Panalpina Annual Report 2006

Panalpina Annual Report 2006

Panalpina Annual Report 2006

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Consolidated and <strong>Annual</strong> Financial Statements <strong>2006</strong><br />

78 <strong>Panalpina</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2006</strong><br />

Foreign currencies translation<br />

Functional and presentation currency<br />

The consolidated financial statements of <strong>Panalpina</strong> Group are presented in Swiss francs (CHF). The financial statements<br />

of each of the Group’s entities are measured using the currency of the primary economic environment in which the entity<br />

operates (functional currency), which is generally the local currency.<br />

Foreign currency transactions<br />

Each entity in the Group determines its own functional currency and items included in the financial statements of each<br />

entity are measured using this functional currency. Transactions in foreign currencies are initially translated into the functional<br />

currency using the exchange rate prevailing at the date of the transaction. Monetary assets and liabilities denominated<br />

in foreign currencies are retranslated at the balance sheet date using the period-end exchange rate. All differences are taken<br />

to profit or loss with the exception of differences on foreign currency borrowings that provide a hedge against a net<br />

investment in a foreign entity. These are taken directly to equity until the disposal of the net investment, at which time they<br />

are recognized in profit or loss. Tax charges and credits attributable to exchange differences on those borrowings are<br />

also dealt with in equity. Non-monetary items that are measured in terms of historical cost in a foreign currency are translated<br />

using the exchange rates as of the dates of the initial transaction. Any goodwill arising on the acquisition are treated as<br />

assets and liabilities of the foreign operation and translated at the closing rate.<br />

Changes in the fair value of monetary securities denominated in foreign currency classified as available for sale are analyzed<br />

between translation differences resulting from changes in the amortized cost of the security and other changes in the<br />

carrying amount of the security. Translation differences related to changes in the amortized cost are recognized in profit or<br />

loss, and others in the carrying amounts are recognized in equity.<br />

Translation of Group companies<br />

The results and financial positions of all Group entities (none of which has the currency of a hyperinflationary economy) that<br />

have a functional currency different from the presentation currency are translated into the presentation currency as follows:<br />

• Assets and liabilities for each balance sheet presented are translated at the closing rate at the date of that balance sheet.<br />

• Income and expenses for each income statement are translated at average exchange rates.<br />

• All resulting exchange differences are recognized as a separate component of equity.<br />

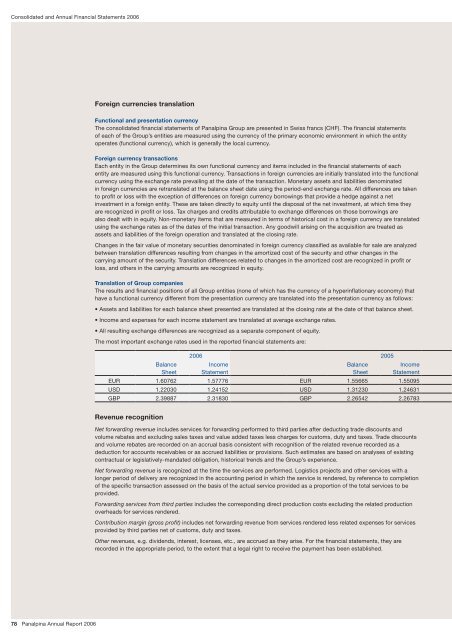

The most important exchange rates used in the reported financial statements are:<br />

Revenue recognition<br />

Balance<br />

Sheet<br />

<strong>2006</strong> 2005<br />

Income<br />

Statement<br />

Balance<br />

Sheet<br />

Income<br />

Statement<br />

EUR 1.60762 1.57776 EUR 1.55665 1.55095<br />

USD 1.22030 1.24152 USD 1.31230 1.24631<br />

GBP 2.39887 2.31830 GBP 2.26542 2.26783<br />

Net forwarding revenue includes services for forwarding performed to third parties after deducting trade discounts and<br />

volume rebates and excluding sales taxes and value added taxes less charges for customs, duty and taxes. Trade discounts<br />

and volume rebates are recorded on an accrual basis consistent with recognition of the related revenue recorded as a<br />

deduction for accounts receivables or as accrued liabilities or provisions. Such estimates are based on analyses of existing<br />

contractual or legislatively-mandated obligation, historical trends and the Group’s experience.<br />

Net forwarding revenue is recognized at the time the services are performed. Logistics projects and other services with a<br />

longer period of delivery are recognized in the accounting period in which the service is rendered, by reference to completion<br />

of the specific transaction assessed on the basis of the actual service provided as a proportion of the total services to be<br />

provided.<br />

Forwarding services from third parties includes the corresponding direct production costs excluding the related production<br />

overheads for services rendered.<br />

Contribution margin (gross profit) includes net forwarding revenue from services rendered less related expenses for services<br />

provided by third parties net of customs, duty and taxes.<br />

Other revenues, e.g. dividends, interest, licenses, etc., are accrued as they arise. For the financial statements, they are<br />

recorded in the appropriate period, to the extent that a legal right to receive the payment has been established.

![Eigenes Luftfrachtnetzwerk [pdf | 244 KB] - Panalpina](https://img.yumpu.com/23347328/1/184x260/eigenes-luftfrachtnetzwerk-pdf-244-kb-panalpina.jpg?quality=85)

![Übersicht Panalpina [pdf | 240 KB]](https://img.yumpu.com/22547731/1/184x260/ubersicht-panalpina-pdf-240-kb.jpg?quality=85)

![Seefracht [pdf | 181 KB] - Panalpina](https://img.yumpu.com/22234724/1/184x260/seefracht-pdf-181-kb-panalpina.jpg?quality=85)

![Annual Report 2012 [pdf | 1 MB] - Panalpina](https://img.yumpu.com/15342099/1/184x260/annual-report-2012-pdf-1-mb-panalpina.jpg?quality=85)