Westpac Group Pillar 3 Report March 2013 - Iguana IR Sites

Westpac Group Pillar 3 Report March 2013 - Iguana IR Sites

Westpac Group Pillar 3 Report March 2013 - Iguana IR Sites

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

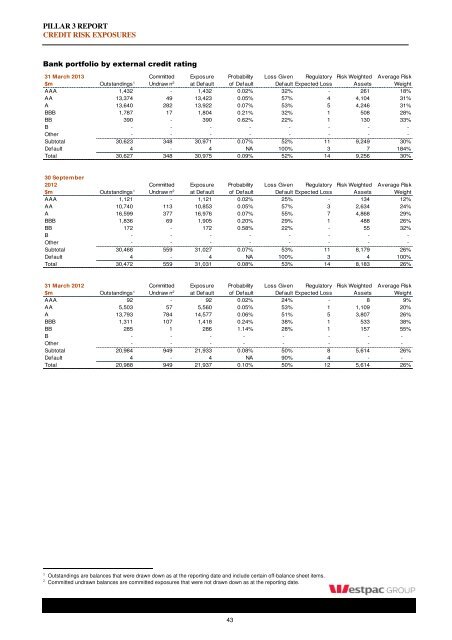

PILLAR 3 REPORT<br />

CREDIT RISK EXPOSURES<br />

Bank portfolio by external credit rating<br />

31 <strong>March</strong> <strong>2013</strong> Committed Exposure Probability Loss Given Regulatory Risk Weighted Average Risk<br />

$m Outstandings 1 Undraw n 2 at Default of Default Default Expected Loss Assets Weight<br />

AAA 1,432 - 1,432 0.02% 32% - 261 18%<br />

AA 13,374 49 13,423 0.05% 57% 4 4,104 31%<br />

A 13,640 282 13,922 0.07% 53% 5 4,246 31%<br />

BBB 1,787 17 1,804 0.21% 32% 1 508 28%<br />

BB 390 - 390 0.62% 22% 1 130 33%<br />

B - - - - - - - -<br />

Other - - - - - - - -<br />

Subtotal 30,623 348 30,971 0.07% 52% 11 9,249 30%<br />

Default 4 - 4 NA 100% 3 7 184%<br />

Total 30,627 348 30,975 0.09% 52% 14 9,256 30%<br />

30 September<br />

2012 Committed Exposure Probability Loss Given Regulatory Risk Weighted Average Risk<br />

$m Outstandings 1 Undraw n 2 at Default of Default Default Expected Loss Assets Weight<br />

AAA 1,121 - 1,121 0.02% 25% - 134 12%<br />

AA 10,740 113 10,853 0.05% 57% 3 2,634 24%<br />

A 16,599 377 16,976 0.07% 55% 7 4,868 29%<br />

BBB 1,836 69 1,905 0.20% 29% 1 488 26%<br />

BB 172 - 172 0.58% 22% - 55 32%<br />

B - - - - - - - -<br />

Other - - - - - - - -<br />

Subtotal 30,468 559 31,027 0.07% 53% 11 8,179 26%<br />

Default 4 - 4 NA 100% 3 4 100%<br />

Total 30,472 559 31,031 0.08% 53% 14 8,183 26%<br />

31 <strong>March</strong> 2012 Committed Exposure Probability Loss Given Regulatory Risk Weighted Average Risk<br />

$m Outstandings 1 Undraw n 2 at Default of Default Default Expected Loss Assets Weight<br />

AAA 92 - 92 0.02% 24% - 8 9%<br />

AA 5,503 57 5,560 0.05% 53% 1 1,109 20%<br />

A 13,793 784 14,577 0.06% 51% 5 3,807 26%<br />

BBB 1,311 107 1,418 0.24% 38% 1 533 38%<br />

BB 285 1 286 1.14% 28% 1 157 55%<br />

B - - - - - - - -<br />

Other - - - - - - - -<br />

Subtotal 20,984 949 21,933 0.08% 50% 8 5,614 26%<br />

Default 4 - 4 NA 90% 4 - -<br />

Total 20,988 949 21,937 0.10% 50% 12 5,614 26%<br />

1 Outstandings are balances that were drawn down as at the reporting date and include certain off-balance sheet items.<br />

2 Committed undrawn balances are committed exposures that were not drawn down as at the reporting date.<br />

43