Annual report and financial statements 2011 - Analist.nl

Annual report and financial statements 2011 - Analist.nl

Annual report and financial statements 2011 - Analist.nl

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

102<br />

Notes to the <strong>financial</strong> <strong>statements</strong> continued<br />

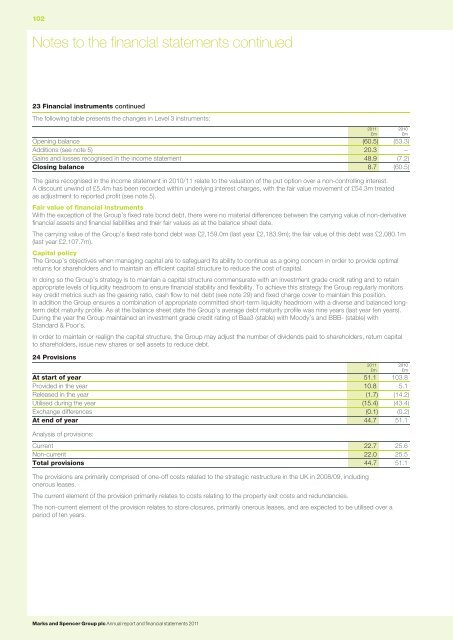

23 Financial instruments continued<br />

The following table presents the changes in Level 3 instruments:<br />

Opening balance (60.5) (53.3)<br />

Additions (see note 5) 20.3 –<br />

Gains <strong>and</strong> losses recognised in the income statement 48.9 (7.2)<br />

Closing balance 8.7 (60.5)<br />

The gains recognised in the income statement in 2010/11 relate to the valuation of the put option over a non-controlling interest.<br />

A discount unwind of £5.4m has been recorded within underlying interest charges, with the fair value movement of £54.3m treated<br />

as adjustment to <strong>report</strong>ed profit (see note 5).<br />

Fair value of <strong>financial</strong> instruments<br />

With the exception of the Group’s fixed rate bond debt, there were no material differences between the carrying value of non-derivative<br />

<strong>financial</strong> assets <strong>and</strong> <strong>financial</strong> liabilities <strong>and</strong> their fair values as at the balance sheet date.<br />

The carrying value of the Group’s fixed rate bond debt was £2,159.0m (last year £2,183.9m); the fair value of this debt was £2,080.1m<br />

(last year £2,107.7m).<br />

Capital policy<br />

The Group’s objectives when managing capital are to safeguard its ability to continue as a going concern in order to provide optimal<br />

returns for shareholders <strong>and</strong> to maintain an efficient capital structure to reduce the cost of capital.<br />

In doing so the Group’s strategy is to maintain a capital structure commensurate with an investment grade credit rating <strong>and</strong> to retain<br />

appropriate levels of liquidity headroom to ensure <strong>financial</strong> stability <strong>and</strong> flexibility. To achieve this strategy the Group regularly monitors<br />

key credit metrics such as the gearing ratio, cash flow to net debt (see note 29) <strong>and</strong> fixed charge cover to maintain this position.<br />

In addition the Group ensures a combination of appropriate committed short-term liquidity headroom with a diverse <strong>and</strong> balanced longterm<br />

debt maturity profile. As at the balance sheet date the Group’s average debt maturity profile was nine years (last year ten years).<br />

During the year the Group maintained an investment grade credit rating of Baa3 (stable) with Moody’s <strong>and</strong> BBB- (stable) with<br />

St<strong>and</strong>ard & Poor’s.<br />

In order to maintain or realign the capital structure, the Group may adjust the number of dividends paid to shareholders, return capital<br />

to shareholders, issue new shares or sell assets to reduce debt.<br />

24 Provisions<br />

At start of year 51.1 103.8<br />

Provided in the year 10.8 5.1<br />

Released in the year (1.7) (14.2)<br />

Utilised during the year (15.4) (43.4)<br />

Exchange differences (0.1) (0.2)<br />

At end of year 44.7 51.1<br />

Analysis of provisions:<br />

Current 22.7 25.6<br />

Non-current 22.0 25.5<br />

Total provisions 44.7 51.1<br />

The provisions are primarily comprised of one-off costs related to the strategic restructure in the UK in 2008/09, including<br />

onerous leases.<br />

The current element of the provision primarily relates to costs relating to the property exit costs <strong>and</strong> redundancies.<br />

The non-current element of the provision relates to store closures, primarily onerous leases, <strong>and</strong> are expected to be utilised over a<br />

period of ten years.<br />

<strong>2011</strong><br />

£m<br />

<strong>2011</strong><br />

£m<br />

2010<br />

£m<br />

2010<br />

£m<br />

Marks <strong>and</strong> Spencer Group plc <strong>Annual</strong> <strong>report</strong> <strong>and</strong> <strong>financial</strong> <strong>statements</strong> <strong>2011</strong>