Complete 2012 forensic audit documents - Kansas Bioscience ...

Complete 2012 forensic audit documents - Kansas Bioscience ...

Complete 2012 forensic audit documents - Kansas Bioscience ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

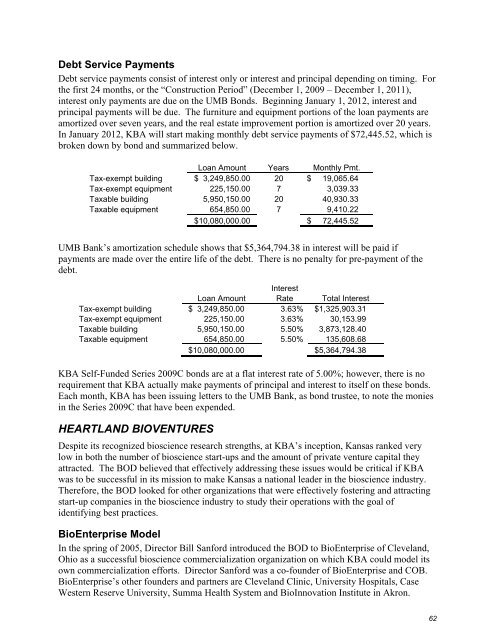

Debt Service Payments<br />

Debt service payments consist of interest only or interest and principal depending on timing. For<br />

the first 24 months, or the “Construction Period” (December 1, 2009 – December 1, 2011),<br />

interest only payments are due on the UMB Bonds. Beginning January 1, <strong>2012</strong>, interest and<br />

principal payments will be due. The furniture and equipment portions of the loan payments are<br />

amortized over seven years, and the real estate improvement portion is amortized over 20 years.<br />

In January <strong>2012</strong>, KBA will start making monthly debt service payments of $72,445.52, which is<br />

broken down by bond and summarized below.<br />

Loan Amount Years Monthly Pmt.<br />

Tax-exempt building $ 3,249,850.00 20 $ 19,065.64<br />

Tax-exempt equipment 225,150.00 7 3,039.33<br />

Taxable building 5,950,150.00 20 40,930.33<br />

Taxable equipment 654,850.00 7 9,410.22<br />

$10,080,000.00 $ 72,445.52<br />

UMB Bank’s amortization schedule shows that $5,364,794.38 in interest will be paid if<br />

payments are made over the entire life of the debt. There is no penalty for pre-payment of the<br />

debt.<br />

Interest<br />

Loan Amount Rate Total Interest<br />

Tax-exempt building $ 3,249,850.00 3.63% $1,325,903.31<br />

Tax-exempt equipment 225,150.00 3.63% 30,153.99<br />

Taxable building 5,950,150.00 5.50% 3,873,128.40<br />

Taxable equipment 654,850.00 5.50% 135,608.68<br />

$10,080,000.00 $5,364,794.38<br />

KBA Self-Funded Series 2009C bonds are at a flat interest rate of 5.00%; however, there is no<br />

requirement that KBA actually make payments of principal and interest to itself on these bonds.<br />

Each month, KBA has been issuing letters to the UMB Bank, as bond trustee, to note the monies<br />

in the Series 2009C that have been expended.<br />

HEARTLAND BIOVENTURES<br />

Despite its recognized bioscience research strengths, at KBA’s inception, <strong>Kansas</strong> ranked very<br />

low in both the number of bioscience start-ups and the amount of private venture capital they<br />

attracted. The BOD believed that effectively addressing these issues would be critical if KBA<br />

was to be successful in its mission to make <strong>Kansas</strong> a national leader in the bioscience industry.<br />

Therefore, the BOD looked for other organizations that were effectively fostering and attracting<br />

start-up companies in the bioscience industry to study their operations with the goal of<br />

identifying best practices.<br />

BioEnterprise Model<br />

In the spring of 2005, Director Bill Sanford introduced the BOD to BioEnterprise of Cleveland,<br />

Ohio as a successful bioscience commercialization organization on which KBA could model its<br />

own commercialization efforts. Director Sanford was a co-founder of BioEnterprise and COB.<br />

BioEnterprise’s other founders and partners are Cleveland Clinic, University Hospitals, Case<br />

Western Reserve University, Summa Health System and BioInnovation Institute in Akron.<br />

62