Annual report and financial statements 2011 - Analist.nl

Annual report and financial statements 2011 - Analist.nl

Annual report and financial statements 2011 - Analist.nl

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

90<br />

Notes to the <strong>financial</strong> <strong>statements</strong> continued<br />

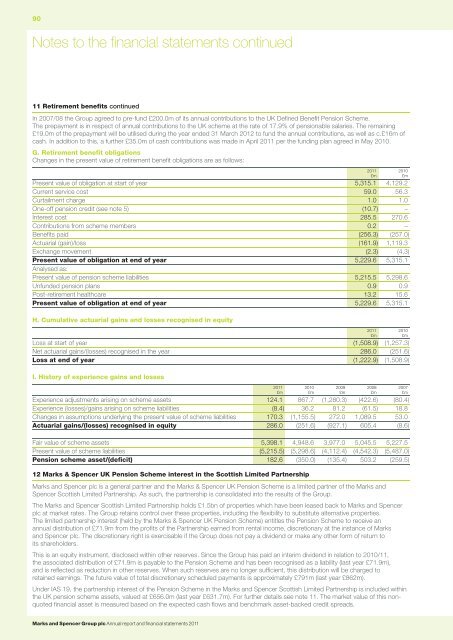

11 Retirement benefits continued<br />

In 2007/08 the Group agreed to pre-fund £200.0m of its annual contributions to the UK Defined Benefit Pension Scheme.<br />

The prepayment is in respect of annual contributions to the UK scheme at the rate of 17.9% of pensionable salaries. The remaining<br />

£19.0m of the prepayment will be utilised during the year ended 31 March 2012 to fund the annual contributions, as well as c.£16m of<br />

cash. In addition to this, a further £35.0m of cash contributions was made in April <strong>2011</strong> per the funding plan agreed in May 2010.<br />

G. Retirement benefit obligations<br />

Changes in the present value of retirement benefit obligations are as follows:<br />

Present value of obligation at start of year 5,315.1 4,129.2<br />

Current service cost 59.0 56.3<br />

Curtailment charge 1.0 1.0<br />

One-off pension credit (see note 5) (10.7) –<br />

Interest cost 285.5 270.6<br />

Contributions from scheme members 0.2 –<br />

Benefits paid (256.3) (257.0)<br />

Actuarial (gain)/loss (161.9) 1,119.3<br />

Exchange movement (2.3) (4.3)<br />

Present value of obligation at end of year 5,229.6 5,315.1<br />

Analysed as:<br />

Present value of pension scheme liabilities 5,215.5 5,298.6<br />

Unfunded pension plans 0.9 0.9<br />

Post-retirement healthcare 13.2 15.6<br />

Present value of obligation at end of year 5,229.6 5,315.1<br />

<strong>2011</strong><br />

£m<br />

2010<br />

£m<br />

H. Cumulative actuarial gains <strong>and</strong> losses recognised in equity<br />

Loss at start of year (1,508.9) (1,257.3)<br />

Net actuarial gains/(losses) recognised in the year 286.0 (251.6)<br />

Loss at end of year (1,222.9) (1,508.9)<br />

<strong>2011</strong><br />

£m<br />

2010<br />

£m<br />

I. History of experience gains <strong>and</strong> losses<br />

Experience adjustments arising on scheme assets 124.1 867.7 (1,280.3) (422.6) (80.4)<br />

Experience (losses)/gains arising on scheme liabilities (8.4) 36.2 81.2 (61.5) 18.8<br />

Changes in assumptions underlying the present value of scheme liabilities 170.3 (1,155.5) 272.0 1,089.5 53.0<br />

Actuarial gains/(losses) recognised in equity 286.0 (251.6) (927.1) 605.4 (8.6)<br />

<strong>2011</strong><br />

£m<br />

2010<br />

£m<br />

2009<br />

£m<br />

2008<br />

£m<br />

2007<br />

£m<br />

Fair value of scheme assets 5,398.1 4,948.6 3,977.0 5,045.5 5,227.5<br />

Present value of scheme liabilities (5,215.5) (5,298.6) (4,112.4) (4,542.3) (5,487.0)<br />

Pension scheme asset/(deficit) 182.6 (350.0) (135.4) 503.2 (259.5)<br />

12 Marks & Spencer UK Pension Scheme interest in the Scottish Limited Partnership<br />

Marks <strong>and</strong> Spencer plc is a general partner <strong>and</strong> the Marks & Spencer UK Pension Scheme is a limited partner of the Marks <strong>and</strong><br />

Spencer Scottish Limited Partnership. As such, the partnership is consolidated into the results of the Group.<br />

The Marks <strong>and</strong> Spencer Scottish Limited Partnership holds £1.5bn of properties which have been leased back to Marks <strong>and</strong> Spencer<br />

plc at market rates. The Group retains control over these properties, including the flexibility to substitute alternative properties.<br />

The limited partnership interest (held by the Marks & Spencer UK Pension Scheme) entitles the Pension Scheme to receive an<br />

annual distribution of £71.9m from the profits of the Partnership earned from rental income, discretionary at the instance of Marks<br />

<strong>and</strong> Spencer plc. The discretionary right is exercisable if the Group does not pay a dividend or make any other form of return to<br />

its shareholders.<br />

This is an equity instrument, disclosed within other reserves. Since the Group has paid an interim dividend in relation to 2010/11,<br />

the associated distribution of £71.9m is payable to the Pension Scheme <strong>and</strong> has been recognised as a liability (last year £71.9m),<br />

<strong>and</strong> is reflected as reduction in other reserves. When such reserves are no longer sufficient, this distribution will be charged to<br />

retained earnings. The future value of total discretionary scheduled payments is approximately £791m (last year £862m).<br />

Under IAS 19, the partnership interest of the Pension Scheme in the Marks <strong>and</strong> Spencer Scottish Limited Partnership is included within<br />

the UK pension scheme assets, valued at £656.0m (last year £631.7m). For further details see note 11. The market value of this nonquoted<br />

<strong>financial</strong> asset is measured based on the expected cash flows <strong>and</strong> benchmark asset-backed credit spreads.<br />

Marks <strong>and</strong> Spencer Group plc <strong>Annual</strong> <strong>report</strong> <strong>and</strong> <strong>financial</strong> <strong>statements</strong> <strong>2011</strong>