Annual report and financial statements 2011 - Analist.nl

Annual report and financial statements 2011 - Analist.nl

Annual report and financial statements 2011 - Analist.nl

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

75<br />

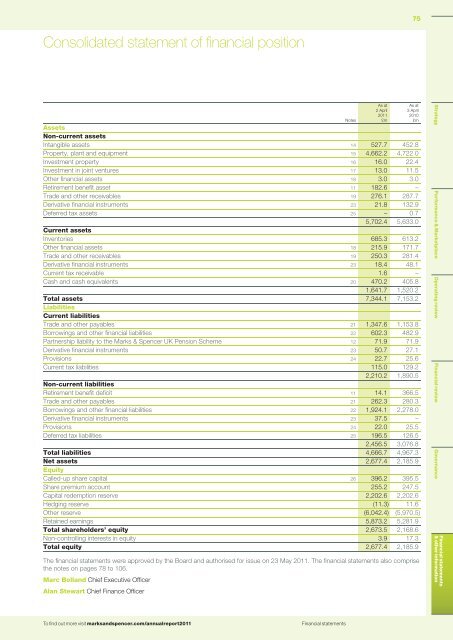

Consolidated statement of <strong>financial</strong> position<br />

Assets<br />

Non-current assets<br />

Intangible assets 14 527.7 452.8<br />

Property, plant <strong>and</strong> equipment 15 4,662.2 4,722.0<br />

Investment property 16 16.0 22.4<br />

Investment in joint ventures 17 13.0 11.5<br />

Other <strong>financial</strong> assets 18 3.0 3.0<br />

Retirement benefit asset 11 182.6 –<br />

Trade <strong>and</strong> other receivables 19 276.1 287.7<br />

Derivative <strong>financial</strong> instruments 23 21.8 132.9<br />

Deferred tax assets 25 – 0.7<br />

5,702.4 5,633.0<br />

Current assets<br />

Inventories 685.3 613.2<br />

Other <strong>financial</strong> assets 18 215.9 171.7<br />

Trade <strong>and</strong> other receivables 19 250.3 281.4<br />

Derivative <strong>financial</strong> instruments 23 18.4 48.1<br />

Current tax receivable 1.6 –<br />

Cash <strong>and</strong> cash equivalents 20 470.2 405.8<br />

1,641.7 1,520.2<br />

Total assets 7,344.1 7,153.2<br />

Liabilities<br />

Current liabilities<br />

Trade <strong>and</strong> other payables 21 1,347.6 1,153.8<br />

Borrowings <strong>and</strong> other <strong>financial</strong> liabilities 22 602.3 482.9<br />

Partnership liability to the Marks & Spencer UK Pension Scheme 12 71.9 71.9<br />

Derivative <strong>financial</strong> instruments 23 50.7 27.1<br />

Provisions 24 22.7 25.6<br />

Current tax liabilities 115.0 129.2<br />

2,210.2 1,890.5<br />

Non-current liabilities<br />

Retirement benefit deficit 11 14.1 366.5<br />

Trade <strong>and</strong> other payables 21 262.3 280.3<br />

Borrowings <strong>and</strong> other <strong>financial</strong> liabilities 22 1,924.1 2,278.0<br />

Derivative <strong>financial</strong> instruments 23 37.5 –<br />

Provisions 24 22.0 25.5<br />

Deferred tax liabilities 25 196.5 126.5<br />

2,456.5 3,076.8<br />

Total liabilities 4,666.7 4,967.3<br />

Net assets 2,677.4 2,185.9<br />

Equity<br />

Called-up share capital 26 396.2 395.5<br />

Share premium account 255.2 247.5<br />

Capital redemption reserve 2,202.6 2,202.6<br />

Hedging reserve (11.3) 11.6<br />

Other reserve (6,042.4) (5,970.5)<br />

Retained earnings 5,873.2 5,281.9<br />

Total shareholders’ equity 2,673.5 2,168.6<br />

Non-controlling interests in equity 3.9 17.3<br />

Total equity 2,677.4 2,185.9<br />

The <strong>financial</strong> <strong>statements</strong> were approved by the Board <strong>and</strong> authorised for issue on 23 May <strong>2011</strong>. The <strong>financial</strong> <strong>statements</strong> also comprise<br />

the notes on pages 78 to 106.<br />

Marc Boll<strong>and</strong> Chief Executive Officer<br />

Alan Stewart Chief Finance Officer<br />

Notes<br />

As at<br />

2 April<br />

<strong>2011</strong><br />

£m<br />

As at<br />

3 April<br />

2010<br />

£m<br />

Strategy Performance & Marketplace Operating review Financial review Governance<br />

Financial <strong>statements</strong><br />

& other information<br />

To find out more visit marks<strong>and</strong>spencer.com/annual<strong>report</strong><strong>2011</strong><br />

Financial <strong>statements</strong>