Westpac Group Pillar 3 Report March 2013 - Iguana IR Sites

Westpac Group Pillar 3 Report March 2013 - Iguana IR Sites

Westpac Group Pillar 3 Report March 2013 - Iguana IR Sites

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

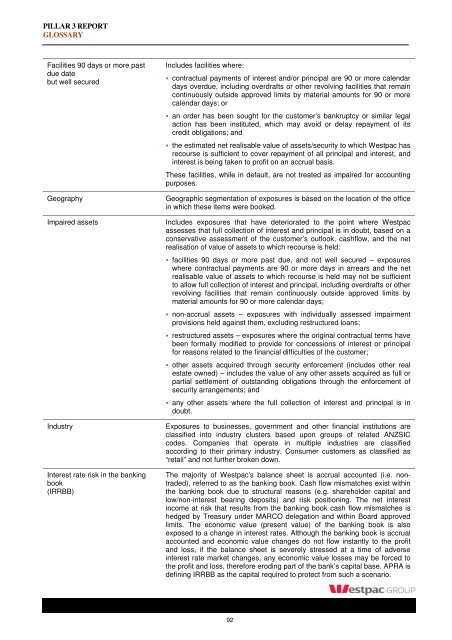

PILLAR 3 REPORT<br />

GLOSSARY<br />

Facilities 90 days or more past<br />

due date<br />

but well secured<br />

Geography<br />

Impaired assets<br />

Industry<br />

Interest rate risk in the banking<br />

book<br />

(<strong>IR</strong>RBB)<br />

Includes facilities where:<br />

contractual payments of interest and/or principal are 90 or more calendar<br />

days overdue, including overdrafts or other revolving facilities that remain<br />

continuously outside approved limits by material amounts for 90 or more<br />

calendar days; or<br />

an order has been sought for the customer’s bankruptcy or similar legal<br />

action has been instituted, which may avoid or delay repayment of its<br />

credit obligations; and<br />

the estimated net realisable value of assets/security to which <strong>Westpac</strong> has<br />

recourse is sufficient to cover repayment of all principal and interest, and<br />

interest is being taken to profit on an accrual basis.<br />

These facilities, while in default, are not treated as impaired for accounting<br />

purposes.<br />

Geographic segmentation of exposures is based on the location of the office<br />

in which these items were booked.<br />

Includes exposures that have deteriorated to the point where <strong>Westpac</strong><br />

assesses that full collection of interest and principal is in doubt, based on a<br />

conservative assessment of the customer’s outlook, cashflow, and the net<br />

realisation of value of assets to which recourse is held:<br />

facilities 90 days or more past due, and not well secured – exposures<br />

where contractual payments are 90 or more days in arrears and the net<br />

realisable value of assets to which recourse is held may not be sufficient<br />

to allow full collection of interest and principal, including overdrafts or other<br />

revolving facilities that remain continuously outside approved limits by<br />

material amounts for 90 or more calendar days;<br />

non-accrual assets – exposures with individually assessed impairment<br />

provisions held against them, excluding restructured loans;<br />

restructured assets – exposures where the original contractual terms have<br />

been formally modified to provide for concessions of interest or principal<br />

for reasons related to the financial difficulties of the customer;<br />

other assets acquired through security enforcement (includes other real<br />

estate owned) – includes the value of any other assets acquired as full or<br />

partial settlement of outstanding obligations through the enforcement of<br />

security arrangements; and<br />

any other assets where the full collection of interest and principal is in<br />

doubt.<br />

Exposures to businesses, government and other financial institutions are<br />

classified into industry clusters based upon groups of related ANZSIC<br />

codes. Companies that operate in multiple industries are classified<br />

according to their primary industry. Consumer customers as classified as<br />

“retail” and not further broken down.<br />

The majority of <strong>Westpac</strong>’s balance sheet is accrual accounted (i.e. nontraded),<br />

referred to as the banking book. Cash flow mismatches exist within<br />

the banking book due to structural reasons (e.g. shareholder capital and<br />

low/non-interest bearing deposits) and risk positioning. The net interest<br />

income at risk that results from the banking book cash flow mismatches is<br />

hedged by Treasury under MARCO delegation and within Board approved<br />

limits. The economic value (present value) of the banking book is also<br />

exposed to a change in interest rates. Although the banking book is accrual<br />

accounted and economic value changes do not flow instantly to the profit<br />

and loss, if the balance sheet is severely stressed at a time of adverse<br />

interest rate market changes, any economic value losses may be forced to<br />

the profit and loss, therefore eroding part of the bank’s capital base. APRA is<br />

defining <strong>IR</strong>RBB as the capital required to protect from such a scenario.<br />

92