Westpac Group Pillar 3 Report March 2013 - Iguana IR Sites

Westpac Group Pillar 3 Report March 2013 - Iguana IR Sites

Westpac Group Pillar 3 Report March 2013 - Iguana IR Sites

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

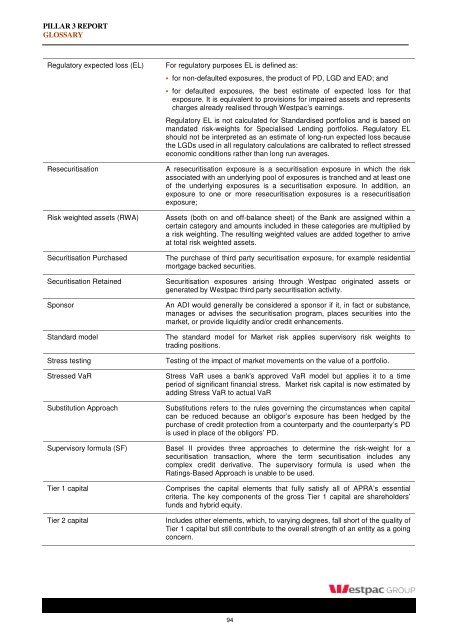

PILLAR 3 REPORT<br />

GLOSSARY<br />

Regulatory expected loss (EL)<br />

Resecuritisation<br />

Risk weighted assets (RWA)<br />

Securitisation Purchased<br />

Securitisation Retained<br />

Sponsor<br />

Standard model<br />

Stress testing<br />

Stressed VaR<br />

Substitution Approach<br />

Supervisory formula (SF)<br />

Tier 1 capital<br />

Tier 2 capital<br />

For regulatory purposes EL is defined as:<br />

for non-defaulted exposures, the product of PD, LGD and EAD; and<br />

for defaulted exposures, the best estimate of expected loss for that<br />

exposure. It is equivalent to provisions for impaired assets and represents<br />

charges already realised through <strong>Westpac</strong>’s earnings.<br />

Regulatory EL is not calculated for Standardised portfolios and is based on<br />

mandated risk-weights for Specialised Lending portfolios. Regulatory EL<br />

should not be interpreted as an estimate of long-run expected loss because<br />

the LGDs used in all regulatory calculations are calibrated to reflect stressed<br />

economic conditions rather than long run averages.<br />

A resecuritisation exposure is a securitisation exposure in which the risk<br />

associated with an underlying pool of exposures is tranched and at least one<br />

of the underlying exposures is a securitisation exposure. In addition, an<br />

exposure to one or more resecuritisation exposures is a resecuritisation<br />

exposure;<br />

Assets (both on and off-balance sheet) of the Bank are assigned within a<br />

certain category and amounts included in these categories are multiplied by<br />

a risk weighting. The resulting weighted values are added together to arrive<br />

at total risk weighted assets.<br />

The purchase of third party securitisation exposure, for example residential<br />

mortgage backed securities.<br />

Securitisation exposures arising through <strong>Westpac</strong> originated assets or<br />

generated by <strong>Westpac</strong> third party securitisation activity.<br />

An ADI would generally be considered a sponsor if it, in fact or substance,<br />

manages or advises the securitisation program, places securities into the<br />

market, or provide liquidity and/or credit enhancements.<br />

The standard model for Market risk applies supervisory risk weights to<br />

trading positions.<br />

Testing of the impact of market movements on the value of a portfolio.<br />

Stress VaR uses a bank's approved VaR model but applies it to a time<br />

period of significant financial stress. Market risk capital is now estimated by<br />

adding Stress VaR to actual VaR<br />

Substitutions refers to the rules governing the circumstances when capital<br />

can be reduced because an obligor’s exposure has been hedged by the<br />

purchase of credit protection from a counterparty and the counterparty’s PD<br />

is used in place of the obligors’ PD.<br />

Basel II provides three approaches to determine the risk-weight for a<br />

securitisation transaction, where the term securitisation includes any<br />

complex credit derivative. The supervisory formula is used when the<br />

Ratings-Based Approach is unable to be used.<br />

Comprises the capital elements that fully satisfy all of APRA’s essential<br />

criteria. The key components of the gross Tier 1 capital are shareholders’<br />

funds and hybrid equity.<br />

Includes other elements, which, to varying degrees, fall short of the quality of<br />

Tier 1 capital but still contribute to the overall strength of an entity as a going<br />

concern.<br />

94