Emerging Trends in Real Estate® Europe 2006 - Urban Land Institute

Emerging Trends in Real Estate® Europe 2006 - Urban Land Institute

Emerging Trends in Real Estate® Europe 2006 - Urban Land Institute

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

eflect<strong>in</strong>g <strong>in</strong>creas<strong>in</strong>g <strong>in</strong>vestor confidence <strong>in</strong> the sector.<br />

While logistics prospects are higher <strong>in</strong> the rank<strong>in</strong>gs, competition<br />

from other sectors has pushed them down a few places<br />

compared with 2005. The sector’s third- and fourth-place<br />

rank<strong>in</strong>gs have been replaced by fifth-, seventh-, and eighthplace<br />

spots. Prospects for total returns were modestly good,<br />

giv<strong>in</strong>g it a fifth-place rank<strong>in</strong>g, with those surveyed expect<strong>in</strong>g<br />

this to be fed by a fairly good prospect for capital growth.<br />

Lett<strong>in</strong>g it down with an eighth-place rank<strong>in</strong>g are its prospects<br />

for rental growth. The buy/hold/sell graph is almost a mirror<br />

image of its manufactur<strong>in</strong>g property subsector, with almost 49<br />

percent hop<strong>in</strong>g to buy and just 13 percent want<strong>in</strong>g to sell.<br />

Industrial has been a beneficiary of a flood of capital <strong>in</strong><br />

the market and this is start<strong>in</strong>g to be reflected <strong>in</strong> its yield compression<br />

and caus<strong>in</strong>g some to believe that “stand<strong>in</strong>g <strong>in</strong>vestment<br />

logistics are too competitive on pric<strong>in</strong>g.” Madrid has<br />

seen a 125–basis po<strong>in</strong>t fall <strong>in</strong> yields from third-quarter 2004<br />

to third-quarter 2005, and three other markets—Prague,<br />

Paris, and Oslo—have each seen a 100–basis po<strong>in</strong>t fall,<br />

accord<strong>in</strong>g to CBRE; most other cities have seen drops of<br />

25 to 75 basis po<strong>in</strong>ts. The markets with steady yields were<br />

Vienna, Frankfurt, Amsterdam, and Zurich. Just Stockholm<br />

saw its yield move out. Our survey results suggest that yields<br />

will likely rema<strong>in</strong> stable, with some further yield compression<br />

possible <strong>in</strong> <strong>2006</strong>.<br />

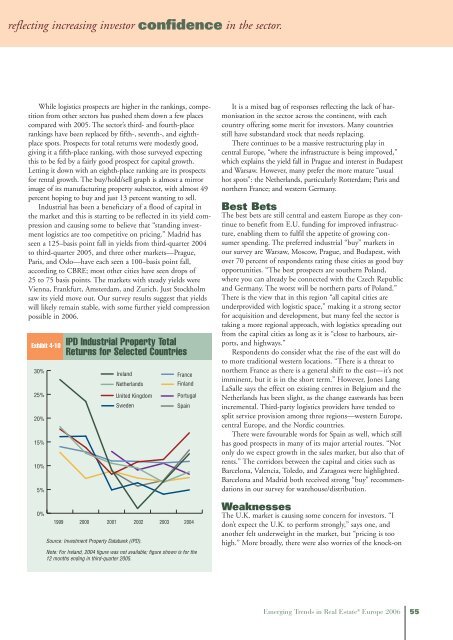

Exhibit 4-10<br />

30%<br />

25%<br />

20%<br />

15%<br />

10%<br />

5%<br />

0%<br />

IPD Industrial Property Total<br />

Returns for Selected Countries<br />

Ireland<br />

Netherlands<br />

United K<strong>in</strong>gdom<br />

Sweden<br />

France<br />

F<strong>in</strong>land<br />

Portugal<br />

Spa<strong>in</strong><br />

1999 2000 2001 2002 2003 2004<br />

Source: Investment Property Databank (IPD).<br />

Note: For Ireland, 2004 figure was not available; figure shown is for the<br />

12 months end<strong>in</strong>g <strong>in</strong> third-quarter 2005.<br />

It is a mixed bag of responses reflect<strong>in</strong>g the lack of harmonisation<br />

