Emerging Trends in Real Estate® Europe 2006 - Urban Land Institute

Emerging Trends in Real Estate® Europe 2006 - Urban Land Institute

Emerging Trends in Real Estate® Europe 2006 - Urban Land Institute

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

is down from the high levels of the late 1990s but cont<strong>in</strong>ues to outpace <strong>Europe</strong>.<br />

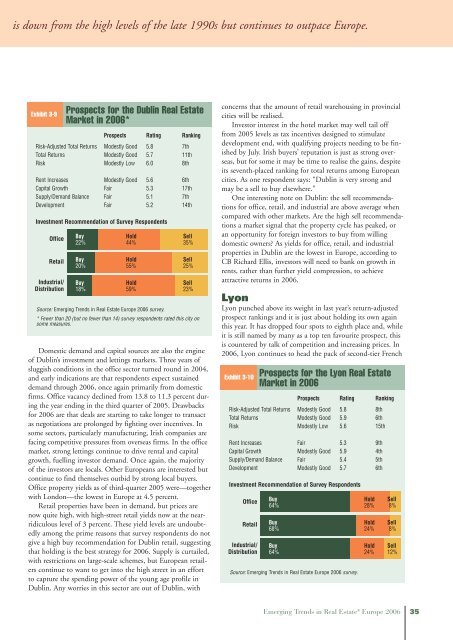

Exhibit 3-9<br />

Prospects for the Dubl<strong>in</strong> <strong>Real</strong> Estate<br />

Market <strong>in</strong> <strong>2006</strong>*<br />

Prospects Rat<strong>in</strong>g Rank<strong>in</strong>g<br />

Risk-Adjusted Total Returns Modestly Good 5.8 7th<br />

Total Returns Modestly Good 5.7 11th<br />

Risk Modestly Low 6.0 8th<br />

Rent Increases Modestly Good 5.6 6th<br />

Capital Growth Fair 5.3 17th<br />

Supply/Demand Balance Fair 5.1 7th<br />

Development Fair 5.2 14th<br />

Investment Recommendation of Survey Respondents<br />

Office<br />

Retail<br />

Industrial/<br />

Distribution<br />

Buy Hold Sell<br />

22% 44% 35%<br />

Buy Hold Sell<br />

20% 55% 25%<br />

Buy Hold Sell<br />

18% 59% 23%<br />

Source: <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> Estate <strong>Europe</strong> <strong>2006</strong> survey.<br />

* Fewer than 20 (but no fewer than 14) survey respondents rated this city on<br />

some measures.<br />

Domestic demand and capital sources are also the eng<strong>in</strong>e<br />

of Dubl<strong>in</strong>’s <strong>in</strong>vestment and lett<strong>in</strong>gs markets. Three years of<br />

sluggish conditions <strong>in</strong> the office sector turned round <strong>in</strong> 2004,<br />

and early <strong>in</strong>dications are that respondents expect susta<strong>in</strong>ed<br />

demand through <strong>2006</strong>, once aga<strong>in</strong> primarily from domestic<br />

firms. Office vacancy decl<strong>in</strong>ed from 13.8 to 11.3 percent dur<strong>in</strong>g<br />

the year end<strong>in</strong>g <strong>in</strong> the third quarter of 2005. Drawbacks<br />

for <strong>2006</strong> are that deals are start<strong>in</strong>g to take longer to transact<br />

as negotiations are prolonged by fight<strong>in</strong>g over <strong>in</strong>centives. In<br />

some sectors, particularly manufactur<strong>in</strong>g, Irish companies are<br />

fac<strong>in</strong>g competitive pressures from overseas firms. In the office<br />

market, strong lett<strong>in</strong>gs cont<strong>in</strong>ue to drive rental and capital<br />

growth, fuell<strong>in</strong>g <strong>in</strong>vestor demand. Once aga<strong>in</strong>, the majority<br />

of the <strong>in</strong>vestors are locals. Other <strong>Europe</strong>ans are <strong>in</strong>terested but<br />

cont<strong>in</strong>ue to f<strong>in</strong>d themselves outbid by strong local buyers.<br />

Office property yields as of third-quarter 2005 were—together<br />

with London—the lowest <strong>in</strong> <strong>Europe</strong> at 4.5 percent.<br />

