Complete 2012 forensic audit documents - Kansas Bioscience ...

Complete 2012 forensic audit documents - Kansas Bioscience ...

Complete 2012 forensic audit documents - Kansas Bioscience ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

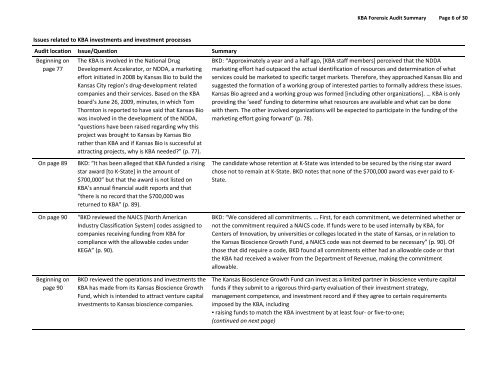

KBA Forensic Audit Summary Page 6 of 30<br />

Issues related to KBA investments and investment processes<br />

Audit location Issue/Question Summary<br />

Beginning on<br />

page 77<br />

The KBA is involved in the National Drug<br />

Development Accelerator, or NDDA, a marketing<br />

effort initiated in 2008 by <strong>Kansas</strong> Bio to build the<br />

<strong>Kansas</strong> City region’s drug‐development related<br />

companies and their services. Based on the KBA<br />

board’s June 26, 2009, minutes, in which Tom<br />

Thornton is reported to have said that <strong>Kansas</strong> Bio<br />

was involved in the development of the NDDA,<br />

“questions have been raised regarding why this<br />

project was brought to <strong>Kansas</strong> by <strong>Kansas</strong> Bio<br />

rather than KBA and if <strong>Kansas</strong> Bio is successful at<br />

attracting projects, why is KBA needed?” (p. 77).<br />

BKD: “Approximately a year and a half ago, [KBA staff members] perceived that the NDDA<br />

marketing effort had outpaced the actual identification of resources and determination of what<br />

services could be marketed to specific target markets. Therefore, they approached <strong>Kansas</strong> Bio and<br />

suggested the formation of a working group of interested parties to formally address these issues.<br />

<strong>Kansas</strong> Bio agreed and a working group was formed [including other organizations]. … KBA is only<br />

providing the ‘seed’ funding to determine what resources are available and what can be done<br />

with them. The other involved organizations will be expected to participate in the funding of the<br />

marketing effort going forward” (p. 78).<br />

On page 89<br />

On page 90<br />

Beginning on<br />

page 90<br />

BKD: “It has been alleged that KBA funded a rising<br />

star award [to K‐State] in the amount of<br />

$700,000” but that the award is not listed on<br />

KBA’s annual financial <strong>audit</strong> reports and that<br />

“there is no record that the $700,000 was<br />

returned to KBA” (p. 89).<br />

“BKD reviewed the NAICS [North American<br />

Industry Classification System] codes assigned to<br />

companies receiving funding from KBA for<br />

compliance with the allowable codes under<br />

KEGA” (p. 90).<br />

BKD reviewed the operations and investments the<br />

KBA has made from its <strong>Kansas</strong> <strong>Bioscience</strong> Growth<br />

Fund, which is intended to attract venture capital<br />

investments to <strong>Kansas</strong> bioscience companies.<br />

The candidate whose retention at K‐State was intended to be secured by the rising star award<br />

chose not to remain at K‐State. BKD notes that none of the $700,000 award was ever paid to K‐<br />

State.<br />

BKD: “We considered all commitments. … First, for each commitment, we determined whether or<br />

not the commitment required a NAICS code. If funds were to be used internally by KBA, for<br />

Centers of Innovation, by universities or colleges located in the state of <strong>Kansas</strong>, or in relation to<br />

the <strong>Kansas</strong> <strong>Bioscience</strong> Growth Fund, a NAICS code was not deemed to be necessary” (p. 90). Of<br />

those that did require a code, BKD found all commitments either had an allowable code or that<br />

the KBA had received a waiver from the Department of Revenue, making the commitment<br />

allowable.<br />

The <strong>Kansas</strong> <strong>Bioscience</strong> Growth Fund can invest as a limited partner in bioscience venture capital<br />

funds if they submit to a rigorous third‐party evaluation of their investment strategy,<br />

management competence, and investment record and if they agree to certain requirements<br />

imposed by the KBA, including<br />

▪ raising funds to match the KBA investment by at least four‐ or five‐to‐one;<br />

(continued on next page)