Westpac Group Pillar 3 Report March 2013 - Iguana IR Sites

Westpac Group Pillar 3 Report March 2013 - Iguana IR Sites

Westpac Group Pillar 3 Report March 2013 - Iguana IR Sites

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

PILLAR 3 REPORT<br />

INTEREST RATE RISK IN THE BANKING BOOK (<strong>IR</strong>RBB)<br />

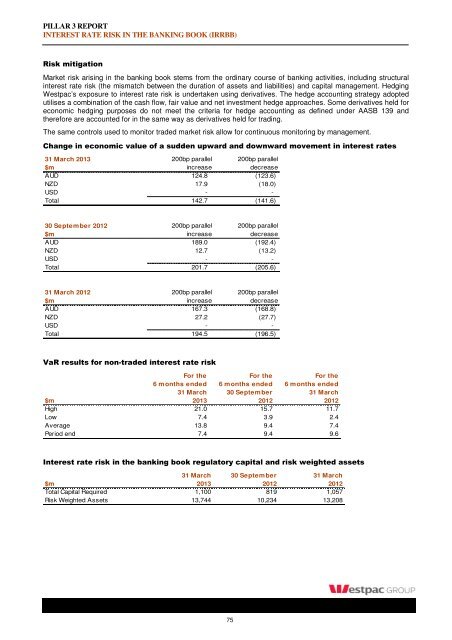

Risk mitigation<br />

Market risk arising in the banking book stems from the ordinary course of banking activities, including structural<br />

interest rate risk (the mismatch between the duration of assets and liabilities) and capital management. Hedging<br />

<strong>Westpac</strong>’s exposure to interest rate risk is undertaken using derivatives. The hedge accounting strategy adopted<br />

utilises a combination of the cash flow, fair value and net investment hedge approaches. Some derivatives held for<br />

economic hedging purposes do not meet the criteria for hedge accounting as defined under AASB 139 and<br />

therefore are accounted for in the same way as derivatives held for trading.<br />

The same controls used to monitor traded market risk allow for continuous monitoring by management.<br />

Change in economic value of a sudden upward and downward movement in interest rates<br />

31 <strong>March</strong> <strong>2013</strong> 200bp parallel 200bp parallel<br />

$m increase decrease<br />

AUD 124.8 (123.6)<br />

NZD 17.9 (18.0)<br />

USD - -<br />

Total 142.7 (141.6)<br />

30 September 2012 200bp parallel 200bp parallel<br />

$m increase decrease<br />

AUD 189.0 (192.4)<br />

NZD 12.7 (13.2)<br />

USD - -<br />

Total 201.7 (205.6)<br />

31 <strong>March</strong> 2012 200bp parallel 200bp parallel<br />

$m increase decrease<br />

AUD 167.3 (168.8)<br />

NZD 27.2 (27.7)<br />

USD - -<br />

Total 194.5 (196.5)<br />

VaR results for non-traded interest rate risk<br />

For the For the For the<br />

6 months ended 6 months ended 6 months ended<br />

31 <strong>March</strong> 30 September 31 <strong>March</strong><br />

$m <strong>2013</strong> 2012 2012<br />

High 21.0 15.7 11.7<br />

Low 7.4 3.9 2.4<br />

Average 13.8 9.4 7.4<br />

Period end 7.4 9.4 9.6<br />

Interest rate risk in the banking book regulatory capital and risk weighted assets<br />

31 <strong>March</strong> 30 September 31 <strong>March</strong><br />

$m <strong>2013</strong> 2012 2012<br />

Total Capital Required 1,100 819 1,057<br />

Risk Weighted Assets 13,744 10,234 13,208<br />

75