Annual report and financial statements 2011 - Analist.nl

Annual report and financial statements 2011 - Analist.nl

Annual report and financial statements 2011 - Analist.nl

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

87<br />

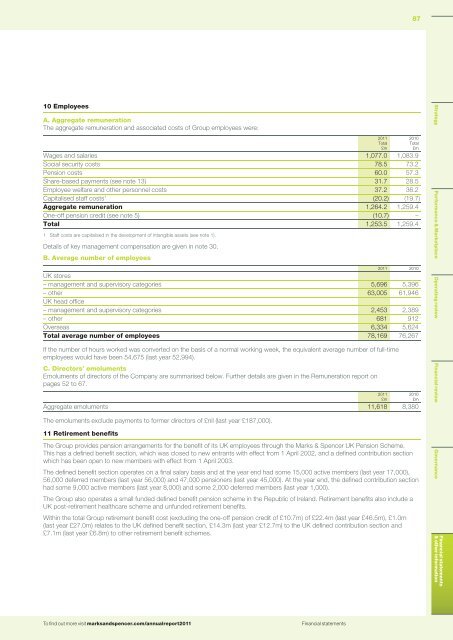

10 Employees<br />

A. Aggregate remuneration<br />

The aggregate remuneration <strong>and</strong> associated costs of Group employees were:<br />

Wages <strong>and</strong> salaries 1,077.0 1,083.9<br />

Social security costs 78.5 73.2<br />

Pension costs 60.0 57.3<br />

Share-based payments (see note 13) 31.7 28.5<br />

Employee welfare <strong>and</strong> other personnel costs 37.2 36.2<br />

Capitalised staff costs 1 (20.2) (19.7)<br />

Aggregate remuneration 1,264.2 1,259.4<br />

One-off pension credit (see note 5) (10.7) –<br />

Total 1,253.5 1,259.4<br />

1 Staff costs are capitalised in the development of intangible assets (see note 1).<br />

Details of key management compensation are given in note 30.<br />

B. Average number of employees<br />

<strong>2011</strong><br />

Total<br />

£m<br />

2010<br />

Total<br />

£m<br />

<strong>2011</strong> 2010<br />

UK stores<br />

– management <strong>and</strong> supervisory categories 5,696 5,396<br />

– other 63,005 61,946<br />

UK head office<br />

– management <strong>and</strong> supervisory categories 2,453 2,389<br />

– other 681 912<br />

Overseas 6,334 5,624<br />

Total average number of employees 78,169 76,267<br />

If the number of hours worked was converted on the basis of a normal working week, the equivalent average number of full-time<br />

employees would have been 54,675 (last year 52,994).<br />

C. Directors’ emoluments<br />

Emoluments of directors of the Company are summarised below. Further details are given in the Remuneration <strong>report</strong> on<br />

pages 52 to 67.<br />

Aggregate emoluments 11,618 8,380<br />

The emoluments exclude payments to former directors of £nil (last year £187,000).<br />

11 Retirement benefits<br />

The Group provides pension arrangements for the benefit of its UK employees through the Marks & Spencer UK Pension Scheme.<br />

This has a defined benefit section, which was closed to new entrants with effect from 1 April 2002, <strong>and</strong> a defined contribution section<br />

which has been open to new members with effect from 1 April 2003.<br />

The defined benefit section operates on a final salary basis <strong>and</strong> at the year end had some 15,000 active members (last year 17,000),<br />

56,000 deferred members (last year 56,000) <strong>and</strong> 47,000 pensioners (last year 45,000). At the year end, the defined contribution section<br />

had some 9,000 active members (last year 8,000) <strong>and</strong> some 2,000 deferred members (last year 1,000).<br />

The Group also operates a small funded defined benefit pension scheme in the Republic of Irel<strong>and</strong>. Retirement benefits also include a<br />

UK post-retirement healthcare scheme <strong>and</strong> unfunded retirement benefits.<br />

Within the total Group retirement benefit cost (excluding the one-off pension credit of £10.7m) of £22.4m (last year £46.5m), £1.0m<br />

(last year £27.0m) relates to the UK defined benefit section, £14.3m (last year £12.7m) to the UK defined contribution section <strong>and</strong><br />

£7.1m (last year £6.8m) to other retirement benefit schemes.<br />

<strong>2011</strong><br />

£m<br />

2010<br />

£m<br />

Strategy Performance & Marketplace Operating review Financial review Governance<br />

Financial <strong>statements</strong><br />

& other information<br />

To find out more visit marks<strong>and</strong>spencer.com/annual<strong>report</strong><strong>2011</strong><br />

Financial <strong>statements</strong>