Annual report and financial statements 2011 - Analist.nl

Annual report and financial statements 2011 - Analist.nl

Annual report and financial statements 2011 - Analist.nl

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

58<br />

Governance<br />

Remuneration<br />

<strong>report</strong><br />

continued<br />

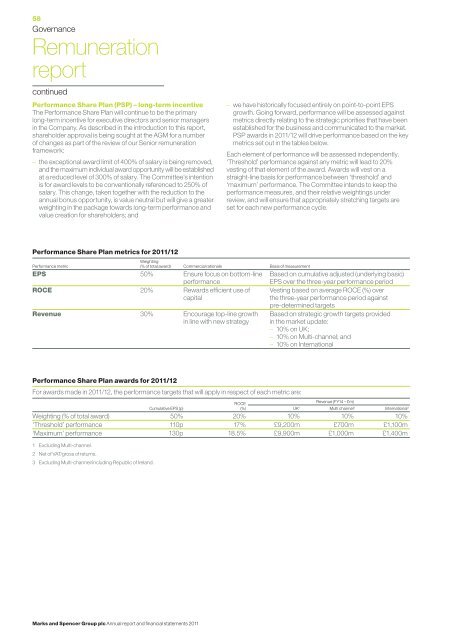

Performance Share Plan (PSP) – long-term incentive<br />

The Performance Share Plan will continue to be the primary<br />

long-term incentive for executive directors <strong>and</strong> senior managers<br />

in the Company. As described in the introduction to this <strong>report</strong>,<br />

shareholder approval is being sought at the AGM for a number<br />

of changes as part of the review of our Senior remuneration<br />

framework:<br />

– the exceptional award limit of 400% of salary is being removed,<br />

<strong>and</strong> the maximum individual award opportunity will be established<br />

at a reduced level of 300% of salary. The Committee’s intention<br />

is for award levels to be conventionally referenced to 250% of<br />

salary. This change, taken together with the reduction to the<br />

annual bonus opportunity, is value neutral but will give a greater<br />

weighting in the package towards long-term performance <strong>and</strong><br />

value creation for shareholders; <strong>and</strong><br />

– we have historically focused entirely on point-to-point EPS<br />

growth. Going forward, performance will be assessed against<br />

metrics directly relating to the strategic priorities that have been<br />

established for the business <strong>and</strong> communicated to the market.<br />

PSP awards in <strong>2011</strong>/12 will drive performance based on the key<br />

metrics set out in the tables below.<br />

Each element of performance will be assessed independently.<br />

‘Threshold’ performance against any metric will lead to 20%<br />

vesting of that element of the award. Awards will vest on a<br />

straight-line basis for performance between ‘threshold’ <strong>and</strong><br />

‘maximum’ performance. The Committee intends to keep the<br />

performance measures, <strong>and</strong> their relative weightings under<br />

review, <strong>and</strong> will ensure that appropriately stretching targets are<br />

set for each new performance cycle.<br />

Performance Share Plan metrics for <strong>2011</strong>/12<br />

Performance metric<br />

Weighting<br />

(% of total award) Commercial rationale Basis of measurement<br />

EPS 50% Ensure focus on bottom-line<br />

performance<br />

ROCE 20% Rewards efficient use of<br />

capital<br />

Revenue 30% Encourage top-line growth<br />

in line with new strategy<br />

Based on cumulative adjusted (underlying basic)<br />

EPS over the three-year performance period<br />

Vesting based on average ROCE (%) over<br />

the three-year performance period against<br />

pre-determined targets<br />

Based on strategic growth targets provided<br />

in the market update:<br />

– 10% on UK;<br />

– 10% on Multi-channel; <strong>and</strong><br />

– 10% on International<br />

Performance Share Plan awards for <strong>2011</strong>/12<br />

For awards made in <strong>2011</strong>/12, the performance targets that will apply in respect of each metric are:<br />

Cumulative EPS (p)<br />

ROCE<br />

(%)<br />

Revenue (FY14 – £m)<br />

UK 1 Multi channel 2 International 3<br />

Weighting (% of total award) 50% 20% 10% 10% 10%<br />

‘Threshold’ performance 110p 17% £9,200m £700m £1,100m<br />

‘Maximum’ performance 130p 18.5% £9,900m £1,000m £1,400m<br />

1 Excluding Multi-channel.<br />

2 Net of VAT/gross of returns.<br />

3 Excluding Multi-channel/including Republic of Irel<strong>and</strong>.<br />

Marks <strong>and</strong> Spencer Group plc <strong>Annual</strong> <strong>report</strong> <strong>and</strong> <strong>financial</strong> <strong>statements</strong> <strong>2011</strong>