Westpac Group Pillar 3 Report March 2013 - Iguana IR Sites

Westpac Group Pillar 3 Report March 2013 - Iguana IR Sites

Westpac Group Pillar 3 Report March 2013 - Iguana IR Sites

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

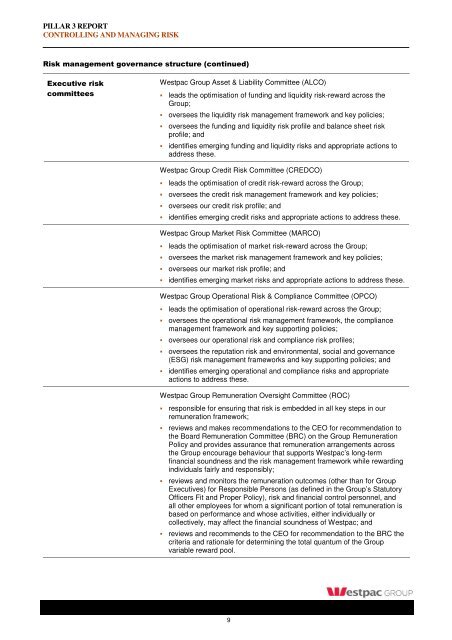

PILLAR 3 REPORT<br />

CONTROLLING AND MANAGING RISK<br />

Risk management governance structure (continued)<br />

Executive risk<br />

committees<br />

<strong>Westpac</strong> <strong>Group</strong> Asset & Liability Committee (ALCO)<br />

leads the optimisation of funding and liquidity risk-reward across the<br />

<strong>Group</strong>;<br />

oversees the liquidity risk management framework and key policies;<br />

oversees the funding and liquidity risk profile and balance sheet risk<br />

profile; and<br />

identifies emerging funding and liquidity risks and appropriate actions to<br />

address these.<br />

<strong>Westpac</strong> <strong>Group</strong> Credit Risk Committee (CREDCO)<br />

leads the optimisation of credit risk-reward across the <strong>Group</strong>;<br />

oversees the credit risk management framework and key policies;<br />

oversees our credit risk profile; and<br />

identifies emerging credit risks and appropriate actions to address these.<br />

<strong>Westpac</strong> <strong>Group</strong> Market Risk Committee (MARCO)<br />

leads the optimisation of market risk-reward across the <strong>Group</strong>;<br />

oversees the market risk management framework and key policies;<br />

oversees our market risk profile; and<br />

identifies emerging market risks and appropriate actions to address these.<br />

<strong>Westpac</strong> <strong>Group</strong> Operational Risk & Compliance Committee (OPCO)<br />

leads the optimisation of operational risk-reward across the <strong>Group</strong>;<br />

oversees the operational risk management framework, the compliance<br />

management framework and key supporting policies;<br />

oversees our operational risk and compliance risk profiles;<br />

oversees the reputation risk and environmental, social and governance<br />

(ESG) risk management frameworks and key supporting policies; and<br />

identifies emerging operational and compliance risks and appropriate<br />

actions to address these.<br />

<strong>Westpac</strong> <strong>Group</strong> Remuneration Oversight Committee (ROC)<br />

responsible for ensuring that risk is embedded in all key steps in our<br />

remuneration framework;<br />

reviews and makes recommendations to the CEO for recommendation to<br />

the Board Remuneration Committee (BRC) on the <strong>Group</strong> Remuneration<br />

Policy and provides assurance that remuneration arrangements across<br />

the <strong>Group</strong> encourage behaviour that supports <strong>Westpac</strong>’s long-term<br />

financial soundness and the risk management framework while rewarding<br />

individuals fairly and responsibly;<br />

reviews and monitors the remuneration outcomes (other than for <strong>Group</strong><br />

Executives) for Responsible Persons (as defined in the <strong>Group</strong>’s Statutory<br />

Officers Fit and Proper Policy), risk and financial control personnel, and<br />

all other employees for whom a significant portion of total remuneration is<br />

based on performance and whose activities, either individually or<br />

collectively, may affect the financial soundness of <strong>Westpac</strong>; and<br />

reviews and recommends to the CEO for recommendation to the BRC the<br />

criteria and rationale for determining the total quantum of the <strong>Group</strong><br />

variable reward pool.<br />

9