Emerging Trends in Real Estate® Europe 2006 - Urban Land Institute

Emerging Trends in Real Estate® Europe 2006 - Urban Land Institute

Emerging Trends in Real Estate® Europe 2006 - Urban Land Institute

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

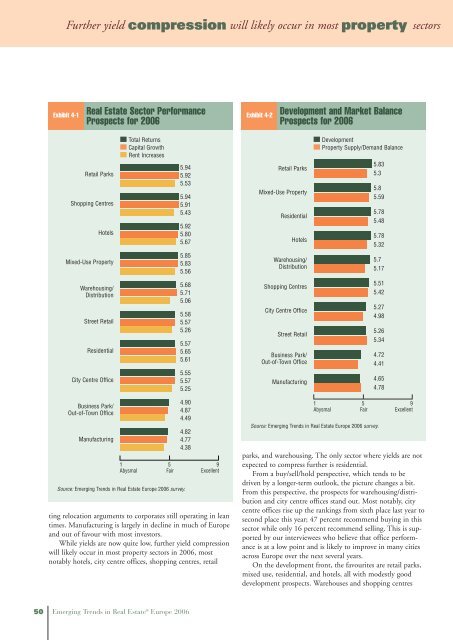

Further yield compression will likely occur <strong>in</strong> most property sectors<br />

Exhibit 4-1<br />

<strong>Real</strong> Estate Sector Performance<br />

Prospects for <strong>2006</strong><br />

Retail Parks<br />

Shopp<strong>in</strong>g Centres<br />

Hotels<br />

Mixed-Use Property<br />

Warehous<strong>in</strong>g/<br />

Distribution<br />

Street Retail<br />

Residential<br />

City Centre Office<br />

Bus<strong>in</strong>ess Park/<br />

Out-of-Town Office<br />

Manufactur<strong>in</strong>g<br />

■ Total Returns<br />

■ Capital Growth<br />

■ Rent Increases<br />

0%<br />

1<br />

5%<br />

5<br />

10%<br />

9<br />

Abysmal Fair Excellent<br />

Source: <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> Estate <strong>Europe</strong> <strong>2006</strong> survey.<br />

5.94<br />

5.92<br />

5.53<br />

5.94<br />

5.91<br />

5.43<br />

5.92<br />

5.80<br />

5.67<br />

5.85<br />

5.83<br />

5.56<br />

5.68<br />

5.71<br />

5.06<br />

5.58<br />

5.57<br />

5.26<br />

5.57<br />

5.65<br />

5.61<br />

5.55<br />

5.57<br />

5.25<br />

4.90<br />

4.87<br />

4.49<br />

4.82<br />

4.77<br />

4.38<br />

t<strong>in</strong>g relocation arguments to corporates still operat<strong>in</strong>g <strong>in</strong> lean<br />

times. Manufactur<strong>in</strong>g is largely <strong>in</strong> decl<strong>in</strong>e <strong>in</strong> much of <strong>Europe</strong><br />

and out of favour with most <strong>in</strong>vestors.<br />

While yields are now quite low, further yield compression<br />

will likely occur <strong>in</strong> most property sectors <strong>in</strong> <strong>2006</strong>, most<br />

notably hotels, city centre offices, shopp<strong>in</strong>g centres, retail<br />

50 <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> Estate ® <strong>Europe</strong> <strong>2006</strong><br />

Exhibit 4-2<br />

Development and Market Balance<br />

Prospects for <strong>2006</strong><br />

Retail Parks<br />

Mixed-Use Property<br />

Residential<br />

Hotels<br />

Warehous<strong>in</strong>g/<br />

Distribution<br />

Shopp<strong>in</strong>g Centres<br />

City Centre Office<br />

Street Retail<br />

Bus<strong>in</strong>ess Park/<br />

Out-of-Town Office<br />

Manufactur<strong>in</strong>g<br />

■ Development<br />

■ Property Supply/Demand Balance<br />

5.83<br />

5.3<br />

5.8<br />

5.59<br />

5.78<br />

5.48<br />

5.78<br />

5.32<br />

5.7<br />

5.17<br />

5.51<br />

5.42<br />

5.27<br />

4.98<br />

5.26<br />

5.34<br />

4.72<br />

4.41<br />

4.65<br />

4.78<br />

0<br />

1<br />

5<br />

10<br />

9<br />

Abysmal Fair Excellent<br />

Source: <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> Estate <strong>Europe</strong> <strong>2006</strong> survey.<br />

parks, and warehous<strong>in</strong>g. The only sector where yields are not<br />

expected to compress further is residential.<br />

From a buy/sell/hold perspective, which tends to be<br />

driven by a longer-term outlook, the picture changes a bit.<br />

From this perspective, the prospects for warehous<strong>in</strong>g/distribution<br />

and city centre offices stand out. Most notably, city<br />

centre offices rise up the rank<strong>in</strong>gs from sixth place last year to<br />

second place this year; 47 percent recommend buy<strong>in</strong>g <strong>in</strong> this<br />

sector while only 16 percent recommend sell<strong>in</strong>g. This is supported<br />

by our <strong>in</strong>terviewees who believe that office performance<br />

is at a low po<strong>in</strong>t and is likely to improve <strong>in</strong> many cities<br />

across <strong>Europe</strong> over the next several years.<br />

On the development front, the favourites are retail parks,<br />

mixed use, residential, and hotels, all with modestly good<br />

development prospects. Warehouses and shopp<strong>in</strong>g centres