<strong>in</strong> the sector across the cont<strong>in</strong>ent, with each<br />

country offer<strong>in</strong>g some merit for <strong>in</strong>vestors. Many countries<br />

still have substandard stock that needs replac<strong>in</strong>g.<br />

There cont<strong>in</strong>ues to be a massive restructur<strong>in</strong>g play <strong>in</strong><br />

central <strong>Europe</strong>, “where the <strong>in</strong>frastructure is be<strong>in</strong>g improved,”<br />

which expla<strong>in</strong>s the yield fall <strong>in</strong> Prague and <strong>in</strong>terest <strong>in</strong> Budapest<br />

and Warsaw. However, many prefer the more mature “usual<br />

hot spots”: the Netherlands, particularly Rotterdam; Paris and<br />

northern France; and western Germany.<br />

Best Bets<br />

The best bets are still central and eastern <strong>Europe</strong> as they cont<strong>in</strong>ue<br />

to benefit from E.U. fund<strong>in</strong>g for improved <strong>in</strong>frastructure,<br />

enabl<strong>in</strong>g them to fulfil the appetite of grow<strong>in</strong>g consumer<br />

spend<strong>in</strong>g. The preferred <strong>in</strong>dustrial “buy” markets <strong>in</strong><br />

our survey are Warsaw, Moscow, Prague, and Budapest, with<br />

over 70 percent of respondents rat<strong>in</strong>g these cities as good buy<br />

opportunities. “The best prospects are southern Poland,<br />

where you can already be connected with the Czech Republic<br />

and Germany. The worst will be northern parts of Poland.”<br />

There is the view that <strong>in</strong> this region “all capital cities are<br />

underprovided with logistic space,” mak<strong>in</strong>g it a strong sector<br />

for acquisition and development, but many feel the sector is<br />

tak<strong>in</strong>g a more regional approach, with logistics spread<strong>in</strong>g out<br />

from the capital cities as long as it is “close to harbours, airports,<br />

and highways.”<br />

Respondents do consider what the rise of the east will do<br />

to more traditional western locations. “There is a threat to<br />

northern France as there is a general shift to the east—it’s not<br />

imm<strong>in</strong>ent, but it is <strong>in</strong> the short term.” However, Jones Lang<br />

LaSalle says the effect on exist<strong>in</strong>g centres <strong>in</strong> Belgium and the<br />

Netherlands has been slight, as the change eastwards has been<br />

<strong>in</strong>cremental. Third-party logistics providers have tended to<br />

split service provision among three regions—western <strong>Europe</strong>,<br />

central <strong>Europe</strong>, and the Nordic countries.<br />

There were favourable words for Spa<strong>in</strong> as well, which still<br />

has good prospects <strong>in</strong> many of its major arterial routes. “Not<br />

only do we expect growth <strong>in</strong> the sales market, but also that of<br />

rents.” The corridors between the capital and cities such as<br />

Barcelona, Valencia, Toledo, and Zaragoza were highlighted.<br />

Barcelona and Madrid both received strong “buy” recommendations<br />

<strong>in</strong> our survey for warehouse/distribution.<br />

Weaknesses<br />

The U.K. market is caus<strong>in</strong>g some concern for <strong>in</strong>vestors. “I<br />

don’t expect the U.K. to perform strongly,” says one, and<br />

another felt underweight <strong>in</strong> the market, but “pric<strong>in</strong>g is too<br />

high.” More broadly, there were also worries of the knock-on<br />

<strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> Estate ® <strong>Europe</strong> <strong>2006</strong> 55