Emerging Trends in Real Estate® Europe 2006 - Urban Land Institute

Emerging Trends in Real Estate® Europe 2006 - Urban Land Institute

Emerging Trends in Real Estate® Europe 2006 - Urban Land Institute

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Even though Moscow ranks at the lower end of the pack, survey respondents are conflicted<br />

of the market, with acquisitions below that level rema<strong>in</strong><strong>in</strong>g the<br />

preserve of private <strong>in</strong>vestors. Capital values will be affected positively,<br />

say respondents, but not exponentially. Many flag up a<br />

worry about land prices cont<strong>in</strong>u<strong>in</strong>g to rise <strong>in</strong> <strong>2006</strong>, though.<br />

Debt and equity are available <strong>in</strong> Greece, with debt look<strong>in</strong>g<br />

to <strong>in</strong>crease <strong>in</strong> share <strong>in</strong> the com<strong>in</strong>g years. Syndicates are<br />

expected to be an important source of f<strong>in</strong>anc<strong>in</strong>g. Most<br />

respondents agree that the capital is generally discipl<strong>in</strong>ed, but<br />

ma<strong>in</strong>ly because “there is not an abundance of <strong>in</strong>vestmentgrade<br />

products.” Also, with a less transparent market, more<br />

care is needed before <strong>in</strong>vest<strong>in</strong>g.<br />

Retail is a preferred sector, which shows with its sixthplace<br />

rank<strong>in</strong>g on retail buy<strong>in</strong>g prospects—64 percent recommend<br />

buy<strong>in</strong>g retail <strong>in</strong> Athens—but there is a shortage of<br />

product. This is likely to be exacerbated <strong>in</strong> <strong>2006</strong> as respondents<br />

see development <strong>in</strong>terest <strong>in</strong> retail tail<strong>in</strong>g off but <strong>in</strong>vestment<br />

<strong>in</strong>terest <strong>in</strong>creas<strong>in</strong>g. Industrial rema<strong>in</strong>s an owner-occupier<br />

market, so little action is forecasted for <strong>2006</strong>. In the<br />

hotel sector, development of top-end, five-star hotels is a significant<br />

trend for <strong>2006</strong>.<br />

Moscow<br />

Even though Moscow ranks at the lower end of the pack, survey<br />

respondents are conflicted about the market and overwhelm<strong>in</strong>gly<br />

<strong>in</strong>dicate strong “buy” signals for all property<br />

types, especially <strong>in</strong>dustrial. Moscow suffers <strong>in</strong> the rank<strong>in</strong>gs<br />

largely because of its poor risk rat<strong>in</strong>gs; respondents rate it the<br />

highest-risk city of all 27 cities <strong>in</strong> our survey. This is reflected<br />

<strong>in</strong> office prime yields, which stood at 12.5 percent <strong>in</strong> the<br />

third quarter of 2005, accord<strong>in</strong>g to CBRE. There is still the<br />

“. . . need for the market to become more transparent and<br />

open; people should be comfortable that there would be fair,<br />

open, clear rules,” accord<strong>in</strong>g to an <strong>in</strong>terviewee active <strong>in</strong><br />

Russia and other CIS countries. Moscow’s risk-adjusted total<br />

return rat<strong>in</strong>g puts it <strong>in</strong> 26th place. On the other hand,<br />

Moscow ranks highly (second place) on prospects for both<br />

capital growth and development.<br />

46 <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> Estate ® <strong>Europe</strong> <strong>2006</strong><br />

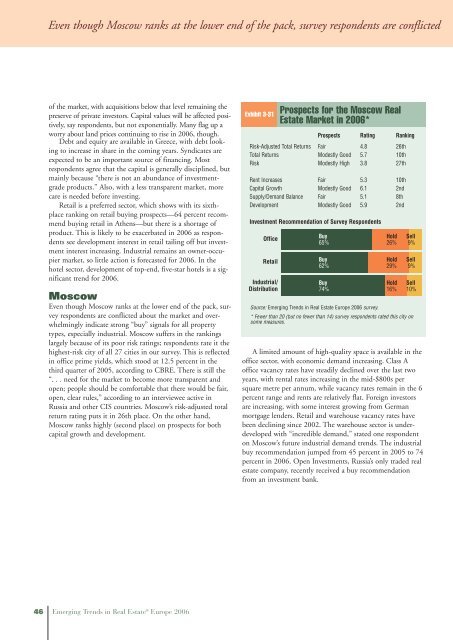

Exhibit 3-31<br />

Prospects for the Moscow <strong>Real</strong><br />

Estate Market <strong>in</strong> <strong>2006</strong>*<br />

Prospects Rat<strong>in</strong>g Rank<strong>in</strong>g<br />

Risk-Adjusted Total Returns Fair 4.8 26th<br />

Total Returns Modestly Good 5.7 10th<br />

Risk Modestly High 3.8 27th<br />

Rent Increases Fair 5.3 10th<br />

Capital Growth Modestly Good 6.1 2nd<br />

Supply/Demand Balance Fair 5.1 8th<br />

Development Modestly Good 5.9 2nd<br />

Investment Recommendation of Survey Respondents<br />

Office<br />

Retail<br />

Industrial/<br />

Distribution<br />

Buy Hold Sell<br />

65% 26% 9%<br />

Buy Hold Sell<br />

62% 29% 9%<br />

Buy Hold Sell<br />

74% 16% 10%<br />

Source: <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> Estate <strong>Europe</strong> <strong>2006</strong> survey.<br />

* Fewer than 20 (but no fewer than 14) survey respondents rated this city on<br />

some measures.<br />

A limited amount of high-quality space is available <strong>in</strong> the<br />

office sector, with economic demand <strong>in</strong>creas<strong>in</strong>g. Class A<br />

office vacancy rates have steadily decl<strong>in</strong>ed over the last two<br />

years, with rental rates <strong>in</strong>creas<strong>in</strong>g <strong>in</strong> the mid-$800s per<br />

square metre per annum, while vacancy rates rema<strong>in</strong> <strong>in</strong> the 6<br />

percent range and rents are relatively flat. Foreign <strong>in</strong>vestors<br />

are <strong>in</strong>creas<strong>in</strong>g, with some <strong>in</strong>terest grow<strong>in</strong>g from German<br />

mortgage lenders. Retail and warehouse vacancy rates have<br />

been decl<strong>in</strong><strong>in</strong>g s<strong>in</strong>ce 2002. The warehouse sector is underdeveloped<br />

with “<strong>in</strong>credible demand,” stated one respondent<br />

on Moscow’s future <strong>in</strong>dustrial demand trends. The <strong>in</strong>dustrial<br />

buy recommendation jumped from 45 percent <strong>in</strong> 2005 to 74<br />

percent <strong>in</strong> <strong>2006</strong>. Open Investments, Russia’s only traded real<br />

estate company, recently received a buy recommendation<br />

from an <strong>in</strong>vestment bank.