View - The Municipality of Lambton Shores

View - The Municipality of Lambton Shores

View - The Municipality of Lambton Shores

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

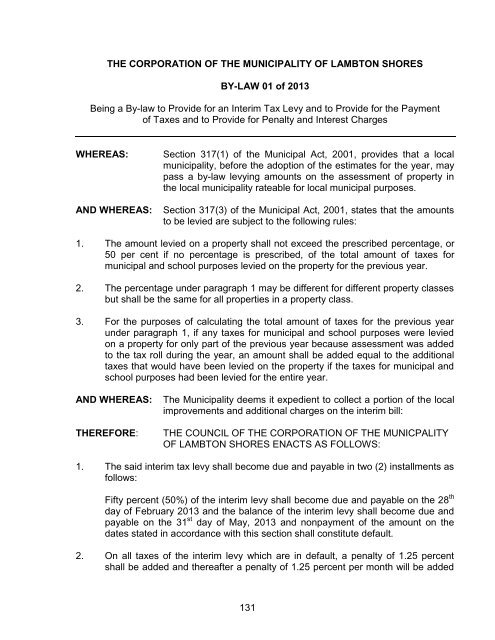

THE CORPORATION OF THE MUNICIPALITY OF LAMBTON SHORES<br />

BY-LAW 01 <strong>of</strong> 2013<br />

Being a By-law to Provide for an Interim Tax Levy and to Provide for the Payment<br />

<strong>of</strong> Taxes and to Provide for Penalty and Interest Charges<br />

WHEREAS:<br />

AND WHEREAS:<br />

Section 317(1) <strong>of</strong> the Municipal Act, 2001, provides that a local<br />

municipality, before the adoption <strong>of</strong> the estimates for the year, may<br />

pass a by-law levying amounts on the assessment <strong>of</strong> property in<br />

the local municipality rateable for local municipal purposes.<br />

Section 317(3) <strong>of</strong> the Municipal Act, 2001, states that the amounts<br />

to be levied are subject to the following rules:<br />

1. <strong>The</strong> amount levied on a property shall not exceed the prescribed percentage, or<br />

50 per cent if no percentage is prescribed, <strong>of</strong> the total amount <strong>of</strong> taxes for<br />

municipal and school purposes levied on the property for the previous year.<br />

2. <strong>The</strong> percentage under paragraph 1 may be different for different property classes<br />

but shall be the same for all properties in a property class.<br />

3. For the purposes <strong>of</strong> calculating the total amount <strong>of</strong> taxes for the previous year<br />

under paragraph 1, if any taxes for municipal and school purposes were levied<br />

on a property for only part <strong>of</strong> the previous year because assessment was added<br />

to the tax roll during the year, an amount shall be added equal to the additional<br />

taxes that would have been levied on the property if the taxes for municipal and<br />

school purposes had been levied for the entire year.<br />

AND WHEREAS:<br />

THEREFORE:<br />

<strong>The</strong> <strong>Municipality</strong> deems it expedient to collect a portion <strong>of</strong> the local<br />

improvements and additional charges on the interim bill:<br />

THE COUNCIL OF THE CORPORATION OF THE MUNICPALITY<br />

OF LAMBTON SHORES ENACTS AS FOLLOWS:<br />

1. <strong>The</strong> said interim tax levy shall become due and payable in two (2) installments as<br />

follows:<br />

Fifty percent (50%) <strong>of</strong> the interim levy shall become due and payable on the 28 th<br />

day <strong>of</strong> February 2013 and the balance <strong>of</strong> the interim levy shall become due and<br />

payable on the 31 st day <strong>of</strong> May, 2013 and nonpayment <strong>of</strong> the amount on the<br />

dates stated in accordance with this section shall constitute default.<br />

2. On all taxes <strong>of</strong> the interim levy which are in default, a penalty <strong>of</strong> 1.25 percent<br />

shall be added and thereafter a penalty <strong>of</strong> 1.25 percent per month will be added<br />

131