Westpac Group Pillar 3 Report March 2013 - Iguana IR Sites

Westpac Group Pillar 3 Report March 2013 - Iguana IR Sites

Westpac Group Pillar 3 Report March 2013 - Iguana IR Sites

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

PILLAR 3 REPORT<br />

CREDIT RISK MANAGEMENT<br />

Approach<br />

<strong>Westpac</strong> adopts two approaches to managing credit risk depending upon the nature of the customer and product.<br />

Transaction-managed approach<br />

For larger customers, <strong>Westpac</strong> evaluates credit requests by undertaking detailed individual customer and<br />

transaction risk analysis (the ‘transaction-managed’ approach). Such customers are assigned a customer risk<br />

grade (CRG) representing <strong>Westpac</strong>’s estimate of their probability of default (PD). Each facility is assigned a loss<br />

given default (LGD). The <strong>Westpac</strong> credit risk rating system has 20 risk grades for non-defaulted customers and 10<br />

risk grades for defaulted customers. Non-defaulted CRGs down to the level of normally acceptable risk (i.e. D<br />

grade – see table below) are mapped to Moody’s and Standard & Poor’s (S&P) external senior ranking unsecured<br />

ratings. This mapping is reviewed annually and allows <strong>Westpac</strong> to integrate the rating agencies’ default history<br />

with our own internal historical data when calculating PDs.<br />

The final assignment of CRGs and LGDs is approved by authorised credit approvers with appropriate delegated<br />

approval authority. All material credit exposures are approved by authorised Credit Officers who are part of the risk<br />

management stream and operate independently of the areas originating the credit risk proposals. Divisional<br />

operational units are responsible for maintaining accurate and timely recording of all credit risk approvals and<br />

changes to customer and facility data. These units also operate independently of both the areas originating the<br />

credit risk proposals and the credit risk approvers. Appropriate segregation of functions is one of the key<br />

requirements of our credit risk management framework.<br />

Program-managed approach<br />

High-volume retail customer credit portfolios with homogenous credit risk characteristics are managed on a<br />

statistical basis according to pre-determined objective criteria (the ‘program-managed’ approach). Programmanaged<br />

exposure to a consumer customer may exceed $1 million. Business customer exposures in excess of $1<br />

million are transaction-managed. Quantitative scorecards are used to assign application and behavioural scores to<br />

enable risk-based decision making within these portfolios. The scorecard outcomes and decisions are regularly<br />

monitored and validated against subsequent customer performance and scorecards are recalibrated or rebuilt<br />

when required. For capital estimation and other purposes, risk-based customer segments are created based upon<br />

modelled expected PD, EAD and LGD. Accounts are then assigned to respective segments based on customer<br />

and account characteristics. Each segment is assigned a quantified measure of its PD, LGD and EAD.<br />

For both transaction and program-managed approaches, CRGs, PDs and LGDs are reviewed at least annually.<br />

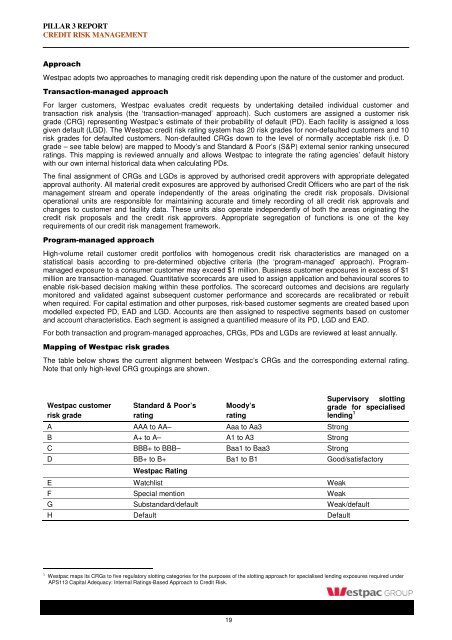

Mapping of <strong>Westpac</strong> risk grades<br />

The table below shows the current alignment between <strong>Westpac</strong>’s CRGs and the corresponding external rating.<br />

Note that only high-level CRG groupings are shown.<br />

<strong>Westpac</strong> customer<br />

risk grade<br />

Standard & Poor’s<br />

rating<br />

Moody’s<br />

rating<br />

A AAA to AA– Aaa to Aa3 Strong<br />

B A+ to A– A1 to A3 Strong<br />

C BBB+ to BBB– Baa1 to Baa3 Strong<br />

Supervisory slotting<br />

grade for specialised<br />

lending 1<br />

D BB+ to B+ Ba1 to B1 Good/satisfactory<br />

<strong>Westpac</strong> Rating<br />

E Watchlist Weak<br />

F Special mention Weak<br />

G Substandard/default Weak/default<br />

H Default Default<br />

1 <strong>Westpac</strong> maps its CRGs to five regulatory slotting categories for the purposes of the slotting approach for specialised lending exposures required under<br />

APS113 Capital Adequacy: Internal Ratings-Based Approach to Credit Risk.<br />

19