View - The Municipality of Lambton Shores

View - The Municipality of Lambton Shores

View - The Municipality of Lambton Shores

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

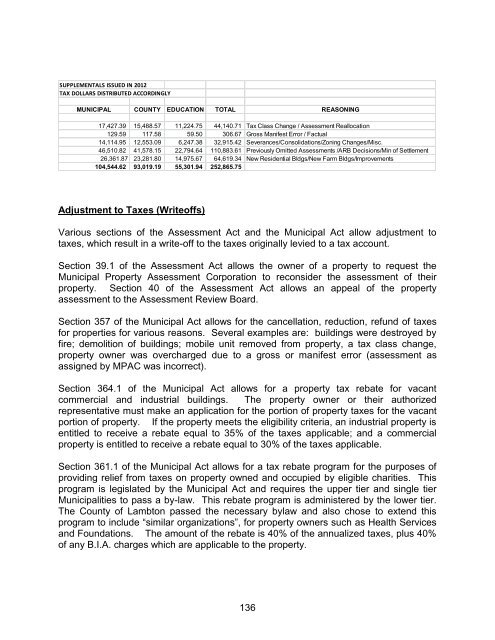

SUPPLEMENTALS ISSUED IN 2012<br />

TAX DOLLARS DISTRIBUTED ACCORDINGLY<br />

MUNICIPAL COUNTY EDUCATION TOTAL REASONING<br />

17,427.39 15,488.57 11,224.75 44,140.71 Tax Class Change / Assessment Reallocation<br />

129.59 117.58 59.50 306.67 Gross Manifest Error / Factual<br />

14,114.95 12,553.09 6,247.38 32,915.42 Severances/Consolidations/Zoning Changes/Misc.<br />

46,510.82 41,578.15 22,794.64 110,883.61 Previously Omitted Assessments /ARB Decisions/Min <strong>of</strong> Settlement<br />

26,361.87 23,281.80 14,975.67 64,619.34 New Residential Bldgs/New Farm Bldgs/Improvements<br />

104,544.62 93,019.19 55,301.94 252,865.75<br />

Adjustment to Taxes (Write<strong>of</strong>fs)<br />

Various sections <strong>of</strong> the Assessment Act and the Municipal Act allow adjustment to<br />

taxes, which result in a write-<strong>of</strong>f to the taxes originally levied to a tax account.<br />

Section 39.1 <strong>of</strong> the Assessment Act allows the owner <strong>of</strong> a property to request the<br />

Municipal Property Assessment Corporation to reconsider the assessment <strong>of</strong> their<br />

property. Section 40 <strong>of</strong> the Assessment Act allows an appeal <strong>of</strong> the property<br />

assessment to the Assessment Review Board.<br />

Section 357 <strong>of</strong> the Municipal Act allows for the cancellation, reduction, refund <strong>of</strong> taxes<br />

for properties for various reasons. Several examples are: buildings were destroyed by<br />

fire; demolition <strong>of</strong> buildings; mobile unit removed from property, a tax class change,<br />

property owner was overcharged due to a gross or manifest error (assessment as<br />

assigned by MPAC was incorrect).<br />

Section 364.1 <strong>of</strong> the Municipal Act allows for a property tax rebate for vacant<br />

commercial and industrial buildings. <strong>The</strong> property owner or their authorized<br />

representative must make an application for the portion <strong>of</strong> property taxes for the vacant<br />

portion <strong>of</strong> property. If the property meets the eligibility criteria, an industrial property is<br />

entitled to receive a rebate equal to 35% <strong>of</strong> the taxes applicable; and a commercial<br />

property is entitled to receive a rebate equal to 30% <strong>of</strong> the taxes applicable.<br />

Section 361.1 <strong>of</strong> the Municipal Act allows for a tax rebate program for the purposes <strong>of</strong><br />

providing relief from taxes on property owned and occupied by eligible charities. This<br />

program is legislated by the Municipal Act and requires the upper tier and single tier<br />

Municipalities to pass a by-law. This rebate program is administered by the lower tier.<br />

<strong>The</strong> County <strong>of</strong> <strong>Lambton</strong> passed the necessary bylaw and also chose to extend this<br />

program to include “similar organizations”, for property owners such as Health Services<br />

and Foundations. <strong>The</strong> amount <strong>of</strong> the rebate is 40% <strong>of</strong> the annualized taxes, plus 40%<br />

<strong>of</strong> any B.I.A. charges which are applicable to the property.<br />

136