Annual report and financial statements 2011 - Analist.nl

Annual report and financial statements 2011 - Analist.nl

Annual report and financial statements 2011 - Analist.nl

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

77<br />

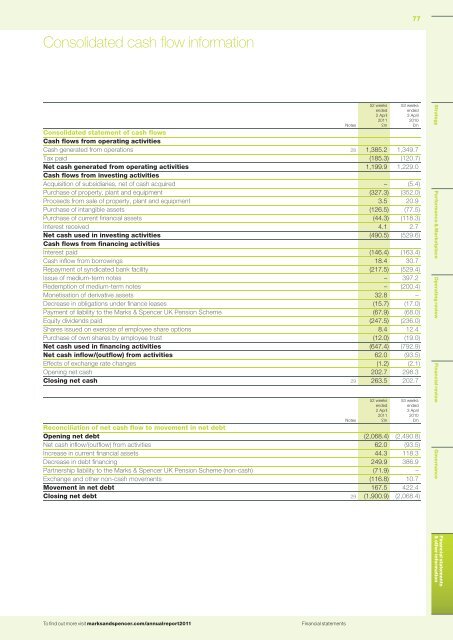

Consolidated cash flow information<br />

Consolidated statement of cash flows<br />

Cash flows from operating activities<br />

Cash generated from operations 28 1,385.2 1,349.7<br />

Tax paid (185.3) (120.7)<br />

Net cash generated from operating activities 1,199.9 1,229.0<br />

Cash flows from investing activities<br />

Acquisition of subsidiaries, net of cash acquired – (5.4)<br />

Purchase of property, plant <strong>and</strong> equipment (327.3) (352.0)<br />

Proceeds from sale of property, plant <strong>and</strong> equipment 3.5 20.9<br />

Purchase of intangible assets (126.5) (77.5)<br />

Purchase of current <strong>financial</strong> assets (44.3) (118.3)<br />

Interest received 4.1 2.7<br />

Net cash used in investing activities (490.5) (529.6)<br />

Cash flows from financing activities<br />

Interest paid (146.4) (163.4)<br />

Cash inflow from borrowings 18.4 30.7<br />

Repayment of syndicated bank facility (217.5) (529.4)<br />

Issue of medium-term notes – 397.2<br />

Redemption of medium-term notes – (200.4)<br />

Monetisation of derivative assets 32.8 –<br />

Decrease in obligations under finance leases (15.7) (17.0)<br />

Payment of liability to the Marks & Spencer UK Pension Scheme (67.9) (68.0)<br />

Equity dividends paid (247.5) (236.0)<br />

Shares issued on exercise of employee share options 8.4 12.4<br />

Purchase of own shares by employee trust (12.0) (19.0)<br />

Net cash used in financing activities (647.4) (792.9)<br />

Net cash inflow/(outflow) from activities 62.0 (93.5)<br />

Effects of exchange rate changes (1.2) (2.1)<br />

Opening net cash 202.7 298.3<br />

Closing net cash 29 263.5 202.7<br />

Reconciliation of net cash flow to movement in net debt<br />

Opening net debt (2,068.4) (2,490.8)<br />

Net cash inflow/(outflow) from activities 62.0 (93.5)<br />

Increase in current <strong>financial</strong> assets 44.3 118.3<br />

Decrease in debt financing 249.9 386.9<br />

Partnership liability to the Marks & Spencer UK Pension Scheme (non-cash) (71.9) –<br />

Exchange <strong>and</strong> other non-cash movements (116.8) 10.7<br />

Movement in net debt 167.5 422.4<br />

Closing net debt 29 (1,900.9) (2,068.4)<br />

Notes<br />

Notes<br />

52 weeks<br />

ended<br />

2 April<br />

<strong>2011</strong><br />

£m<br />

52 weeks<br />

ended<br />

2 April<br />

<strong>2011</strong><br />

£m<br />

53 weeks<br />

ended<br />

3 April<br />

2010<br />

£m<br />

53 weeks<br />

ended<br />

3 April<br />

2010<br />

£m<br />

Strategy Performance & Marketplace Operating review Financial review Governance<br />

Financial <strong>statements</strong><br />

& other information<br />

To find out more visit marks<strong>and</strong>spencer.com/annual<strong>report</strong><strong>2011</strong><br />

Financial <strong>statements</strong>