Annual report and financial statements 2011 - Analist.nl

Annual report and financial statements 2011 - Analist.nl

Annual report and financial statements 2011 - Analist.nl

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

96<br />

Notes to the <strong>financial</strong> <strong>statements</strong> continued<br />

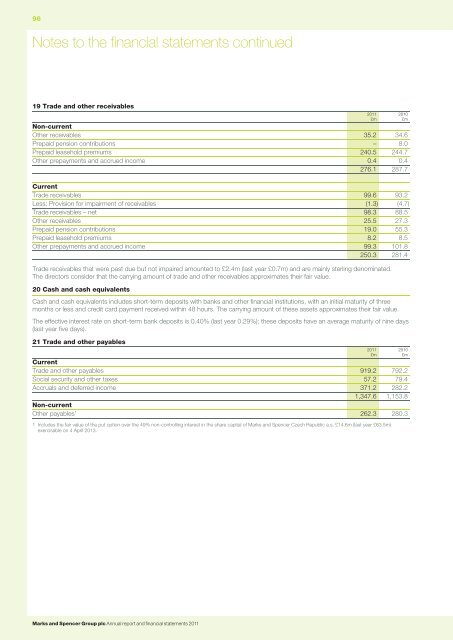

19 Trade <strong>and</strong> other receivables<br />

Non-current<br />

Other receivables 35.2 34.6<br />

Prepaid pension contributions – 8.0<br />

Prepaid leasehold premiums 240.5 244.7<br />

Other prepayments <strong>and</strong> accrued income 0.4 0.4<br />

276.1 287.7<br />

Current<br />

Trade receivables 99.6 93.2<br />

Less: Provision for impairment of receivables (1.3) (4.7)<br />

Trade receivables – net 98.3 88.5<br />

Other receivables 25.5 27.3<br />

Prepaid pension contributions 19.0 55.3<br />

Prepaid leasehold premiums 8.2 8.5<br />

Other prepayments <strong>and</strong> accrued income 99.3 101.8<br />

250.3 281.4<br />

Trade receivables that were past due but not impaired amounted to £2.4m (last year £0.7m) <strong>and</strong> are mai<strong>nl</strong>y sterling denominated.<br />

The directors consider that the carrying amount of trade <strong>and</strong> other receivables approximates their fair value.<br />

20 Cash <strong>and</strong> cash equivalents<br />

Cash <strong>and</strong> cash equivalents includes short-term deposits with banks <strong>and</strong> other <strong>financial</strong> institutions, with an initial maturity of three<br />

months or less <strong>and</strong> credit card payment received within 48 hours. The carrying amount of these assets approximates their fair value.<br />

The effective interest rate on short-term bank deposits is 0.40% (last year 0.29%); these deposits have an average maturity of nine days<br />

(last year five days).<br />

21 Trade <strong>and</strong> other payables<br />

Current<br />

Trade <strong>and</strong> other payables 919.2 792.2<br />

Social security <strong>and</strong> other taxes 57.2 79.4<br />

Accruals <strong>and</strong> deferred income 371.2 282.2<br />

1,347.6 1,153.8<br />

Non-current<br />

Other payables 1 262.3 280.3<br />

1 Includes the fair value of the put option over the 49% non-controlling interest in the share capital of Marks <strong>and</strong> Spencer Czech Republic a.s. £14.6m (last year £63.5m)<br />

exercisable on 4 April 2013.<br />

<strong>2011</strong><br />

£m<br />

<strong>2011</strong><br />

£m<br />

2010<br />

£m<br />

2010<br />

£m<br />

Marks <strong>and</strong> Spencer Group plc <strong>Annual</strong> <strong>report</strong> <strong>and</strong> <strong>financial</strong> <strong>statements</strong> <strong>2011</strong>