Westpac Group Pillar 3 Report March 2013 - Iguana IR Sites

Westpac Group Pillar 3 Report March 2013 - Iguana IR Sites

Westpac Group Pillar 3 Report March 2013 - Iguana IR Sites

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

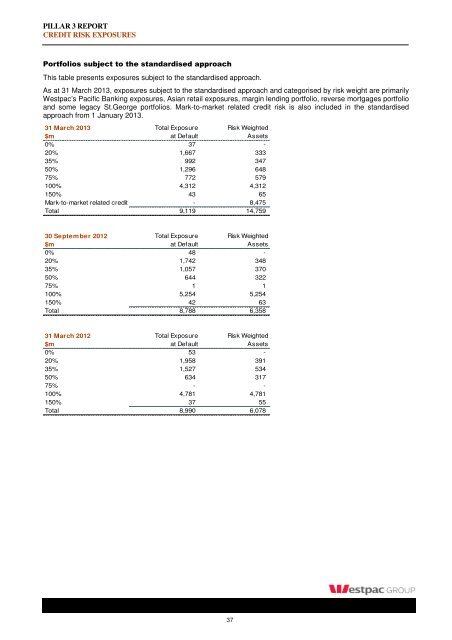

PILLAR 3 REPORT<br />

CREDIT RISK EXPOSURES<br />

Portfolios subject to the standardised approach<br />

This table presents exposures subject to the standardised approach.<br />

As at 31 <strong>March</strong> <strong>2013</strong>, exposures subject to the standardised approach and categorised by risk weight are primarily<br />

<strong>Westpac</strong>’s Pacific Banking exposures, Asian retail exposures, margin lending portfolio, reverse mortgages portfolio<br />

and some legacy St.George portfolios. Mark-to-market related credit risk is also included in the standardised<br />

approach from 1 January <strong>2013</strong>.<br />

31 <strong>March</strong> <strong>2013</strong> Total Exposure Risk Weighted<br />

$m at Default Assets<br />

0% 37 -<br />

20% 1,667 333<br />

35% 992 347<br />

50% 1,296 648<br />

75% 772 579<br />

100% 4,312 4,312<br />

150% 43 65<br />

Mark-to-market related credit risk - 8,475<br />

Total 9,119 14,759<br />

30 September 2012 Total Exposure Risk Weighted<br />

$m at Default Assets<br />

0% 48 -<br />

20% 1,742 348<br />

35% 1,057 370<br />

50% 644 322<br />

75% 1 1<br />

100% 5,254 5,254<br />

150% 42 63<br />

Total 8,788 6,358<br />

31 <strong>March</strong> 2012 Total Exposure Risk Weighted<br />

$m at Default Assets<br />

0% 53 -<br />

20% 1,958 391<br />

35% 1,527 534<br />

50% 634 317<br />

75% - -<br />

100% 4,781 4,781<br />

150% 37 55<br />

Total 8,990 6,078<br />

37