View - The Municipality of Lambton Shores

View - The Municipality of Lambton Shores

View - The Municipality of Lambton Shores

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

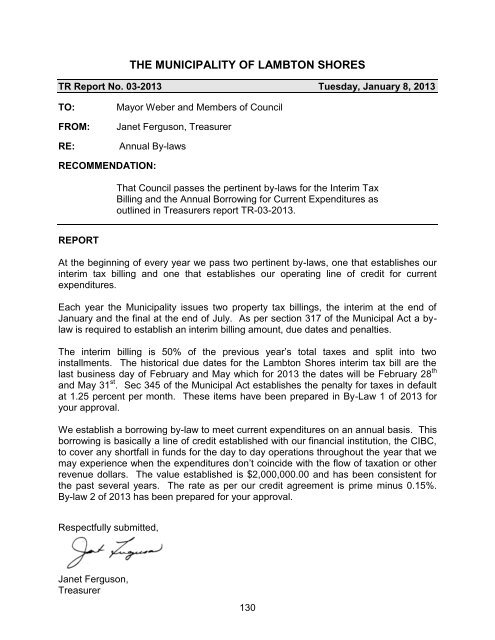

THE MUNICIPALITY OF LAMBTON SHORES<br />

TR Report No. 03-2013 Tuesday, January 8, 2013<br />

TO:<br />

FROM:<br />

RE:<br />

Mayor Weber and Members <strong>of</strong> Council<br />

Janet Ferguson, Treasurer<br />

Annual By-laws<br />

RECOMMENDATION:<br />

That Council passes the pertinent by-laws for the Interim Tax<br />

Billing and the Annual Borrowing for Current Expenditures as<br />

outlined in Treasurers report TR-03-2013.<br />

REPORT<br />

At the beginning <strong>of</strong> every year we pass two pertinent by-laws, one that establishes our<br />

interim tax billing and one that establishes our operating line <strong>of</strong> credit for current<br />

expenditures.<br />

Each year the <strong>Municipality</strong> issues two property tax billings, the interim at the end <strong>of</strong><br />

January and the final at the end <strong>of</strong> July. As per section 317 <strong>of</strong> the Municipal Act a bylaw<br />

is required to establish an interim billing amount, due dates and penalties.<br />

<strong>The</strong> interim billing is 50% <strong>of</strong> the previous year’s total taxes and split into two<br />

installments. <strong>The</strong> historical due dates for the <strong>Lambton</strong> <strong>Shores</strong> interim tax bill are the<br />

last business day <strong>of</strong> February and May which for 2013 the dates will be February 28 th<br />

and May 31 st . Sec 345 <strong>of</strong> the Municipal Act establishes the penalty for taxes in default<br />

at 1.25 percent per month. <strong>The</strong>se items have been prepared in By-Law 1 <strong>of</strong> 2013 for<br />

your approval.<br />

We establish a borrowing by-law to meet current expenditures on an annual basis. This<br />

borrowing is basically a line <strong>of</strong> credit established with our financial institution, the CIBC,<br />

to cover any shortfall in funds for the day to day operations throughout the year that we<br />

may experience when the expenditures don’t coincide with the flow <strong>of</strong> taxation or other<br />

revenue dollars. <strong>The</strong> value established is $2,000,000.00 and has been consistent for<br />

the past several years. <strong>The</strong> rate as per our credit agreement is prime minus 0.15%.<br />

By-law 2 <strong>of</strong> 2013 has been prepared for your approval.<br />

Respectfully submitted,<br />

Janet Ferguson,<br />

Treasurer<br />

130