Retail properties have been <strong>in</strong> demand, but prices are<br />

now quite high, with high-street retail yields now at the nearridiculous<br />

level of 3 percent. These yield levels are undoubtedly<br />

among the prime reasons that survey respondents do not<br />

give a high buy recommendation for Dubl<strong>in</strong> retail, suggest<strong>in</strong>g<br />

that hold<strong>in</strong>g is the best strategy for <strong>2006</strong>. Supply is curtailed,<br />

with restrictions on large-scale schemes, but <strong>Europe</strong>an retailers<br />

cont<strong>in</strong>ue to want to get <strong>in</strong>to the high street <strong>in</strong> an effort<br />

to capture the spend<strong>in</strong>g power of the young age profile <strong>in</strong><br />

Dubl<strong>in</strong>. Any worries <strong>in</strong> this sector are out of Dubl<strong>in</strong>, with<br />

concerns that the amount of retail warehous<strong>in</strong>g <strong>in</strong> prov<strong>in</strong>cial<br />

cities will be realised.<br />

Investor <strong>in</strong>terest <strong>in</strong> the hotel market may well tail off<br />

from 2005 levels as tax <strong>in</strong>centives designed to stimulate<br />

development end, with qualify<strong>in</strong>g projects need<strong>in</strong>g to be f<strong>in</strong>ished<br />

by July. Irish buyers’ reputation is just as strong overseas,<br />

but for some it may be time to realise the ga<strong>in</strong>s, despite<br />

its seventh-placed rank<strong>in</strong>g for total returns among <strong>Europe</strong>an<br />

cities. As one respondent says: “Dubl<strong>in</strong> is very strong and<br />

may be a sell to buy elsewhere.”<br />

One <strong>in</strong>terest<strong>in</strong>g note on Dubl<strong>in</strong>: the sell recommendations<br />

for office, retail, and <strong>in</strong>dustrial are above average when<br />

compared with other markets. Are the high sell recommendations<br />

a market signal that the property cycle has peaked, or<br />

an opportunity for foreign <strong>in</strong>vestors to buy from will<strong>in</strong>g<br />

domestic owners? As yields for office, retail, and <strong>in</strong>dustrial<br />

properties <strong>in</strong> Dubl<strong>in</strong> are the lowest <strong>in</strong> <strong>Europe</strong>, accord<strong>in</strong>g to<br />

CB Richard Ellis, <strong>in</strong>vestors will need to bank on growth <strong>in</strong><br />

rents, rather than further yield compression, to achieve<br />

attractive returns <strong>in</strong> <strong>2006</strong>.<br />

Lyon<br />

Lyon punched above its weight <strong>in</strong> last year’s return-adjusted<br />

prospect rank<strong>in</strong>gs and it is just about hold<strong>in</strong>g its own aga<strong>in</strong><br />

this year. It has dropped four spots to eighth place and, while<br />

it is still named by many as a top ten favourite prospect, this<br />

is countered by talk of competition and <strong>in</strong>creas<strong>in</strong>g prices. In<br />

<strong>2006</strong>, Lyon cont<strong>in</strong>ues to head the pack of second-tier French<br />

Exhibit 3-10<br />

Prospects for the Lyon <strong>Real</strong> Estate<br />

Market <strong>in</strong> <strong>2006</strong><br />

Prospects Rat<strong>in</strong>g Rank<strong>in</strong>g<br />

Risk-Adjusted Total Returns Modestly Good 5.8 8th<br />

Total Returns Modestly Good 5.9 6th<br />

Risk Modestly Low 5.6 15th<br />

Rent Increases Fair 5.3 9th<br />

Capital Growth Modestly Good 5.9 4th<br />

Supply/Demand Balance Fair 5.4 5th<br />

Development Modestly Good 5.7 6th<br />

Investment Recommendation of Survey Respondents<br />

Office<br />

Retail<br />

Industrial/<br />

Distribution<br />

Buy Hold Sell<br />

64% 28% 8%<br />

Buy Hold Sell<br />

68% 24% 8%<br />

Buy Hold Sell<br />

64% 24% 12%<br />

Source: <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> Estate <strong>Europe</strong> <strong>2006</strong> survey.<br />

<strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> Estate ® <strong>Europe</strong> <strong>2006</strong> 35