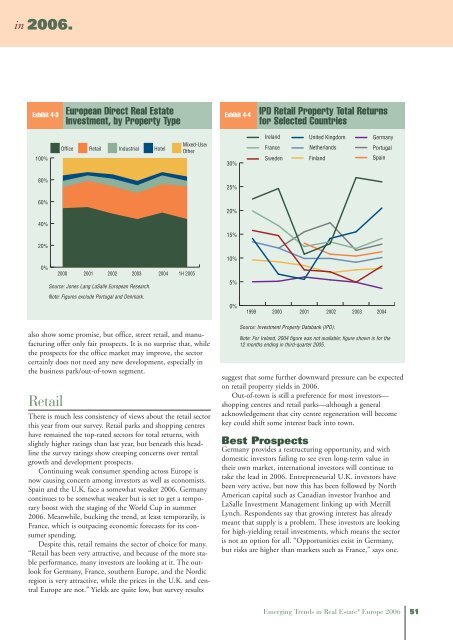

Exhibit 4-4 IPD Retail Property Total Returns<br />

for Selected Countries<br />

30%<br />

25%<br />

20%<br />

15%<br />

10%<br />

5%<br />

0%<br />

Ireland<br />

France<br />

Sweden<br />

United K<strong>in</strong>gdom<br />

Netherlands<br />

F<strong>in</strong>land<br />

Germany<br />

Portugal<br />

Spa<strong>in</strong><br />

1999 2000 2001 2002 2003 2004<br />

Source: Investment Property Databank (IPD).<br />

Note: For Ireland, 2004 figure was not available; figure shown is for the<br />

12 months end<strong>in</strong>g <strong>in</strong> third-quarter 2005.<br />

suggest that some further downward pressure can be expected<br />

on retail property yields <strong>in</strong> <strong>2006</strong>.<br />

Out-of-town is still a preference for most <strong>in</strong>vestors—<br />

shopp<strong>in</strong>g centres and retail parks—although a general<br />

acknowledgement that city centre regeneration will become<br />

key could shift some <strong>in</strong>terest back <strong>in</strong>to town.<br />

Best Prospects<br />

Germany provides a restructur<strong>in</strong>g opportunity, and with<br />

domestic <strong>in</strong>vestors fail<strong>in</strong>g to see even long-term value <strong>in</strong><br />

their own market, <strong>in</strong>ternational <strong>in</strong>vestors will cont<strong>in</strong>ue to<br />

take the lead <strong>in</strong> <strong>2006</strong>. Entrepreneurial U.K. <strong>in</strong>vestors have<br />

been very active, but now this has been followed by North<br />

American capital such as Canadian <strong>in</strong>vestor Ivanhoe and<br />

LaSalle Investment Management l<strong>in</strong>k<strong>in</strong>g up with Merrill<br />

Lynch. Respondents say that grow<strong>in</strong>g <strong>in</strong>terest has already<br />

meant that supply is a problem. These <strong>in</strong>vestors are look<strong>in</strong>g<br />

for high-yield<strong>in</strong>g retail <strong>in</strong>vestments, which means the sector<br />

is not an option for all. “Opportunities exist <strong>in</strong> Germany,<br />

but risks are higher than markets such as France,” says one.<br />

<strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> Estate ® <strong>Europe</strong> <strong>2006</strong> 51