Complete 2012 forensic audit documents - Kansas Bioscience ...

Complete 2012 forensic audit documents - Kansas Bioscience ...

Complete 2012 forensic audit documents - Kansas Bioscience ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

KBA Forensic Audit Summary Page 1 of 30<br />

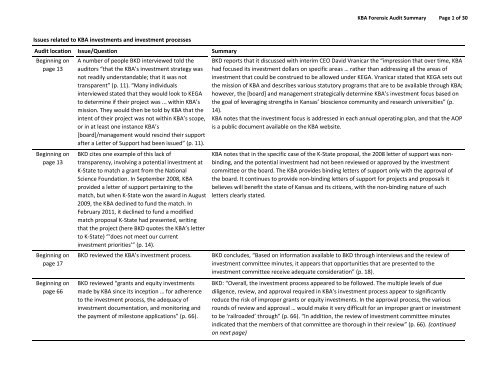

Issues related to KBA investments and investment processes<br />

Audit location Issue/Question Summary<br />

Beginning on<br />

page 13<br />

Beginning on<br />

page 13<br />

Beginning on<br />

page 17<br />

Beginning on<br />

page 66<br />

A number of people BKD interviewed told the<br />

<strong>audit</strong>ors “that the KBA’s investment strategy was<br />

not readily understandable; that it was not<br />

transparent” (p. 11). “Many individuals<br />

interviewed stated that they would look to KEGA<br />

to determine if their project was ... within KBA’s<br />

mission. They would then be told by KBA that the<br />

intent of their project was not within KBA’s scope,<br />

or in at least one instance KBA’s<br />

[board]/management would rescind their support<br />

after a Letter of Support had been issued” (p. 11).<br />

BKD cites one example of this lack of<br />

transparency, involving a potential investment at<br />

K‐State to match a grant from the National<br />

Science Foundation. In September 2008, KBA<br />

provided a letter of support pertaining to the<br />

match, but when K‐State won the award in August<br />

2009, the KBA declined to fund the match. In<br />

February 2011, it declined to fund a modified<br />

match proposal K‐State had presented, writing<br />

that the project (here BKD quotes the KBA’s letter<br />

to K‐State) “‘does not meet our current<br />

investment priorities’” (p. 14).<br />

BKD reviewed the KBA’s investment process.<br />

BKD reviewed “grants and equity investments<br />

made by KBA since its inception … for adherence<br />

to the investment process, the adequacy of<br />

investment documentation, and monitoring and<br />

the payment of milestone applications” (p. 66).<br />

BKD reports that it discussed with interim CEO David Vranicar the “impression that over time, KBA<br />

had focused its investment dollars on specific areas … rather than addressing all the areas of<br />

investment that could be construed to be allowed under KEGA. Vranicar stated that KEGA sets out<br />

the mission of KBA and describes various statutory programs that are to be available through KBA;<br />

however, the [board] and management strategically determine KBA’s investment focus based on<br />

the goal of leveraging strengths in <strong>Kansas</strong>’ bioscience community and research universities” (p.<br />

14).<br />

KBA notes that the investment focus is addressed in each annual operating plan, and that the AOP<br />

is a public document available on the KBA website.<br />

KBA notes that in the specific case of the K‐State proposal, the 2008 letter of support was nonbinding,<br />

and the potential investment had not been reviewed or approved by the investment<br />

committee or the board. The KBA provides binding letters of support only with the approval of<br />

the board. It continues to provide non‐binding letters of support for projects and proposals it<br />

believes will benefit the state of <strong>Kansas</strong> and its citizens, with the non‐binding nature of such<br />

letters clearly stated.<br />

BKD concludes, “Based on information available to BKD through interviews and the review of<br />

investment committee minutes, it appears that opportunities that are presented to the<br />

investment committee receive adequate consideration” (p. 18).<br />

BKD: “Overall, the investment process appeared to be followed. The multiple levels of due<br />

diligence, review, and approval required in KBA’s investment process appear to significantly<br />

reduce the risk of improper grants or equity investments. In the approval process, the various<br />

rounds of review and approval … would make it very difficult for an improper grant or investment<br />

to be ‘railroaded’ through” (p. 66). “In addition, the review of investment committee minutes<br />

indicated that the members of that committee are thorough in their review” (p. 66). (continued<br />

on next page)