Panalpina Annual Report 2006

Panalpina Annual Report 2006

Panalpina Annual Report 2006

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Report</strong> of the Executive Board<br />

18 <strong>Panalpina</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2006</strong><br />

Forwarding services/<br />

expenses<br />

in million CHF<br />

<strong>2006</strong><br />

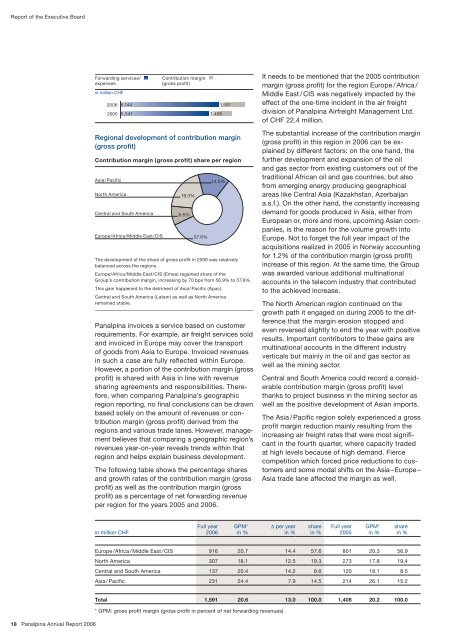

Contribution margin (gross profit) share per region<br />

Asia/Pacific<br />

North America<br />

6,144<br />

2005<br />

5,541<br />

Central and South America<br />

Europe/Africa/Middle East/CIS<br />

in million CHF<br />

Contribution margin<br />

(gross profit)<br />

19.3%<br />

8.6%<br />

57.6%<br />

1,408<br />

14.5%<br />

The development of the share of gross profit in <strong>2006</strong> was relatively<br />

balanced across the regions.<br />

Europe/Africa/Middle East/CIS (Emea) regained share of the<br />

Group’s contribution margin, increasing by 70 bps from 56.9% to 57.6%.<br />

This gain happened to the detriment of Asia/Pacific (Apac).<br />

Central and South America (Latam) as well as North America<br />

remained stable.<br />

Full year<br />

<strong>2006</strong><br />

1,591<br />

Regional development of contribution margin<br />

(gross profit)<br />

<strong>Panalpina</strong> invoices a service based on customer<br />

requirements. For example, air freight services sold<br />

and invoiced in Europe may cover the transport<br />

of goods from Asia to Europe. Invoiced revenues<br />

in such a case are fully reflected within Europe.<br />

However, a portion of the contribution margin (gross<br />

profit) is shared with Asia in line with revenue<br />

sharing agreements and responsibilities. Therefore,<br />

when comparing <strong>Panalpina</strong>’s geographic<br />

region reporting, no final conclusions can be drawn<br />

based solely on the amount of revenues or contribution<br />

margin (gross profit) derived from the<br />

regions and various trade lanes. However, management<br />

believes that comparing a geographic region’s<br />

revenues yearonyear reveals trends within that<br />

region and helps explain business development.<br />

The following table shows the percentage shares<br />

and growth rates of the contribution margin (gross<br />

profit) as well as the contribution margin (gross<br />

profit) as a percentage of net forwarding revenue<br />

per region for the years 2005 and <strong>2006</strong>.<br />

GPM*<br />

in %<br />

It needs to be mentioned that the 2005 contribution<br />

margin (gross profit) for the region Europe / Africa /<br />

Middle East / CIS was negatively impacted by the<br />

effect of the onetime incident in the air freight<br />

division of <strong>Panalpina</strong> Airfreight Management Ltd.<br />

of CHF 22.4 million.<br />

The substantial increase of the contribution margin<br />

(gross profit) in this region in <strong>2006</strong> can be ex<br />

plained by different factors: on the one hand, the<br />

further development and expansion of the oil<br />

and gas sector from existing customers out of the<br />

traditional African oil and gas countries, but also<br />

from emerging energy producing geographical<br />

areas like Central Asia (Kazakhstan, Azerbaijan<br />

a.s.f.). On the other hand, the constantly increasing<br />

demand for goods produced in Asia, either from<br />

European or, more and more, upcoming Asian companies,<br />

is the reason for the volume growth into<br />

Europe. Not to forget the full year impact of the<br />

acquisitions realized in 2005 in Norway accounting<br />

for 1.2% of the contribution margin (gross profit)<br />

increase of this region. At the same time, the Group<br />

was awarded various additional multinational<br />

accounts in the telecom industry that contributed<br />

to the achieved increase.<br />

The North American region continued on the<br />

growth path it engaged on during 2005 to the difference<br />

that the margin erosion stopped and<br />

even reversed slightly to end the year with positive<br />

results. Important contributors to these gains are<br />

multinational accounts in the different industry<br />

verticals but mainly in the oil and gas sector as<br />

well as the mining sector.<br />

Central and South America could record a considerable<br />

contribution margin (gross profit) level<br />

thanks to project business in the mining sector as<br />

well as the positive development of Asian imports.<br />

The Asia / Pacific region solely experienced a gross<br />

profit margin reduction mainly resulting from the<br />

increasing air freight rates that were most significant<br />

in the fourth quarter, where capacity traded<br />

at high levels because of high demand. Fierce<br />

competition which forced price reductions to customers<br />

and some modal shifts on the Asia – Europe –<br />

Asia trade lane affected the margin as well.<br />

∆ per year<br />

in %<br />

share<br />

in %<br />

Full year<br />

2005<br />

Europe /Africa / Middle East / CIS 916 20.7 14.4 57.6 801 20.3 56.9<br />

North America 307 18.1 12.5 19.3 273 17.8 19.4<br />

Central and South America 137 20.4 14.2 8.6 120 18.1 8.5<br />

Asia / Pacific 231 24.4 7.9 14.5 214 26.1 15.2<br />

GPM*<br />

in %<br />

Total 1,5 1 20.6 1 .0 100.0 1,408 20.2 100.0<br />

* GPM: gross profit margin (gross profit in percent of net forwarding revenues)<br />

share<br />

in %

![Eigenes Luftfrachtnetzwerk [pdf | 244 KB] - Panalpina](https://img.yumpu.com/23347328/1/184x260/eigenes-luftfrachtnetzwerk-pdf-244-kb-panalpina.jpg?quality=85)

![Übersicht Panalpina [pdf | 240 KB]](https://img.yumpu.com/22547731/1/184x260/ubersicht-panalpina-pdf-240-kb.jpg?quality=85)

![Seefracht [pdf | 181 KB] - Panalpina](https://img.yumpu.com/22234724/1/184x260/seefracht-pdf-181-kb-panalpina.jpg?quality=85)

![Annual Report 2012 [pdf | 1 MB] - Panalpina](https://img.yumpu.com/15342099/1/184x260/annual-report-2012-pdf-1-mb-panalpina.jpg?quality=85)