Westpac Group Pillar 3 Report March 2013 - Iguana IR Sites

Westpac Group Pillar 3 Report March 2013 - Iguana IR Sites

Westpac Group Pillar 3 Report March 2013 - Iguana IR Sites

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

PILLAR 3 REPORT<br />

SECURITISATION<br />

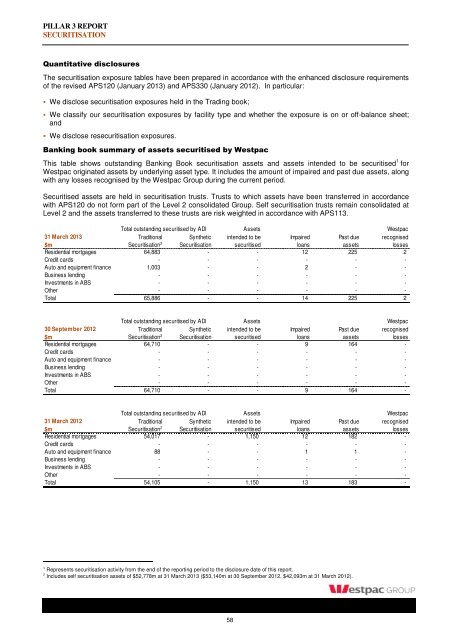

Quantitative disclosures<br />

The securitisation exposure tables have been prepared in accordance with the enhanced disclosure requirements<br />

of the revised APS120 (January <strong>2013</strong>) and APS330 (January 2012). In particular:<br />

We disclose securitisation exposures held in the Trading book;<br />

We classify our securitisation exposures by facility type and whether the exposure is on or off-balance sheet;<br />

and<br />

We disclose resecuritisation exposures.<br />

Banking book summary of assets securitised by <strong>Westpac</strong><br />

This table shows outstanding Banking Book securitisation assets and assets intended to be securitised 1 2 for<br />

<strong>Westpac</strong> originated assets by underlying asset type. It includes the amount of impaired and past due assets, along<br />

with any losses recognised by the <strong>Westpac</strong> <strong>Group</strong> during the current period.<br />

Securitised assets are held in securitisation trusts. Trusts to which assets have been transferred in accordance<br />

with APS120 do not form part of the Level 2 consolidated <strong>Group</strong>. Self securitisation trusts remain consolidated at<br />

Level 2 and the assets transferred to these trusts are risk weighted in accordance with APS113.<br />

Total outstanding securitised by ADI<br />

Assets<br />

<strong>Westpac</strong><br />

31 <strong>March</strong> <strong>2013</strong> Traditional Synthetic intended to be Impaired Past due recognised<br />

$m Securitisation 2 Securitisation securitised loans assets losses<br />

Residential mortgages 64,883 - - 12 225 2<br />

Credit cards - - - - - -<br />

Auto and equipment finance 1,003 - - 2 - -<br />

Business lending - - - - - -<br />

Investments in ABS - - - - - -<br />

Other - - - - - -<br />

Total 65,886 - - 14 225 2<br />

Total outstanding securitised by ADI<br />

Assets<br />

<strong>Westpac</strong><br />

30 September 2012 Traditional Synthetic intended to be Impaired Past due recognised<br />

$m Securitisation 2 Securitisation securitised loans assets losses<br />

Residential mortgages 64,710 - - 9 164 -<br />

Credit cards - - - - - -<br />

Auto and equipment finance - - - - - -<br />

Business lending - - - - - -<br />

Investments in ABS - - - - - -<br />

Other - - - - - -<br />

Total 64,710 - - 9 164 -<br />

Total outstanding securitised by ADI<br />

Assets<br />

<strong>Westpac</strong><br />

31 <strong>March</strong> 2012 Traditional Synthetic intended to be Impaired Past due recognised<br />

$m Securitisation 2 Securitisation securitised loans assets losses<br />

Residential mortgages 54,017 - 1,150 12 182 -<br />

Credit cards - - - - - -<br />

Auto and equipment finance 88 - - 1 1 -<br />

Business lending - - - - - -<br />

Investments in ABS - - - - - -<br />

Other - - - - - -<br />

Total 54,105 - 1,150 13 183 -<br />

1 Represents securitisation activity from the end of the reporting period to the disclosure date of this report.<br />

2 Includes self securitisation assets of $52,778m at 31 <strong>March</strong> <strong>2013</strong> ($53,140m at 30 September 2012, $42,093m at 31 <strong>March</strong> 2012).<br />

58