Panalpina Annual Report 2006

Panalpina Annual Report 2006

Panalpina Annual Report 2006

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

16<br />

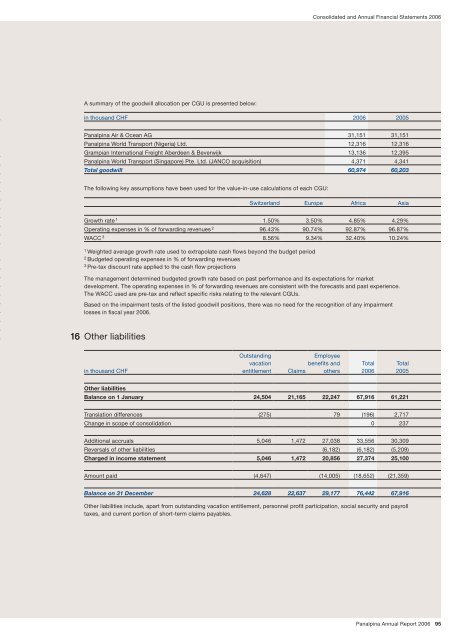

A summary of the goodwill allocation per CGU is presented below:<br />

The following key assumptions have been used for the value-in-use calculations of each CGU:<br />

Consolidated and <strong>Annual</strong> Financial Statements <strong>2006</strong><br />

in thousand CHF <strong>2006</strong> 2005<br />

<strong>Panalpina</strong> Air & Ocean AG 31,151 31,151<br />

<strong>Panalpina</strong> World Transport (Nigeria) Ltd. 12,316 12,316<br />

Grampian International Freight Aberdeen & Beverwijk 13,136 12,395<br />

<strong>Panalpina</strong> World Transport (Singapore) Pte. Ltd. (JANCO acquisition) 4,371 4,341<br />

Total goodwill 60,974 60,203<br />

The management determined budgeted growth rate based on past performance and its expectations for market<br />

development. The operating expenses in % of forwarding revenues are consistent with the forecasts and past experience.<br />

The WACC used are pre-tax and reflect specific risks relating to the relevant CGUs.<br />

Based on the impairment tests of the listed goodwill positions, there was no need for the recognition of any impairment<br />

losses in fiscal year <strong>2006</strong>.<br />

Other liabilities<br />

Switzerland Europe Africa Asia<br />

Growth rate 1 1.50% 3.50% 4.85% 4.29%<br />

Operating expenses in % of forwarding revenues 2 96.43% 90.74% 92.87% 96.87%<br />

WACC 3 8.56% 9.34% 32.40% 10.24%<br />

1 Weighted average growth rate used to extrapolate cash flows beyond the budget period<br />

2 Budgeted operating expenses in % of forwarding revenues<br />

3 Pre-tax discount rate applied to the cash flow projections<br />

in thousand CHF<br />

Outstanding<br />

vacation<br />

entitlement<br />

Claims<br />

Employee<br />

benefits and<br />

others<br />

Other liabilities<br />

Balance on 1 January 24,504 21,165 22,247 67,916 61,221<br />

Translation differences (275) 79 (196) 2,717<br />

Change in scope of consolidation 0 237<br />

Additional accruals 5,046 1,472 27,038 33,556 30,309<br />

Reversals of other liabilities (6,182) (6,182) (5,209)<br />

Charged in income statement 5,046 1,472 20,856 27,374 25,100<br />

Amount paid (4,647) (14,005) (18,652) (21,359)<br />

Balance on 31 December 24,628 22,637 29,177 76,442 67,916<br />

Other liabilities include, apart from outstanding vacation entitlement, personnel profit participation, social security and payroll<br />

taxes, and current portion of short-term claims payables.<br />

Total<br />

<strong>2006</strong><br />

Total<br />

2005<br />

<strong>Panalpina</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2006</strong> 95

![Eigenes Luftfrachtnetzwerk [pdf | 244 KB] - Panalpina](https://img.yumpu.com/23347328/1/184x260/eigenes-luftfrachtnetzwerk-pdf-244-kb-panalpina.jpg?quality=85)

![Übersicht Panalpina [pdf | 240 KB]](https://img.yumpu.com/22547731/1/184x260/ubersicht-panalpina-pdf-240-kb.jpg?quality=85)

![Seefracht [pdf | 181 KB] - Panalpina](https://img.yumpu.com/22234724/1/184x260/seefracht-pdf-181-kb-panalpina.jpg?quality=85)

![Annual Report 2012 [pdf | 1 MB] - Panalpina](https://img.yumpu.com/15342099/1/184x260/annual-report-2012-pdf-1-mb-panalpina.jpg?quality=85)