Emerging Trends in Real Estate® Europe 2006 - Urban Land Institute

Emerging Trends in Real Estate® Europe 2006 - Urban Land Institute

Emerging Trends in Real Estate® Europe 2006 - Urban Land Institute

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

c h a p t e r 2<br />

There is thwarted<br />

capital hunt<strong>in</strong>g everywhere.<br />

Capital Markets<br />

The one th<strong>in</strong>g <strong>Europe</strong>’s real estate <strong>in</strong>vestment markets<br />

are not short of is capital. “If you have an asset with<br />

an <strong>in</strong>come stream to sell, there are 50 people queu<strong>in</strong>g<br />

up to take it off you.” In most markets, the ample fund<strong>in</strong>g of<br />

a few years ago has given way to surfeit. Indeed, the excess of<br />

capital given the shortage of <strong>in</strong>vestment stock is seen as one<br />

of the most serious problems fac<strong>in</strong>g <strong>in</strong>vestors over the com<strong>in</strong>g<br />

year. Nearly 56 percent of those surveyed th<strong>in</strong>k that capital<br />

will be either moderately or substantially oversupplied <strong>in</strong><br />

<strong>2006</strong> and the availability of both debt and equity capital will<br />

cont<strong>in</strong>ue to <strong>in</strong>crease relative to last year.<br />

However, a significant m<strong>in</strong>ority—nearly 29 percent—<br />

th<strong>in</strong>k that capital will be moderately or substantially undersupplied<br />

dur<strong>in</strong>g the same period. This result appears to be<br />

contradictory, but it is not. Capital shortage is the stark reality<br />

for small- to medium-sized developers who depend on<br />

debt f<strong>in</strong>ance. There is now little appetite for lend<strong>in</strong>g to developers<br />

unless they have a prelet or presold project because the<br />

capital requirement to back lend<strong>in</strong>g for speculative development<br />

is so onerous under the rules for Basel II.<br />

The <strong>Europe</strong>an Parliament approved the Capital Requirements<br />

Directive—the law that makes the Basel II bank capital<br />

adequacy rules obligatory throughout the E.U.—<strong>in</strong> September<br />

2005. Thus, those banks that are plann<strong>in</strong>g to use the<br />

“Foundation Internal Rat<strong>in</strong>gs Based” (IRB) approach under<br />

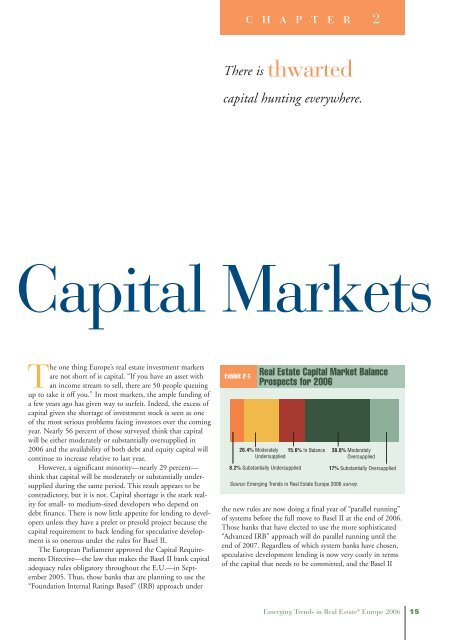

Exhibit 2-1<br />

<strong>Real</strong> Estate Capital Market Balance<br />

Prospects for <strong>2006</strong><br />

20.4% Moderately<br />

Undersupplied<br />

8.2% Substantially Undersupplied<br />

15.6% In Balance 38.8% Moderately<br />

Oversupplied<br />

Source: <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> Estate <strong>Europe</strong> <strong>2006</strong> survey.<br />

17% Substantially Oversupplied<br />

the new rules are now do<strong>in</strong>g a f<strong>in</strong>al year of “parallel runn<strong>in</strong>g”<br />

of systems before the full move to Basel II at the end of <strong>2006</strong>.<br />

Those banks that have elected to use the more sophisticated<br />

“Advanced IRB” approach will do parallel runn<strong>in</strong>g until the<br />

end of 2007. Regardless of which system banks have chosen,<br />

speculative development lend<strong>in</strong>g is now very costly <strong>in</strong> terms<br />

of the capital that needs to be committed, and the Basel II<br />

<strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> Estate ® <strong>Europe</strong> <strong>2006</strong> 15