Westpac Group Pillar 3 Report March 2013 - Iguana IR Sites

Westpac Group Pillar 3 Report March 2013 - Iguana IR Sites

Westpac Group Pillar 3 Report March 2013 - Iguana IR Sites

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

PILLAR 3 REPORT<br />

APPENDIX II - REGULATORY EXPECTED LOSS<br />

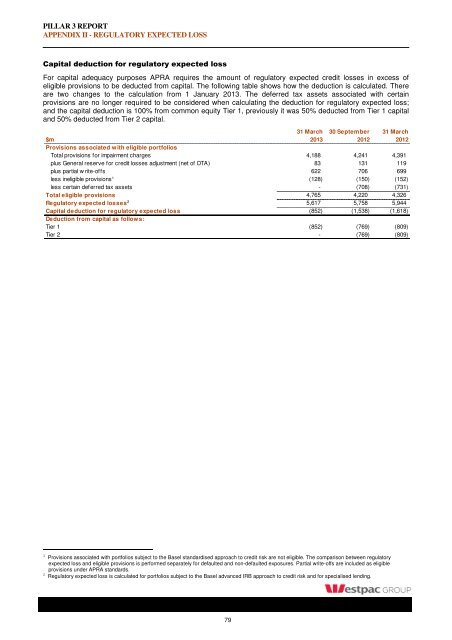

Capital deduction for regulatory expected loss<br />

For capital adequacy purposes APRA requires the amount of regulatory expected credit losses in excess of<br />

eligible provisions to be deducted from capital. The following table shows how the deduction is calculated. There<br />

are two changes to the calculation from 1 January <strong>2013</strong>. The deferred tax assets associated with certain<br />

provisions are no longer required to be considered when calculating the deduction for regulatory expected loss;<br />

and the capital deduction is 100% from common equity Tier 1, previously it was 50% deducted from Tier 1 capital<br />

and 50% deducted from Tier 2 capital.<br />

31 <strong>March</strong> 30 September 31 <strong>March</strong><br />

$m <strong>2013</strong> 2012 2012<br />

Provisions associated with eligible portfolios<br />

Total provisions for impairment charges 4,188 4,241 4,391<br />

plus General reserve for credit losses adjustment (net of DTA) 83 131 119<br />

plus partial w rite-offs 622 706 699<br />

less ineligible provisions 1 (128) (150) (152)<br />

less certain deferred tax assets - (708) (731)<br />

Total eligible provisions 4,765 4,220 4,326<br />

Regulatory expected losses 2 5,617 5,758 5,944<br />

Capital deduction for regulatory expected loss (852) (1,538) (1,618)<br />

Deduction from capital as follows:<br />

Tier 1 (852) (769) (809)<br />

Tier 2 - (769) (809)<br />

1 Provisions associated with portfolios subject to the Basel standardised approach to credit risk are not eligible. The comparison between regulatory<br />

expected loss and eligible provisions is performed separately for defaulted and non-defaulted exposures. Partial write-offs are included as eligible<br />

provisions under APRA standards.<br />

2 Regulatory expected loss is calculated for portfolios subject to the Basel advanced <strong>IR</strong>B approach to credit risk and for specialised lending.<br />

79