Scania annual report 2003

Scania annual report 2003

Scania annual report 2003

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

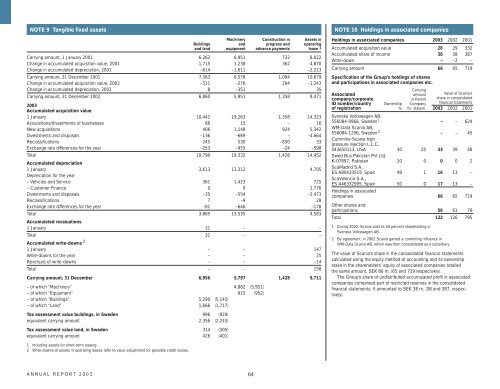

NOTE 9 Tangible fixed assets<br />

Machinery Construction in Assets in<br />

Buildings and progress and operating<br />

and land equipment advance payments lease 1<br />

Carrying amount, 1 January 2001 6,262 6,951 732 8,022<br />

Change in accumulated acquisition value, 2001 1,715 1,238 362 4,870<br />

Change in accumulated depreciation, 2001 –614 –1,611 – –2,213<br />

Carrying amount, 31 December 2001 7,363 6,578 1,094 10,679<br />

Change in accumulated acquisition value, 2002 –511 –276 264 –1,243<br />

Change in accumulated depreciation, 2002 8 –351 – 35<br />

Carrying amount, 31 December 2002 6,860 5,951 1,358 9,471<br />

<strong>2003</strong><br />

Accumulated acquisition value<br />

1 January 10,442 19,263 1,358 14,323<br />

Acquisitions/divestments of businesses 86 15 – 16<br />

New acquisitions 406 1,148 924 5,342<br />

Divestments and disposals –136 –669 – –4,664<br />

Reclassifications 245 530 –830 33<br />

Exchange rate differences for the year –253 –955 –24 –598<br />

Total 10,790 19,332 1,428 14,452<br />

Accumulated depreciation<br />

1 January 3,613 13,312 4,705<br />

Depreciation for the year<br />

– Vehicles and Service 361 1,423 725<br />

– Customer Finance 0 9 1,776<br />

Divestments and disposals –35 –554 –2,473<br />

Reclassifications 7 –9 28<br />

Exchange rate differences for the year –81 –646 –178<br />

Total 3,865 13,535 4,583<br />

Accumulated revaluations<br />

1 January 31 – –<br />

Total 31 – –<br />

Accumulated write-downs 2<br />

1 January – – 147<br />

Write-downs for the year – – 25<br />

Reversals of write-downs – – –14<br />

Total – – 158<br />

Carrying amount, 31 December 6,956 5,797 1,428 9,711<br />

– of which “Machinery” 4,882 (5,951)<br />

– of which “Equipment” 915 (952)<br />

– of which “Buildings” 5,290 (5,143)<br />

– of which “Land” 1,666 (1,717)<br />

NOTE 10 Holdings in associated companies<br />

Holdings in associated companies <strong>2003</strong> 2002 2001<br />

Accumulated acquisition value 28 29 332<br />

Accumulated share of income 38 38 387<br />

Write-down – –2 –<br />

Carrying amount 66 65 719<br />

Specification of the Group’s holdings of shares<br />

and participations in associated companies etc.<br />

Carrying<br />

Associated amount Value of <strong>Scania</strong>’s<br />

company/corporate in Parent share in consolidated<br />

ID number/country Ownership Company financial statements<br />

of registration % fin. statem. <strong>2003</strong> 2002 2001<br />

Svenska Volkswagen AB,<br />

556084-0968, Sweden 1 – – 624<br />

WM-Data <strong>Scania</strong> AB,<br />

556084-1206, Sweden 2 – – 45<br />

Cummins-<strong>Scania</strong> high<br />

pressure injection L.L.C,<br />

043650113, USA 30 25 33 39 48<br />

Swed Bus Pakistan Pvt Ltd,<br />

K-07897, Pakistan 10 0 0 0 2<br />

ScaMadrid S.A.,<br />

ES A80433519, Spain 49 1 16 13 –<br />

ScaValencia S.A.,<br />

ES A46332995, Spain 50 0 17 13 –<br />

Holdings in associated<br />

companies 66 65 719<br />

Other shares and<br />

participations 56 61 76<br />

Total 122 126 795<br />

1 During 2002, <strong>Scania</strong> sold its 50 percent shareholding in<br />

Svenska Volkswagen AB.<br />

2 By agreement, in 2002 <strong>Scania</strong> gained a controlling influence in<br />

WM-Data <strong>Scania</strong> AB, which was then consolidated as a subsidiary.<br />

The value of <strong>Scania</strong>’s share in the consolidated financial statements<br />

calculated using the equity method of accounting and its ownership<br />

stake in the shareholders’ equity of associated companies totalled<br />

the same amount, SEK 66 m. (65 and 719 respectively).<br />

The Group’s share of undistributed accumulated profit in associated<br />

companies comprised part of restricted reserves in the consolidated<br />

financial statements. It amounted to SEK 38 m. (38 and 387, respectively).<br />

Tax assessment value buildings, in Sweden 996 (920)<br />

equivalent carrying amount 2,356 (2,243)<br />

Tax assessment value land, in Sweden 314 (305)<br />

equivalent carrying amount 426 (401)<br />

1 Including assets for short-term leasing.<br />

2 Write-downs of assets in operating leases refer to value adjustment for possible credit losses.<br />

ANNUAL REPORT <strong>2003</strong><br />

64