Emerging Trends in Real Estate® Europe 2006 - Urban Land Institute

Emerging Trends in Real Estate® Europe 2006 - Urban Land Institute

Emerging Trends in Real Estate® Europe 2006 - Urban Land Institute

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Residential is the only sector <strong>in</strong> our survey where respondents believe yields<br />

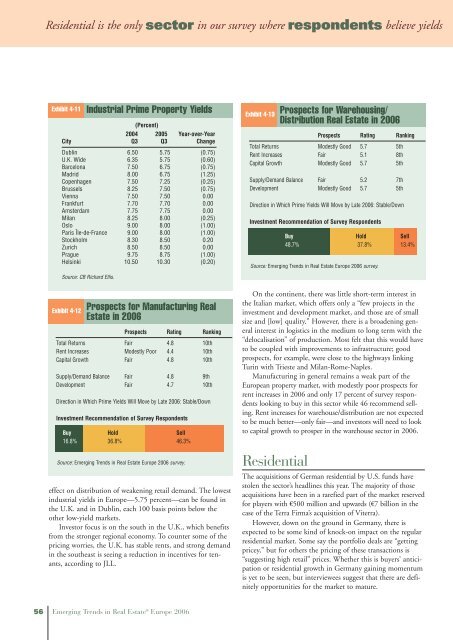

Exhibit 4-11 Industrial Prime Property Yields<br />

(Percent)<br />

2004 2005 Year-over-Year<br />

City Q3 Q3 Change<br />

Dubl<strong>in</strong> 6.50 5.75 (0.75)<br />

U.K. Wide 6.35 5.75 (0.60)<br />

Barcelona 7.50 6.75 (0.75)<br />

Madrid 8.00 6.75 (1.25)<br />

Copenhagen 7.50 7.25 (0.25)<br />

Brussels 8.25 7.50 (0.75)<br />

Vienna 7.50 7.50 0.00<br />

Frankfurt 7.70 7.70 0.00<br />

Amsterdam 7.75 7.75 0.00<br />

Milan 8.25 8.00 (0.25)<br />

Oslo 9.00 8.00 (1.00)<br />

Paris Île-de-France 9.00 8.00 (1.00)<br />

Stockholm 8.30 8.50 0.20<br />

Zurich 8.50 8.50 0.00<br />

Prague 9.75 8.75 (1.00)<br />

Hels<strong>in</strong>ki 10.50 10.30 (0.20)<br />

Source: CB Richard Ellis.<br />

Exhibit 4-12<br />

Prospects for Manufactur<strong>in</strong>g <strong>Real</strong><br />

Estate <strong>in</strong> <strong>2006</strong><br />

Prospects Rat<strong>in</strong>g Rank<strong>in</strong>g<br />

Total Returns Fair 4.8 10th<br />

Rent Increases Modestly Poor 4.4 10th<br />

Capital Growth Fair 4.8 10th<br />

Supply/Demand Balance Fair 4.8 9th<br />

Development Fair 4.7 10th<br />

Direction <strong>in</strong> Which Prime Yields Will Move by Late <strong>2006</strong>: Stable/Down<br />

Investment Recommendation of Survey Respondents<br />

Buy Hold Sell<br />

16.8% 36.8% 46.3%<br />

Source: <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> Estate <strong>Europe</strong> <strong>2006</strong> survey.<br />

effect on distribution of weaken<strong>in</strong>g retail demand. The lowest<br />

<strong>in</strong>dustrial yields <strong>in</strong> <strong>Europe</strong>—5.75 percent—can be found <strong>in</strong><br />

the U.K. and <strong>in</strong> Dubl<strong>in</strong>, each 100 basis po<strong>in</strong>ts below the<br />

other low-yield markets.<br />

Investor focus is on the south <strong>in</strong> the U.K., which benefits<br />

from the stronger regional economy. To counter some of the<br />

pric<strong>in</strong>g worries, the U.K. has stable rents, and strong demand<br />

<strong>in</strong> the southeast is see<strong>in</strong>g a reduction <strong>in</strong> <strong>in</strong>centives for tenants,<br />

accord<strong>in</strong>g to JLL.<br />

56 <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> Estate ® <strong>Europe</strong> <strong>2006</strong><br />

Exhibit 4-13<br />

On the cont<strong>in</strong>ent, there was little short-term <strong>in</strong>terest <strong>in</strong><br />

the Italian market, which offers only a “few projects <strong>in</strong> the<br />

<strong>in</strong>vestment and development market, and those are of small<br />

size and [low] quality.” However, there is a broaden<strong>in</strong>g general<br />

<strong>in</strong>terest <strong>in</strong> logistics <strong>in</strong> the medium to long term with the<br />

“delocalisation” of production. Most felt that this would have<br />

to be coupled with improvements to <strong>in</strong>frastructure; good<br />

prospects, for example, were close to the highways l<strong>in</strong>k<strong>in</strong>g<br />

Tur<strong>in</strong> with Trieste and Milan-Rome-Naples.<br />

Manufactur<strong>in</strong>g <strong>in</strong> general rema<strong>in</strong>s a weak part of the<br />

<strong>Europe</strong>an property market, with modestly poor prospects for<br />

rent <strong>in</strong>creases <strong>in</strong> <strong>2006</strong> and only 17 percent of survey respondents<br />

look<strong>in</strong>g to buy <strong>in</strong> this sector while 46 recommend sell<strong>in</strong>g.<br />

Rent <strong>in</strong>creases for warehouse/distribution are not expected<br />

to be much better—only fair—and <strong>in</strong>vestors will need to look<br />

to capital growth to prosper <strong>in</strong> the warehouse sector <strong>in</strong> <strong>2006</strong>.<br />

Residential<br />

Prospects for Warehous<strong>in</strong>g/<br />

Distribution <strong>Real</strong> Estate <strong>in</strong> <strong>2006</strong><br />

Prospects Rat<strong>in</strong>g Rank<strong>in</strong>g<br />

Total Returns Modestly Good 5.7 5th<br />

Rent Increases Fair 5.1 8th<br />

Capital Growth Modestly Good 5.7 5th<br />

Supply/Demand Balance Fair 5.2 7th<br />

Development Modestly Good 5.7 5th<br />

Direction <strong>in</strong> Which Prime Yields Will Move by Late <strong>2006</strong>: Stable/Down<br />

Investment Recommendation of Survey Respondents<br />

Buy Hold Sell<br />

48.7% 37.8% 13.4%<br />

Source: <strong>Emerg<strong>in</strong>g</strong> <strong>Trends</strong> <strong>in</strong> <strong>Real</strong> Estate <strong>Europe</strong> <strong>2006</strong> survey.<br />

The acquisitions of German residential by U.S. funds have<br />

stolen the sector’s headl<strong>in</strong>es this year. The majority of those<br />

acquisitions have been <strong>in</strong> a rarefied part of the market reserved<br />

for players with €500 million and upwards (€7 billion <strong>in</strong> the<br />

case of the Terra Firma’s acquisition of Viterra).<br />

However, down on the ground <strong>in</strong> Germany, there is<br />

expected to be some k<strong>in</strong>d of knock-on impact on the regular<br />

residential market. Some say the portfolio deals are “gett<strong>in</strong>g<br />

pricey,” but for others the pric<strong>in</strong>g of these transactions is<br />

“suggest<strong>in</strong>g high retail” prices. Whether this is buyers’ anticipation<br />

or residential growth <strong>in</strong> Germany ga<strong>in</strong><strong>in</strong>g momentum<br />

is yet to be seen, but <strong>in</strong>terviewees suggest that there are def<strong>in</strong>itely<br />

opportunities for the market to mature.