Scania annual report 2003

Scania annual report 2003

Scania annual report 2003

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Note 28 continued<br />

The other members of the Executive Board, if the company terminates<br />

their employment, are entitled to severance pay equivalent to a maximum<br />

of two years’ salary, in addition to their salary during six months’<br />

notice period. If they obtain new employment within 18 months, counting<br />

from their termination date, their severance pay ceases. In case of<br />

a substantial change in the ownership structure of <strong>Scania</strong>, the members<br />

of the Executive Board are entitled to resign of their own volition with<br />

severance pay amounting to two years’ salary.<br />

Compensation issues for the President and the Executive Board<br />

are decided by the Board after preparation by a committee that was<br />

established earlier, the Remuneration Committee, which now consists<br />

of Bernd Pischetsrieder, Chairman; Peggy Bruzelius; Rolf Stomberg;<br />

and Clas Åke Hedström. During <strong>2003</strong>, the Committee met on three<br />

occasions.<br />

Salaries and other remuneration to the Chairman of the Board, the<br />

President and Group Management executive officers are shown in the<br />

table on page 69 (excluding employers’ contribution according to law).<br />

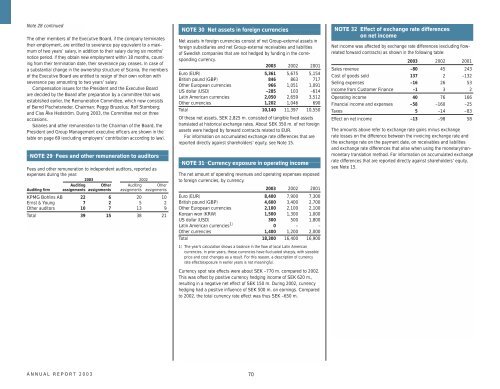

NOTE 29 Fees and other remuneration to auditors<br />

Fees and other remuneration to independent auditors, <strong>report</strong>ed as<br />

expenses during the year:<br />

<strong>2003</strong> 2002<br />

Auditing Other Auditing Other<br />

Auditing firm assignments assignments assignments assignments<br />

KPMG Bohlins AB 22 6 20 10<br />

Ernst & Young 7 2 5 2<br />

Other auditors 10 7 13 9<br />

Total 39 15 38 21<br />

NOTE 30 Net assets in foreign currencies<br />

Net assets in foreign currencies consist of net Group-external assets in<br />

foreign subsidiaries and net Group-external receivables and liabilities<br />

of Swedish companies that are not hedged by funding in the corresponding<br />

currency.<br />

<strong>2003</strong> 2002 2001<br />

Euro (EUR) 5,361 5,675 5,154<br />

British pound (GBP) 846 863 717<br />

Other European currencies 966 1,051 1,091<br />

US dollar (USD) –285 103 –614<br />

Latin American currencies 2,050 2,659 3,512<br />

Other currencies 1,202 1,046 690<br />

Total 10,140 11,397 10,550<br />

Of these net assets, SEK 2,825 m. consisted of tangible fixed assets<br />

translated at historical exchange rates. About SEK 350 m. of net foreign<br />

assets were hedged by forward contracts related to EUR.<br />

For information on accumulated exchange rate differences that are<br />

<strong>report</strong>ed directly against shareholders’ equity, see Note 15.<br />

NOTE 31 Currency exposure in operating income<br />

The net amount of operating revenues and operating expenses exposed<br />

to foreign currencies, by currency.<br />

<strong>2003</strong> 2002 2001<br />

Euro (EUR) 8,400 7,900 7,300<br />

British pound (GBP) 4,600 3,400 2,700<br />

Other European currencies 2,100 2,100 2,100<br />

Korean won (KRW) 1,500 1,300 1,000<br />

US dollar (USD) 300 500 1,800<br />

Latin American currencies 1) 0 – –<br />

Other currencies 1,400 1,200 2,000<br />

Total 18,300 16,400 16,900<br />

1) The year’s calculation shows a balance in the flow of local Latin American<br />

currencies. In prior years, these currencies have fluctuated sharply, with sizeable<br />

price and cost changes as a result. For this reason, a description of currency<br />

rate effect/exposure in earlier years is not meaningful.<br />

Currency spot rate effects were about SEK –770 m. compared to 2002.<br />

This was offset by positive currency hedging income of SEK 620 m.,<br />

resulting in a negative net effect of SEK 150 m. During 2002, currency<br />

hedging had a positive influence of SEK 500 m. on earnings. Compared<br />

to 2002, the total currency rate effect was thus SEK –650 m.<br />

NOTE 32 Effect of exchange rate differences<br />

on net income<br />

Net income was affected by exchange rate differences (excluding flowrelated<br />

forward contracts) as shown in the following table:<br />

<strong>2003</strong> 2002 2001<br />

Sales revenue –80 45 243<br />

Cost of goods sold 137 2 –132<br />

Selling expenses –16 26 53<br />

Income from Customer Finance –1 3 2<br />

Operating income 40 76 166<br />

Financial income and expenses –58 –160 –25<br />

Taxes 5 –14 –83<br />

Effect on net income –13 –98 58<br />

The amounts above refer to exchange rate gains minus exchange<br />

rate losses on the difference between the invoicing exchange rate and<br />

the exchange rate on the payment date, on receivables and liabilities<br />

and exchange rate differences that arise when using the monetary/nonmonetary<br />

translation method. For information on accumulated exchange<br />

rate differences that are <strong>report</strong>ed directly against shareholders’ equity,<br />

see Note 15.<br />

ANNUAL REPORT <strong>2003</strong><br />

70