Panalpina Annual Report 2006

Panalpina Annual Report 2006

Panalpina Annual Report 2006

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Report</strong> of the Executive Board<br />

20 <strong>Panalpina</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2006</strong><br />

Supply chain management achieved a contribution<br />

margin (gross profit) growth of 11.7% over the previous<br />

year. This value added service is increasingly<br />

attractive to our existing customers, who also<br />

become more and more demanding for tailormade<br />

solutions supporting their outsourcing strategies.<br />

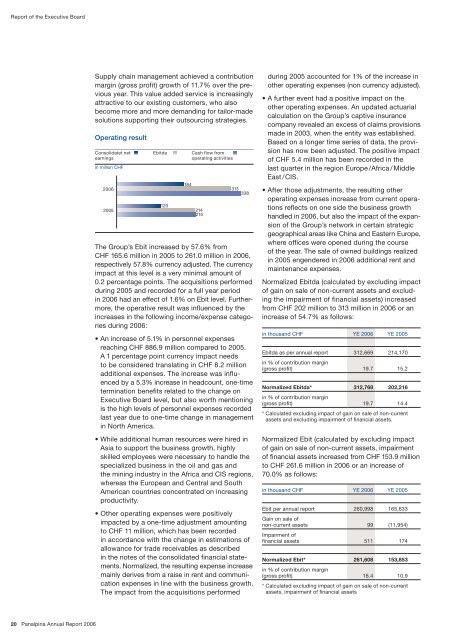

Operating result<br />

Consolidatet net<br />

earnings<br />

in million CHF<br />

<strong>2006</strong><br />

2005<br />

Ebitda<br />

120<br />

184<br />

Cash flow from<br />

operating activities<br />

214<br />

215<br />

313 338<br />

The Group’s Ebit increased by 57.6% from<br />

CHF 165.6 million in 2005 to 261.0 million in <strong>2006</strong>,<br />

respectively 57.8% currency adjusted. The currency<br />

impact at this level is a very minimal amount of<br />

0.2 percentage points. The acquisitions performed<br />

during 2005 and recorded for a full year period<br />

in <strong>2006</strong> had an effect of 1.6% on Ebit level. Furthermore,<br />

the operative result was influenced by the<br />

increases in the following income/expense categories<br />

during <strong>2006</strong>:<br />

• An increase of 5.1% in personnel expenses<br />

reaching CHF 886.9 million compared to 2005.<br />

A 1 percentage point currency impact needs<br />

to be considered translating in CHF 8.2 million<br />

additional expenses. The increase was influenced<br />

by a 5.3% increase in headcount, onetime<br />

termination benefits related to the change on<br />

Executive Board level, but also worth mentioning<br />

is the high levels of personnel expenses recorded<br />

last year due to onetime change in management<br />

in North America.<br />

• While additional human resources were hired in<br />

Asia to support the business growth, highly<br />

skilled employees were necessary to handle the<br />

specialized business in the oil and gas and<br />

the mining industry in the Africa and CIS regions,<br />

whereas the European and Central and South<br />

American countries concentrated on increasing<br />

productivity.<br />

• Other operating expenses were positively<br />

impacted by a onetime adjustment amounting<br />

to CHF 11 million, which has been recorded<br />

in accordance with the change in estimations of<br />

allowance for trade receivables as described<br />

in the notes of the consolidated financial statements.<br />

Normalized, the resulting expense increase<br />

mainly derives from a raise in rent and communication<br />

expenses in line with the business growth.<br />

The impact from the acquisitions performed<br />

during 2005 accounted for 1% of the increase in<br />

other operating expenses (non currency adjusted).<br />

• A further event had a positive impact on the<br />

other operating expenses. An updated actuarial<br />

calculation on the Group’s captive insurance<br />

company revealed an excess of claims provisions<br />

made in 2003, when the entity was established.<br />

Based on a longer time series of data, the provision<br />

has now been adjusted. The positive impact<br />

of CHF 5.4 million has been recorded in the<br />

last quarter in the region Europe /Africa / Middle<br />

East / CIS.<br />

• After those adjustments, the resulting other<br />

operating expenses increase from current operations<br />

reflects on one side the business growth<br />

handled in <strong>2006</strong>, but also the impact of the expansion<br />

of the Group’s network in certain strategic<br />

geographical areas like China and Eastern Europe,<br />

where offices were opened during the course<br />

of the year. The sale of owned buildings realized<br />

in 2005 engendered in <strong>2006</strong> additional rent and<br />

maintenance expenses.<br />

Normalized Ebitda (calculated by excluding impact<br />

of gain on sale of noncurrent assets and excluding<br />

the impairment of financial assets) increased<br />

from CHF 202 million to 313 million in <strong>2006</strong> or an<br />

increase of 54.7% as follows:<br />

in thousand CHF YE <strong>2006</strong> YE 2005<br />

Ebitda as per annual report 312,669 214,170<br />

in % of contribution margin<br />

(gross profit) 19.7 15.2<br />

Normalized Ebitda* 12, 68 202,216<br />

in % of contribution margin<br />

(gross profit) 19.7 14.4<br />

* Calculated excluding impact of gain on sale of noncurrent<br />

assets and excluding impairment of financial assets.<br />

Normalized Ebit (calculated by excluding impact<br />

of gain on sale of noncurrent assets, impairment<br />

of financial assets increased from CHF 153.9 million<br />

to CHF 261.6 million in <strong>2006</strong> or an increase of<br />

70.0% as follows:<br />

in thousand CHF YE <strong>2006</strong> YE 2005<br />

Ebit per annual report 260,998 165,633<br />

Gain on sale of<br />

noncurrent assets 99 (11,954)<br />

Impairment of<br />

financial assets 511 174<br />

Normalized Ebit* 261,608 15 ,85<br />

in % of contribution margin<br />

(gross profit) 16.4 10.9<br />

* Calculated excluding impact of gain on sale of noncurrent<br />

assets, impairment of financial assets

![Eigenes Luftfrachtnetzwerk [pdf | 244 KB] - Panalpina](https://img.yumpu.com/23347328/1/184x260/eigenes-luftfrachtnetzwerk-pdf-244-kb-panalpina.jpg?quality=85)

![Übersicht Panalpina [pdf | 240 KB]](https://img.yumpu.com/22547731/1/184x260/ubersicht-panalpina-pdf-240-kb.jpg?quality=85)

![Seefracht [pdf | 181 KB] - Panalpina](https://img.yumpu.com/22234724/1/184x260/seefracht-pdf-181-kb-panalpina.jpg?quality=85)

![Annual Report 2012 [pdf | 1 MB] - Panalpina](https://img.yumpu.com/15342099/1/184x260/annual-report-2012-pdf-1-mb-panalpina.jpg?quality=85)