Complete 2012 forensic audit documents - Kansas Bioscience ...

Complete 2012 forensic audit documents - Kansas Bioscience ...

Complete 2012 forensic audit documents - Kansas Bioscience ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

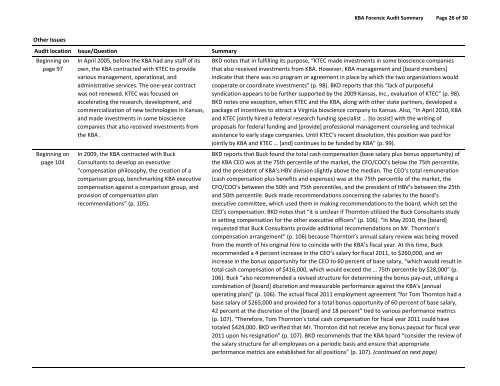

KBA Forensic Audit Summary Page 26 of 30<br />

Other Issues<br />

Audit location Issue/Question Summary<br />

Beginning on<br />

page 97<br />

Beginning on<br />

page 104<br />

In April 2005, before the KBA had any staff of its<br />

own, the KBA contracted with KTEC to provide<br />

various management, operational, and<br />

administrative services. The one‐year contract<br />

was not renewed. KTEC was focused on<br />

accelerating the research, development, and<br />

commercialization of new technologies in <strong>Kansas</strong>,<br />

and made investments in some bioscience<br />

companies that also received investments from<br />

the KBA .<br />

In 2009, the KBA contracted with Buck<br />

Consultants to develop an executive<br />

“compensation philosophy, the creation of a<br />

comparison group, benchmarking KBA executive<br />

compensation against a comparison group, and<br />

provision of compensation plan<br />

recommendations” (p. 105).<br />

BKD notes that in fulfilling its purpose, “KTEC made investments in some bioscience companies<br />

that also received investments from KBA. However, KBA management and [board members]<br />

indicate that there was no program or agreement in place by which the two organizations would<br />

cooperate or coordinate investments” (p. 98). BKD reports that this “lack of purposeful<br />

syndication appears to be further supported by the 2009 <strong>Kansas</strong>, Inc., evaluation of KTEC” (p. 98).<br />

BKD notes one exception, when KTEC and the KBA, along with other state partners, developed a<br />

package of incentives to attract a Virginia bioscience company to <strong>Kansas</strong>. Also, “In April 2010, KBA<br />

and KTEC jointly hired a federal research funding specialist … [to assist] with the writing of<br />

proposals for federal funding and [provide] professional management counseling and technical<br />

assistance to early stage companies. Until KTEC’s recent dissolution, this position was paid for<br />

jointly by KBA and KTEC … [and] continues to be funded by KBA” (p. 99).<br />

BKD reports that Buck found the total cash compensation (base salary plus bonus opportunity) of<br />

the KBA CEO was at the 75th percentile of the market, the CFO/COO’s below the 75th percentile,<br />

and the president of KBA’s HBV division slightly above the median. The CEO’s total remuneration<br />

(cash compensation plus benefits and expenses) was at the 75th percentile of the market, the<br />

CFO/COO’s between the 50th and 75th percentiles, and the president of HBV’s between the 25th<br />

and 50th percentile. Buck made recommendations concerning the salaries to the board’s<br />

executive committee, which used them in making recommendations to the board, which set the<br />

CEO’s compensation. BKD notes that “it is unclear if Thornton utilized the Buck Consultants study<br />

in setting compensation for the other executive officers” (p. 106). “In May 2010, the [board]<br />

requested that Buck Consultants provide additional recommendations on Mr. Thornton’s<br />

compensation arrangement” (p. 106) because Thornton’s annual salary review was being moved<br />

from the month of his original hire to coincide with the KBA’s fiscal year. At this time, Buck<br />

recommended a 4 percent increase in the CEO’s salary for fiscal 2011, to $260,000, and an<br />

increase in the bonus opportunity for the CEO to 60 percent of base salary, “which would result in<br />

total cash compensation of $416,000, which would exceed the … 75th percentile by $28,000” (p.<br />

106). Buck “also recommended a revised structure for determining the bonus pay‐out, utilizing a<br />

combination of [board] discretion and measurable performance against the KBA’s [annual<br />

operating plan]” (p. 106). The actual fiscal 2011 employment agreement “for Tom Thornton had a<br />

base salary of $265,000 and provided for a total bonus opportunity of 60 percent of base salary,<br />

42 percent at the discretion of the [board] and 18 percent” tied to various performance metrics<br />

(p. 107). “Therefore, Tom Thornton’s total cash compensation for fiscal year 2011 could have<br />

totaled $424,000. BKD verified that Mr. Thornton did not receive any bonus payout for fiscal year<br />

2011 upon his resignation” (p. 107). BKD recommends that the KBA board “consider the review of<br />

the salary structure for all employees on a periodic basis and ensure that appropriate<br />

performance metrics are established for all positions” (p. 107). (continued on next page)