Annual report and financial statements 2011 - Analist.nl

Annual report and financial statements 2011 - Analist.nl

Annual report and financial statements 2011 - Analist.nl

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

95<br />

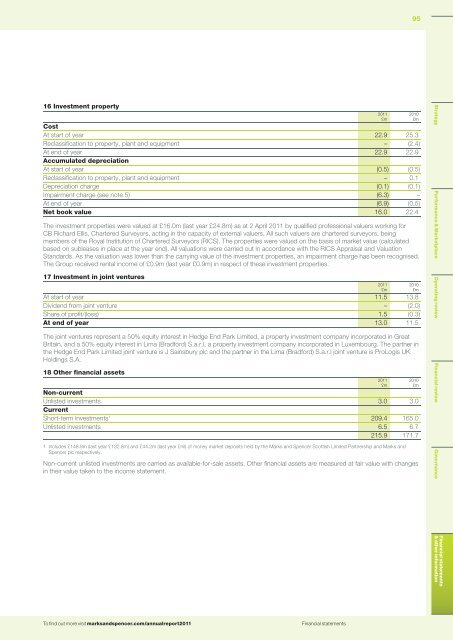

16 Investment property<br />

Cost<br />

At start of year 22.9 25.3<br />

Reclassification to property, plant <strong>and</strong> equipment – (2.4)<br />

At end of year 22.9 22.9<br />

Accumulated depreciation<br />

At start of year (0.5) (0.5)<br />

Reclassification to property, plant <strong>and</strong> equipment – 0.1<br />

Depreciation charge (0.1) (0.1)<br />

Impairment charge (see note 5) (6.3) –<br />

At end of year (6.9) (0.5)<br />

Net book value 16.0 22.4<br />

The investment properties were valued at £16.0m (last year £24.8m) as at 2 April <strong>2011</strong> by qualified professional valuers working for<br />

CB Richard Ellis, Chartered Surveyors, acting in the capacity of external valuers. All such valuers are chartered surveyors, being<br />

members of the Royal Institution of Chartered Surveyors (RICS). The properties were valued on the basis of market value (calculated<br />

based on subleases in place at the year end). All valuations were carried out in accordance with the RICS Appraisal <strong>and</strong> Valuation<br />

St<strong>and</strong>ards. As the valuation was lower than the carrying value of the investment properties, an impairment charge has been recognised.<br />

The Group received rental income of £0.9m (last year £0.9m) in respect of these investment properties.<br />

17 Investment in joint ventures<br />

At start of year 11.5 13.8<br />

Dividend from joint venture – (2.0)<br />

Share of profit/(loss) 1.5 (0.3)<br />

At end of year 13.0 11.5<br />

The joint ventures represent a 50% equity interest in Hedge End Park Limited, a property investment company incorporated in Great<br />

Britain, <strong>and</strong> a 50% equity interest in Lima (Bradford) S.a.r.l, a property investment company incorporated in Luxembourg. The partner in<br />

the Hedge End Park Limited joint venture is J Sainsbury plc <strong>and</strong> the partner in the Lima (Bradford) S.a.r.l joint venture is ProLogis UK<br />

Holdings S.A.<br />

18 Other <strong>financial</strong> assets<br />

Non-current<br />

U<strong>nl</strong>isted investments 3.0 3.0<br />

Current<br />

Short-term investments 1 209.4 165.0<br />

U<strong>nl</strong>isted investments 6.5 6.7<br />

215.9 171.7<br />

1 Includes £148.9m (last year £132.8m) <strong>and</strong> £44.2m (last year £nil) of money market deposits held by the Marks <strong>and</strong> Spencer Scottish Limited Partnership <strong>and</strong> Marks <strong>and</strong><br />

Spencer plc respectively.<br />

Non-current u<strong>nl</strong>isted investments are carried as available-for-sale assets. Other <strong>financial</strong> assets are measured at fair value with changes<br />

in their value taken to the income statement.<br />

<strong>2011</strong><br />

£m<br />

<strong>2011</strong><br />

£m<br />

<strong>2011</strong><br />

£m<br />

2010<br />

£m<br />

2010<br />

£m<br />

2010<br />

£m<br />

Strategy Performance & Marketplace Operating review Financial review Governance<br />

Financial <strong>statements</strong><br />

& other information<br />

To find out more visit marks<strong>and</strong>spencer.com/annual<strong>report</strong><strong>2011</strong><br />

Financial <strong>statements</strong>