Scania annual report 2003

Scania annual report 2003

Scania annual report 2003

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The <strong>Scania</strong> Group’s net financial items<br />

amounted to SEK –521 m. (–684). The improvement<br />

was attributable to lower net<br />

debt as well as lower borrowing in Latin<br />

American currencies.<br />

Income after financial items amounted<br />

to SEK 4,604 m. (3,722).<br />

Earnings, <strong>Scania</strong> Group<br />

SEK m. <strong>2003</strong> 2002<br />

Operating income 5,125 4,406<br />

Income after<br />

financial items 4,604 3,722<br />

Net income 3,034 2,739<br />

Earnings per share, SEK 15.17 13.70<br />

Return on equity 17.4% 17.2%<br />

Tax expenses for the year amounted to<br />

SEK 1,565 m. (985), equivalent to 34.0<br />

(26.5) percent of income after financial<br />

items. The higher tax rate compared to<br />

the previous year was mainly due the taxexempt<br />

capital gain related to Swedish car<br />

operations <strong>report</strong>ed in 2002. Excluding<br />

this capital gain, the tax rate in 2002<br />

amounted to 31.1 percent. During <strong>2003</strong>,<br />

tax expenses rose due to higher taxes<br />

outside Sweden.<br />

The Swedish local tax authority has<br />

denied <strong>Scania</strong>’s claim for a deduction due<br />

to a loss of SEK 2.9 billion. <strong>Scania</strong> will appeal<br />

this decision. The overall effect on<br />

<strong>Scania</strong>’s income can reach a maximum of<br />

SEK 575 m. if the deduction is not<br />

approved in its entirety. No provision has<br />

been made.<br />

Net income for the year amounted to<br />

SEK 3,034 m. (2,739), equivalent to earnings<br />

per share of SEK 15.17 (13.70).<br />

CASH FLOW<br />

The <strong>Scania</strong> Group’s cash flow, excluding<br />

Customer Finance as well as divestments<br />

and acquisitions of businesses, amounted<br />

to SEK 2,476 m. (2,418). Cash flow<br />

including divestments and acquisitions<br />

totalled SEK 2,450 m. (3,583).<br />

Tied-up working capital declined by<br />

SEK 270 m. (772). Positive cash flow from<br />

increased non-interest-bearing liabilities<br />

and provisions were partly offset by higher<br />

tied-up inventories and increased receivables.<br />

Net investments excluding divestments<br />

and acquisitions of businesses had an adverse<br />

effect on cash flow and amounted to<br />

SEK 3,285 m. (2,921), including capitalised<br />

development expenditures totalling<br />

SEK 669 m. (573). The effects of divestments<br />

and acquisitions of businesses totalled<br />

SEK –26 m. (1,165).<br />

FINANCIAL POSITION<br />

During the year, gross investments<br />

totalled SEK 3,196 m. (3,025), including<br />

capitalised development expenditures of<br />

SEK 669 m. (573).<br />

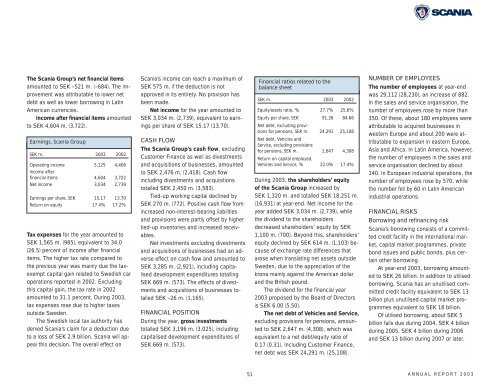

Financial ratios related to the<br />

balance sheet<br />

SEK m. <strong>2003</strong> 2002<br />

Equity/assets ratio, % 27.7% 25.6%<br />

Equity per share, SEK 91.26 84.66<br />

Net debt, excluding provisions<br />

for pensions, SEK m. 24,291 25,108<br />

Net debt, Vehicles and<br />

Service, excluding provisions<br />

for pensions, SEK m. 2,647 4,308<br />

Return on capital employed,<br />

Vehicles and Service, % 22.0% 17.4%<br />

During <strong>2003</strong>, the shareholders’ equity<br />

of the <strong>Scania</strong> Group increased by<br />

SEK 1,320 m. and totalled SEK 18,251 m.<br />

(16,931) at year-end. Net income for the<br />

year added SEK 3,034 m. (2,739), while<br />

the dividend to the shareholders<br />

decreased shareholders’ equity by SEK<br />

1,100 m. (700). Beyond this, shareholders’<br />

equity declined by SEK 614 m. (1,103) because<br />

of exchange rate differences that<br />

arose when translating net assets outside<br />

Sweden, due to the appreciation of the<br />

krona mainly against the American dollar<br />

and the British pound.<br />

The dividend for the financial year<br />

<strong>2003</strong> proposed by the Board of Directors<br />

is SEK 6.00 (5.50).<br />

The net debt of Vehicles and Service,<br />

excluding provisions for pensions, amounted<br />

to SEK 2,647 m. (4,308), which was<br />

equivalent to a net debt/equity ratio of<br />

0.17 (0.31). Including Customer Finance,<br />

net debt was SEK 24,291 m. (25,108).<br />

NUMBER OF EMPLOYEES<br />

The number of employees at year-end<br />

was 29,112 (28,230), an increase of 882.<br />

In the sales and service organisation, the<br />

number of employees rose by more than<br />

350. Of these, about 180 employees were<br />

attributable to acquired businesses in<br />

western Europe and about 200 were attributable<br />

to expansion in eastern Europe,<br />

Asia and Africa. In Latin America, however,<br />

the number of employees in the sales and<br />

service organisation declined by about<br />

140. In European industrial operations, the<br />

number of employees rose by 570, while<br />

the number fell by 60 in Latin American<br />

industrial operations.<br />

FINANCIAL RISKS<br />

Borrowing and refinancing risk<br />

<strong>Scania</strong>’s borrowing consists of a committed<br />

credit facility in the international market,<br />

capital market programmes, private<br />

bond issues and public bonds, plus certain<br />

other borrowing.<br />

At year-end <strong>2003</strong>, borrowing amounted<br />

to SEK 26 billion. In addition to utilised<br />

borrowing, <strong>Scania</strong> has an unutilised committed<br />

credit facility equivalent to SEK 13<br />

billion plus unutilised capital market programmes<br />

equivalent to SEK 18 billion.<br />

Of utilised borrowing, about SEK 5<br />

billion falls due during 2004, SEK 4 billion<br />

during 2005, SEK 4 billion during 2006<br />

and SEK 13 billion during 2007 or later.<br />

51 ANNUAL REPORT <strong>2003</strong>