Complete 2012 forensic audit documents - Kansas Bioscience ...

Complete 2012 forensic audit documents - Kansas Bioscience ...

Complete 2012 forensic audit documents - Kansas Bioscience ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

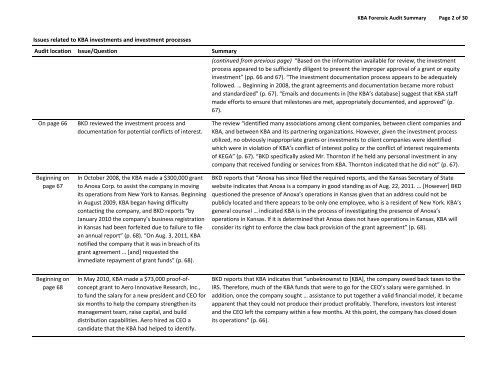

KBA Forensic Audit Summary Page 2 of 30<br />

Issues related to KBA investments and investment processes<br />

Audit location Issue/Question Summary<br />

(continued from previous page) “Based on the information available for review, the investment<br />

process appeared to be sufficiently diligent to prevent the improper approval of a grant or equity<br />

investment” (pp. 66 and 67). “The investment documentation process appears to be adequately<br />

followed. … Beginning in 2008, the grant agreements and documentation became more robust<br />

and standardized” (p. 67). “Emails and <strong>documents</strong> in [the KBA’s database] suggest that KBA staff<br />

made efforts to ensure that milestones are met, appropriately documented, and approved” (p.<br />

67).<br />

On page 66<br />

Beginning on<br />

page 67<br />

BKD reviewed the investment process and<br />

documentation for potential conflicts of interest.<br />

In October 2008, the KBA made a $300,000 grant<br />

to Anoxa Corp. to assist the company in moving<br />

its operations from New York to <strong>Kansas</strong>. Beginning<br />

in August 2009, KBA began having difficulty<br />

contacting the company, and BKD reports “by<br />

January 2010 the company’s business registration<br />

in <strong>Kansas</strong> had been forfeited due to failure to file<br />

an annual report” (p. 68). “On Aug. 3, 2011, KBA<br />

notified the company that it was in breach of its<br />

grant agreement … [and] requested the<br />

immediate repayment of grant funds” (p. 68).<br />

The review “identified many associations among client companies, between client companies and<br />

KBA, and between KBA and its partnering organizations. However, given the investment process<br />

utilized, no obviously inappropriate grants or investments to client companies were identified<br />

which were in violation of KBA’s conflict of interest policy or the conflict of interest requirements<br />

of KEGA” (p. 67). “BKD specifically asked Mr. Thornton if he held any personal investment in any<br />

company that received funding or services from KBA. Thornton indicated that he did not” (p. 67).<br />

BKD reports that “Anoxa has since filed the required reports, and the <strong>Kansas</strong> Secretary of State<br />

website indicates that Anoxa is a company in good standing as of Aug. 22, 2011. … [However] BKD<br />

questioned the presence of Anoxa’s operations in <strong>Kansas</strong> given that an address could not be<br />

publicly located and there appears to be only one employee, who is a resident of New York. KBA’s<br />

general counsel … indicated KBA is in the process of investigating the presence of Anoxa’s<br />

operations in <strong>Kansas</strong>. If it is determined that Anoxa does not have operations in <strong>Kansas</strong>, KBA will<br />

consider its right to enforce the claw back provision of the grant agreement” (p. 68).<br />

Beginning on<br />

page 68<br />

In May 2010, KBA made a $73,000 proof‐ofconcept<br />

grant to Aero Innovative Research, Inc.,<br />

to fund the salary for a new president and CEO for<br />

six months to help the company strengthen its<br />

management team, raise capital, and build<br />

distribution capabilities. Aero hired as CEO a<br />

candidate that the KBA had helped to identify.<br />

BKD reports that KBA indicates that “unbeknownst to [KBA], the company owed back taxes to the<br />

IRS. Therefore, much of the KBA funds that were to go for the CEO’s salary were garnished. In<br />

addition, once the company sought … assistance to put together a valid financial model, it became<br />

apparent that they could not produce their product profitably. Therefore, investors lost interest<br />

and the CEO left the company within a few months. At this point, the company has closed down<br />

its operations” (p. 66).