Annual report and financial statements 2011 - Analist.nl

Annual report and financial statements 2011 - Analist.nl

Annual report and financial statements 2011 - Analist.nl

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

103<br />

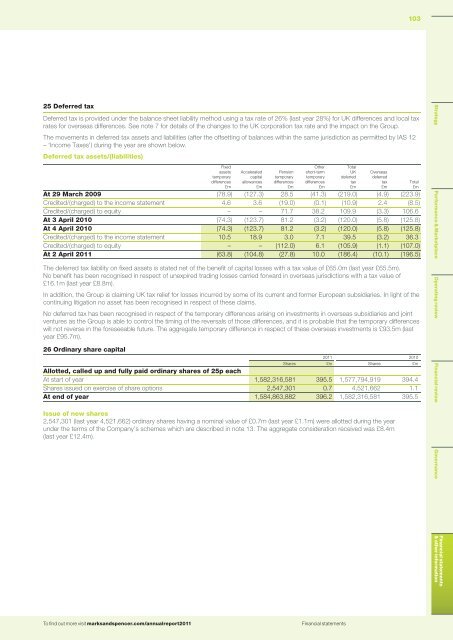

25 Deferred tax<br />

Deferred tax is provided under the balance sheet liability method using a tax rate of 26% (last year 28%) for UK differences <strong>and</strong> local tax<br />

rates for overseas differences. See note 7 for details of the changes to the UK corporation tax rate <strong>and</strong> the impact on the Group.<br />

The movements in deferred tax assets <strong>and</strong> liabilities (after the offsetting of balances within the same jurisdiction as permitted by IAS 12<br />

– ‘Income Taxes’) during the year are shown below.<br />

Deferred tax assets/(liabilities)<br />

Fixed<br />

assets<br />

temporary<br />

differences<br />

£m<br />

Accelerated<br />

capital<br />

allowances<br />

£m<br />

Pension<br />

temporary<br />

differences<br />

£m<br />

Other<br />

short-term<br />

temporary<br />

differences<br />

£m<br />

At 29 March 2009 (78.9) (127.3) 28.5 (41.3) (219.0) (4.9) (223.9)<br />

Credited/(charged) to the income statement 4.6 3.6 (19.0) (0.1) (10.9) 2.4 (8.5)<br />

Credited/(charged) to equity – – 71.7 38.2 109.9 (3.3) 106.6<br />

At 3 April 2010 (74.3) (123.7) 81.2 (3.2) (120.0) (5.8) (125.8)<br />

At 4 April 2010 (74.3) (123.7) 81.2 (3.2) (120.0) (5.8) (125.8)<br />

Credited/(charged) to the income statement 10.5 18.9 3.0 7.1 39.5 (3.2) 36.3<br />

Credited/(charged) to equity – – (112.0) 6.1 (105.9) (1.1) (107.0)<br />

At 2 April <strong>2011</strong> (63.8) (104.8) (27.8) 10.0 (186.4) (10.1) (196.5)<br />

The deferred tax liability on fixed assets is stated net of the benefit of capital losses with a tax value of £65.0m (last year £65.5m).<br />

No benefit has been recognised in respect of unexpired trading losses carried forward in overseas jurisdictions with a tax value of<br />

£16.1m (last year £8.8m).<br />

In addition, the Group is claiming UK tax relief for losses incurred by some of its current <strong>and</strong> former European subsidiaries. In light of the<br />

continuing litigation no asset has been recognised in respect of these claims.<br />

No deferred tax has been recognised in respect of the temporary differences arising on investments in overseas subsidiaries <strong>and</strong> joint<br />

ventures as the Group is able to control the timing of the reversals of those differences, <strong>and</strong> it is probable that the temporary differences<br />

will not reverse in the foreseeable future. The aggregate temporary difference in respect of these overseas investments is £93.5m (last<br />

year £95.7m).<br />

26 Ordinary share capital<br />

Total<br />

UK<br />

deferred<br />

tax<br />

£m<br />

Overseas<br />

deferred<br />

tax<br />

£m<br />

Total<br />

£m<br />

<strong>2011</strong> 2010<br />

Shares £m Shares £m<br />

Allotted, called up <strong>and</strong> fully paid ordinary shares of 25p each<br />

At start of year 1,582,316,581 395.5 1,577,794,919 394.4<br />

Shares issued on exercise of share options 2,547,301 0.7 4,521,662 1.1<br />

At end of year 1,584,863,882 396.2 1,582,316,581 395.5<br />

Issue of new shares<br />

2,547,301 (last year 4,521,662) ordinary shares having a nominal value of £0.7m (last year £1.1m) were allotted during the year<br />

under the terms of the Company’s schemes which are described in note 13. The aggregate consideration received was £8.4m<br />

(last year £12.4m).<br />

Strategy Performance & Marketplace Operating review Financial review Governance<br />

Financial <strong>statements</strong><br />

& other information<br />

To find out more visit marks<strong>and</strong>spencer.com/annual<strong>report</strong><strong>2011</strong><br />

Financial <strong>statements</strong>